If you have an insurance company, it is essential to represent your company online. It is not enough to use ads on TV and other media. You need software development. Insurance applications for mobile or web will be an additional tool for your customers to cooperate with you.

That is why you should know what business model and digital trends to choose, what development company you can collaborate with, and other helpful tips. Keep reading this article to get all the answers.

What Is The Insurance Software?

Insurance software is the web or mobile application that is created for insurance agents and their customers. Its main goal is to simplify insurance procedures, provide all detailed information, and let specialists manage their daily operations.

Besides, insurance agencies can process claims and policy data, manage and control their employees’ performance levels, etc. In turn, customers can use insurance software to inspect available insurance types, and they can fill out forms, make payments, and create claims.

Insurance software can also be integrated with existing BPM (business process management) and CRM (customer relationship management) systems. By the way, you can read our articles about BPM system development and CRM software creation.

Main Types of Insurance Software

Insurance software can have different features and perform various tasks, but there are several types of particularly common solutions. So let’s discuss them in more detail.

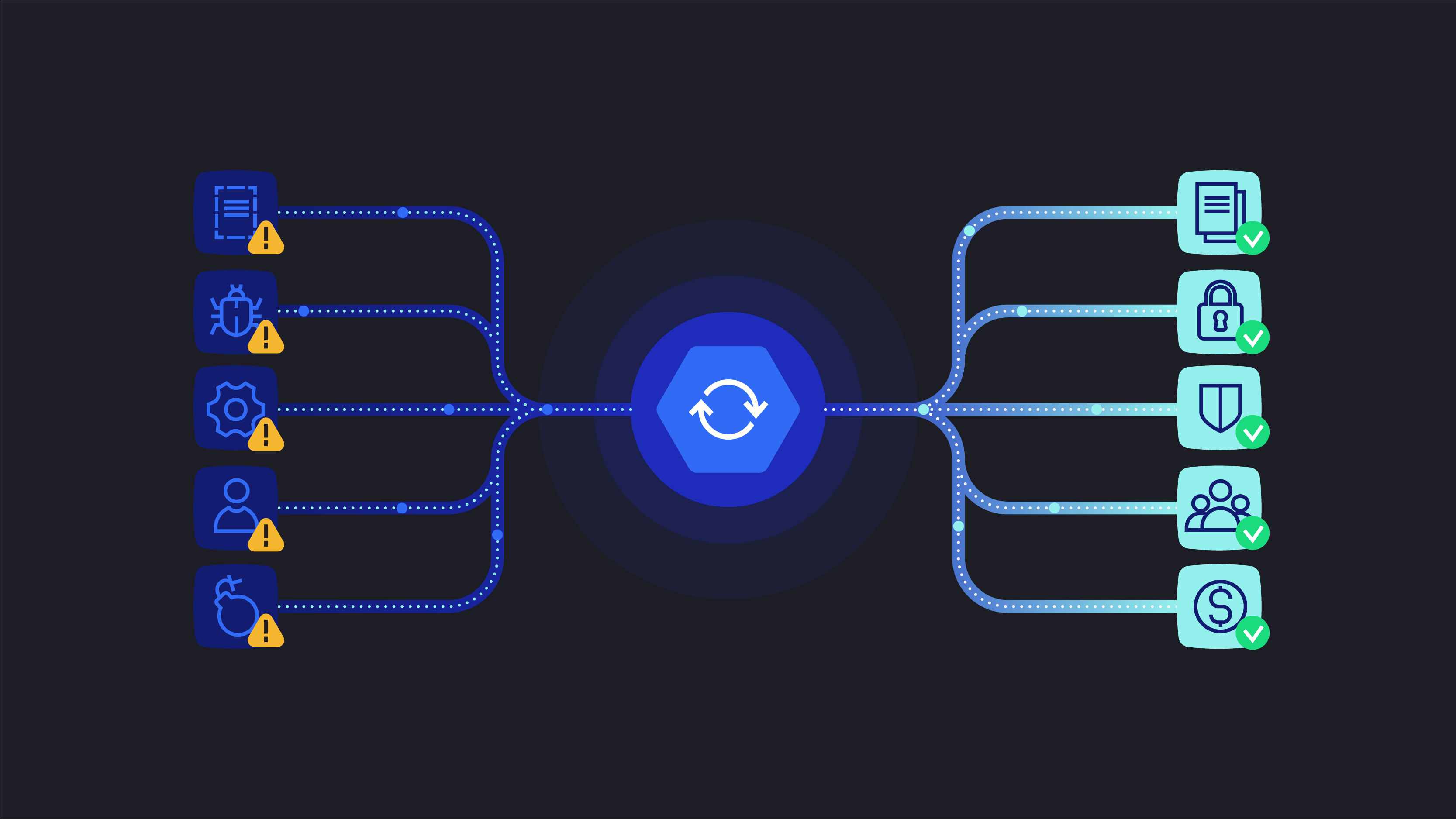

- Policy Management Software. Functionality includes the creation, administration, approval and management of insurance policies.

- Software for automation. Helps in organization, monitoring, control and coordination of various business processes, including marketing campaigns.

- Enterprise Risk Management or ERM. Software for analytics and risk assessment. Lately, such software often uses the capabilities of AI for predictive analysis and automated risk management.

- Insurance software solutions for document management. These are products for safe storage, systematization, processing, sending, approval and archiving of important documents (policies, agreements, customer proofs, etc.).

- CRM or customer relationship management software. It is an internal use system for communication between teams and departments, management of all products and customer base, performance tracking, etc.

Special types of insurance software are mobile applications for customers and agents, software for call centers, etc. Custom solutions can combine different types of functionality to meet user needs better.

Why Does Your Insurance Agency Need A Software?

It is worth noting that mobile insurance apps have become more popular. As Digital Insurer report claims, the number of insurance mobile app downloads increases to a few billion every year. However, it doesn’t mean that websites are in the past. Our article about insurance website designs proves it.

But let’s take a look at the reasons why you need insurance software development.

Improved customer-company relations. Users have more trust in companies that have websites or mobile apps. Besides, it is much more convenient to communicate online. Agencies are always ready to provide the information timely, and it increases customer satisfaction and loyalty.

