Insurance App Development Company

For picky clients

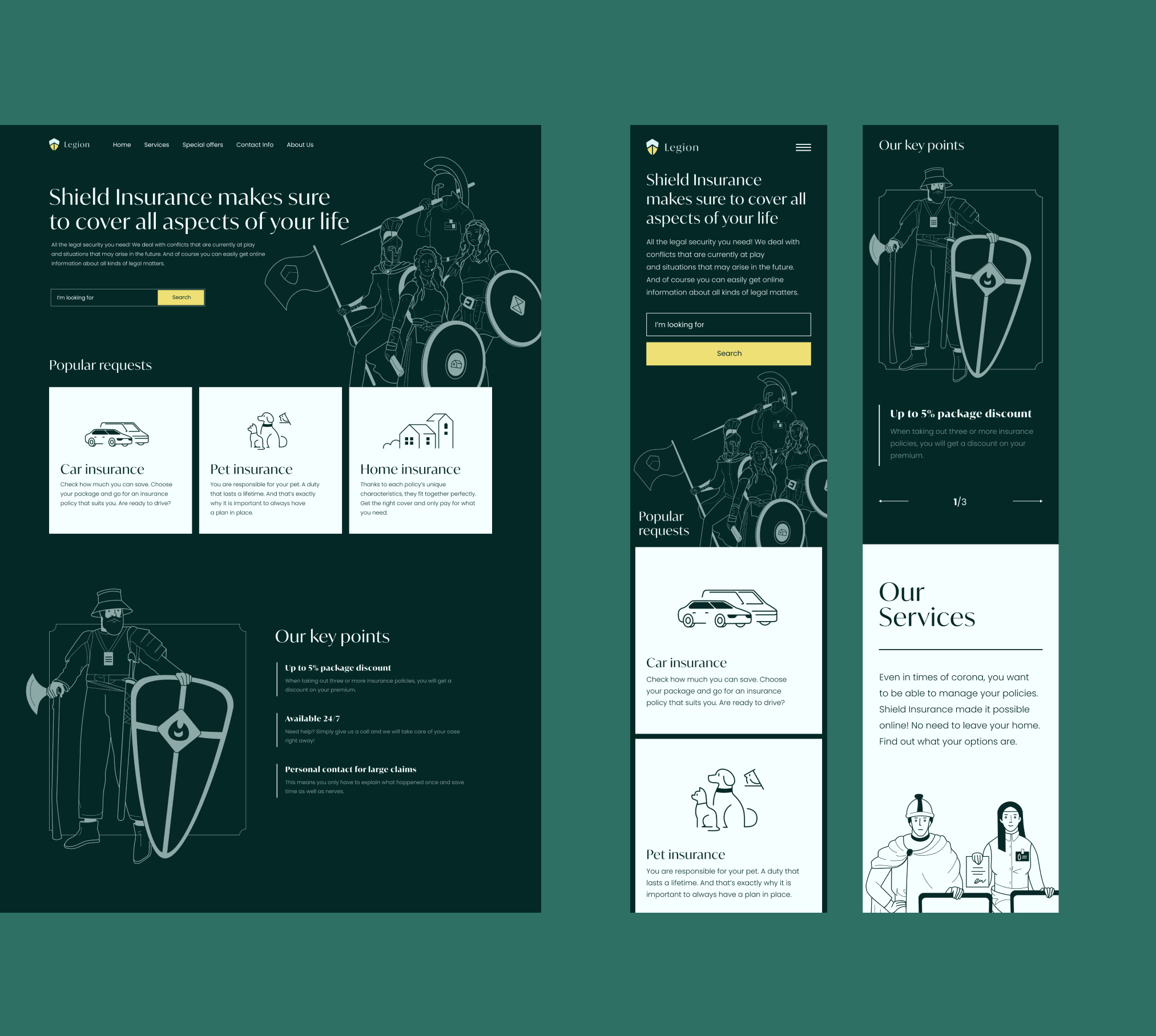

Discover what insurance app development solutions should look like with mobile-ready design, neat and easy-to-use layouts, intuitive navigation design, strategically-placed call-to-action blocks, and smooth integration of third-party services.

Challenges We Solve With Insurance App Development

Our clients from the insurance niche usually turn to us when they struggle with automatizing several issues. We listed the top ones but we are ready to discuss any of it!

On-demand insurance services

Automate claims processing

Optimize support costs

Ensure brand awareness

Our Insurance App Development Case Studies

We developed all our insurance mobile app projects aiming to be a lifesaver for the users when an emergency comes up. Any of our apps enable them to act quickly and easily.

- Aesthetics and functionality intuitive design;

- Easy-to-use content management system;

- Visit time to the site increased by three times;

- Increased conversion rate by 233.95%.

01

/02