Automation. Some organizational tasks have to be automated, and they don’t require the involvement of your employees. It helps optimize workflow and improve efficiency.

Availability of e-forms. Customers don’t need to visit your company personally to fill out necessary documents. They can use electronic forms on your website and do everything remotely. Then your agents just need to process these forms.

Improved marketing efforts. According to recent research, about 63% of companies that use sales tools integrated into custom software are significantly ahead of their competitors. Hence, insurance software solutions help to improve your marketing efforts significantly.

The attraction of new customers. It doesn’t matter whether it be health insurance software development, car or business insurance (or all of them); customers want to have reliable software at hand. If you can provide one, it will attract many more customers.

Regulatory Compliance. Adherence to compliance rules, especially in the insurance field, is quite a complex challenge that requires constant monitoring and timely changes. This is one of the most difficult parts of the insurance company’s work, as these rules are constantly changing and updating. Custom insurance software may include tools for automatic verification and updating of requirements and making changes to the document based on this.

Cost reduction and revenue growth. Software development leads to lower operational costs, and many processes become automated. But the growth of new customers leads to higher profits, so it is another reason why insurance software is a must.

An insurance application can also automate complex accounting processes that require special attention and diligence. This is one of the most important parts of the insurance business, so a system that manages all the small accounting tasks really saves time and simplifies the work of agents.

With the right web design, such software systems are simple and scalable, they significantly speed up the most time-consuming parts of accounting, and also have functionality for tracking payments, invoicing and recording their history, etc.

Plan to build insurance software? Need a dependable partner? Contact Cadabra Studio to get high-quality development services.

Top Trends For Insurance Software Development

If you want to gain the lead and beat your competitors, your software should use up-to-date trends. Customers are capricious, and you must amaze them with your software product. Otherwise, they choose a competitor’s app. Thus, we will list the top trends to pay attention to.

Chatbots. Even when your support team cannot reply to new customers, chatbots can. Chatbots are AI-based consultants who will help customers navigate through your website and answer all their questions. Chatbots are available 24/7, and machine learning algorithms allow them to adhere to human-like communication. We recommend using chatbots since FAQ on your website is not enough.

- Low code. This trend applies not only to custom insurance software, but it is particularly relevant in this area. The point is to create such software that would allow you to manage the platform, update and deploy it, as well as bring it to the market without having special technical skills. Low-code configuration tools provide users with an intuitive drag-and-drop management interface to modify UI and implement new features for their customers.

Artificial intelligence. Apart from chatbots, AI can be used for predictive analytics to evaluate risks and analyze the data to devise a risk score for the insured party. Artificial intelligence can also be used for underwriting, customer service, fraud detection, claims processing, etc. Today AI is the technology you cannot ignore if you want to be on top.

- Predictive analytics. This trend is related to the previous one, namely, the use of artificial intelligence. However, it is a whole system of predicting future events. So insurance agents can determine even the slightest risk factors and make better decisions about insurance policies. That is why insurance software development companies offer clients a wide set of predictive analytics tools.

Big Data. Many InsurTech startups start using Big Data, and it provides them with multiple benefits. Thus, Big Data is the technology that allows insurance agencies to store and quickly process a vast amount of data. Big Data tech enables you to analyze data about potential customers and attract them to your services using predictive analytics. AI and Big Data often work hand in hand, so their combination will be advantageous.

Blockchain. Blockchain is a distributed register containing a chain of blocks, where each block stores a part of the information. It protects the data and makes all insurance related-process more secure. Besides, blockchain implies the application of smart contracts. These contracts make fraudulent operations impossible, and they require mandatory fulfillment of obligations by both parties. Once obligations are fulfilled, the contract may be considered complete.

IoT. The Internet of Things, or IoT, implies connecting various smart devices around the house or business centers. And this chain of connected devices allows gathering crucial data from security systems and other devices like fire detectors to call emergency services and prevent severe damages. Besides, collected data helps insurers detect fraudulent attempts to receive compensation.

Telematics. Insurance software development companies most often use telematics technologies to work with car insurance policies. The essence is simple: monitoring devices measure indicators such as geolocation, speed, etc., and transfer this data to the insurance application. Insurance decisions regarding accidents are made much faster and more objectively based on this information.

Security. Well, this is even not a trend. It is a principle you should never forget. Your software must be protected from unauthorized access, hacking attempts, and other malefactors. You process personal data, and your customers must be confident that their data is adequately protected. Let developers use all up-to-date security measures to ensure high protection level.

As is clear from the trends above, every reliable insurance software development company invests maximum resources in the latest technologies that could reduce costs for both customers and agents. The main goal is to improve operational efficiency and interaction with customers. Automated solutions such as chatbots are becoming more personalized, as are agency services.

Read more: about how technologies are changing the Insurance industry and what InsurTech is.

What Business Model To Choose When Hiring Insurance Software Developers

It can be a huge dilemma — what contractor to choose for your project. Is it better and cheaper to hire a freelancer? Or build an in-house team to manage it by yourself? Or is software development outsourcing the appropriate option? Well, read this section to make the decision.

Freelance Developers

Freelancers are independent contractors who use platforms like Upwork, Toptal, etc., to offer their services. You can choose your candidate by narrowing down the search, picking the skills and technology a developer should have. However, it is better to hire freelancers for a short-term project. Besides, there are specific pros and cons of cooperating with freelancers.

Pros: It is cheaper, of course than hiring a large development team. Moreover, you contact the developer directly, and it can improve the final result. And freelancers are usually flexible and adapt quickly to your needs.

In addition, not every insurance software development company is flexible and can adapt to your needs, while some freelancers are interested in providing the most optimal solutions.

Cons: Deadlines can be broken if a freelancer cannot keep working due to disease or an emergency. If you are not a tech-savvy person, you won’t be able to test a freelancer’s skills. Then, your app idea can be stolen even if you signed an NDA — freelancers can disappear and use your idea for their purposes, leaving you with nothing.

The flexibility of freelancers can also have the other side of the coin. Such developers may have experience working with very different projects, but their knowledge will be superficial. In most cases, freelancers are hired to create simple products without unique functionality and unusual solutions. As a result, they cannot provide customers with sufficient tech skills and expertise that custom insurance software requires. Not to mention that lack of commercial experience affects communication and planning.

In-House Developers

You’re planning to build large-scale insurance software, and the project will take a lot of time. You may then think about creating an in-house development team, i.e., making your development department. You will hire all team members on your own, and you will manage their work more thoroughly.

Pros: You set deadlines on your own, and the project’s quality is in your hands. Besides, in-house teams fit long-term projects perfectly.

In this case, you are hiring someone who works with a team on a common goal – perfect insurance software solutions. All your developers are in one place, which makes communication a bit easier.

Another plus is that no one outside will have access to your project and corporate data, although this still does not provide 100% protection of sensitive information.

Cons: You will have to spend your time on the hiring process; you will need to learn more about development skills, tools, and techniques since you cannot hire specialists without knowledge in this sector.

In addition, a permanent employee is equal expenses on insurance, bonuses, regular salary increases, training, etc. And what to do if, over time, your project needs to change the tech stack or find new solutions? You will have to hire another specialist or wait until your in-house developer is trained. At the same time, outsourcing companies, in such cases, simply replace one team member with another because they have specialists of different levels and technical skills at their disposal.

You will also have to spend a lot of time and resources to solve internal issues, and at the same time, in-house development still cannot guarantee data security or 100% quality of custom insurance software.

Finally, this option is costly — you must purchase hardware, licensed software, pay taxes, pay office rent.

Outsourcing Developers

Outsourcing developers, aka offshore developers, remain the most popular option today. You hire a development team like Cadabra Studio located in another region, but it has high development skills, a good reputation, and affordable rates. Software development outsourcing is suitable for mid-sized and large projects. For more information, you should read the article about offshore software development services.

Pros: You hire relevant specialists for your project who know what to do. You don’t need to control them constantly since dependable companies always value their clients and do their best. A project manager in an outsourcing company will keep you updated, and they will manage all the processes.

The company will also provide you with a technical specification and detailed description of the development process step by step. And the protection of your idea and project security will be guaranteed.

Outsourcing insurance software development companies have a large talent pool. Accordingly, by signing the contract, you get access to them and the right to choose the best and most suitable specialists without the costs of finding, hiring, possessing, etc.

In addition, if you have several projects, you can focus on the core business, leaving everything else in the hands of qualified dedicated teams. This will help save resources for those areas where your experience and skills are more important.

And the last thing: outsourcing in reliable hands is an opportunity to use the latest technologies and solutions, to use rare expertise for the development of your product. Thanks to this and all the advantages listed above, outsourcing significantly reduces time to market.

Cons: An outsourcing company’s cost is much higher than a freelancer’s cost, but there is a quality assurance when cooperating with offshore companies. Likewise, an in-house team remains the most expensive option.

So, choosing an outsourced insurance software development company has its absolute pluses and pitfalls. However, it is one of the best options for developing insurance products when it comes to optimal results at minimal costs.

However, all this is possible only when you have chosen a really reliable partner with a proven team of specialists, favorable terms of cooperation and sufficient experience. Therefore, finding the best partner and making a solid business deal is significant.

Need a qualified consultation on your project? Contact Cadabra Studio to get more.

Where Can You Find Software Development Companies?

It is better to know more about platforms where you can hire trustworthy developers. Not all platforms ensure the companies provided are reliable. So we will list these platforms for your consideration.

Clutch. This platform is considered to be the trusted website where only verified companies are presented. You can narrow your search by filtering it, look for a company by rates, countries, development areas, etc.

Upwork. A marketplace where you can hire a freelancer or outstaff a specialist working in a software development company.

AppFutura. Another platform that helps business owners find and categorize software development and marketing companies, select company by field of activity.

Toptal. Toptal is an accessible platform similar to Upwork, where you can find developers of different levels and skills. Toptal remains one of the popular platforms for finding and hiring developers.

After viewing the company’s rating on the platforms above, be sure to check its website and portfolio of successful projects. You should ensure that the selected vendor has experience in creating insurance software solutions that precisely meet your business needs and requirements. In some cases, companies may not have the appropriate specialists or expertise to implementing certain technologies.

You can also use a demo call or a free consultation to clarify important points. Discuss the terms of cooperation, development technologies and methodologies, methods of communication, etc.

Seven Insurance Software Development Companies To Hire

It is the right time to find an outsourcing development company that provides affordable rates, reliable services, and a responsible software creation approach. We want to help you and provide a list of the top seven companies involved in InsurTech development.

Of course, this is a conditional list, as you will be looking for an outsourcing partner depending on your own business needs and requirements. However, the companies listed below have enough experience, expertise and resources to develop truly high-quality and forward-looking insurance solutions. In addition, they have an excellent reputation and a wide portfolio of projects.

So, let’s discuss each example in more detail.

VelveTech

VelveTech is a US-based company (located in Chicago) specialized in CRM, BPM, insurance, and healthcare software development. The company has more than 15-year experience in the development sector, and their main goal is to deliver a scalable and high-quality product to clients.

Coding Pixel

Another company from the USA, Los Angeles. Coding Pixel was founded in 2006, and it is involved in the development of insurance software of all types — health, car, property, life insurance. The company strives to use advanced tech solutions like AI, blockchain, and Big Data in the software development process.

Cadabra Studio

Cadabra Studio company, based in Ukraine, was founded in 2015. The company established itself as a reliable company that values its reputation. The profile on Clutch.co and clients’ reviews speak for themselves. Our company creates software in many sectors like FinTech, healthcare, insurance, eCommerce, education, SaaS, real estate, etc.

However, insurance and healthcare are two sectors Cadabra Studio has a high skill level in. You can check the company’s portfolio and delve into a case study describing how we created a customer web portal for the RVOS insurance company. Our mission is to understand how digitalization and the right branding direction will help your business multiply revenue.

Serokell

Serokell is the following software development company that is located in Tallinn, Estonia. The company successfully does its business since 2015, and this company is growing. The primary trick of Serokell is to combine computer science and high programming skills in insurance app development. Sreokell uses Big Data and blockchain technology to make their products robust and invulnerable.

Quick Silver Systems

Bradenton-based Quick Silver Systems company (USA) exists for three years only, but it has already gained a reputation as a qualified and robust development team. What’s interesting, Quick Silver Systems is engaged in web development only. But it creates many web-based insurance systems, portals, automobile underwriting, and claims processing systems.

Sapiens

We cannot bypass Sapiens company, and it should be present on our list. This company from Cary city, USA, provides off-the-shelf products, i.e., it has ready-made solutions that can be adapted and customized for your services. The company is rather old, it has existed since 1982, and insurance services is their main area of expertise.

Chetu

Chetu is a large company with headquarters in the USA and offices in England, Netherlands, and India. It has worked as a software development company since 2000. Chetu is specialized in the development of insurance mobile and web applications of all complexity levels. The company is always ready to help everyone who wants to move their business forward.

Essential Tips To Consider When You Build Insurance Software

Finally, we want to share a couple of tips with you before you start hiring a development team. Basically, these tips will be answers to frequently asked questions during insurance software development.

Type of software. Insurance companies may hesitate when choosing what software type is better — on-premise or cloud-based. On-premise software means that it is used on company servers. Cloud-based software uses servers of third-party vendors. Everything depends on your needs. On-premise software can be customized to your needs better. In contrast, cloud-based software requires fewer investments and remains more secure.

- Technical infrastructure. Custom insurance software must have a reliable and secure infrastructure, as such products deal with sensitive corporate and clients’ data. Any errors and disruptions in work lead to loss of time, resources and customers. In addition, the proper infrastructure affects the ease of use of the software, its speed, the ability to update, improve and scale.

Integration and compatibility. If you already use CRM or BPM systems for your insurance business, you need to discuss with developers the possibility of the integration of new insurance software with existing systems. It will optimize many processes, and seamless integration will contribute to a more efficient workflow.

- Design. Whether you’re developing a mobile app or a web product, modern design is critical. UI/UX specialists are engaged in creating the interface and shaping the user experience. It depends on them how convenient, clear and engaging your software will be. So, web design and UI/UX practices are a must.

Software segment. If your company is involved in various insurance types, your software should also provide all these insurance types. Don’t split different segments into different apps — it will be more expensive and less convenient. Let your app be a comprehensive solution for your customers.

Popular insurance software solutions are those that fully cover the needs of the target audience. Whether it is enterprise software for agents or applications for customers, the main goal should always be based on the user’s precise needs. Client-centric products always win the competitive race and bring real value.

In addition, knowing your own audience helps to define a clear list of features and reduce costs for the development of redundant functionality. It helps you plan your product development, create a really solid strategy, and form a proposition for your customers that they can’t refuse.

The development of insurance software is a process that requires specific skills and knowledge. But there is always an assistant like Cadabra Studio that will help you make your project from scratch.

We have enough experience and expertise to create flexible and scalable products that fully meet the requirements of customer-centric development and regulatory compliance.

Less talking, though. As our company has significant insurance software development expertise, the development team is ready to make your project real. Just contact us, and we will do the rest.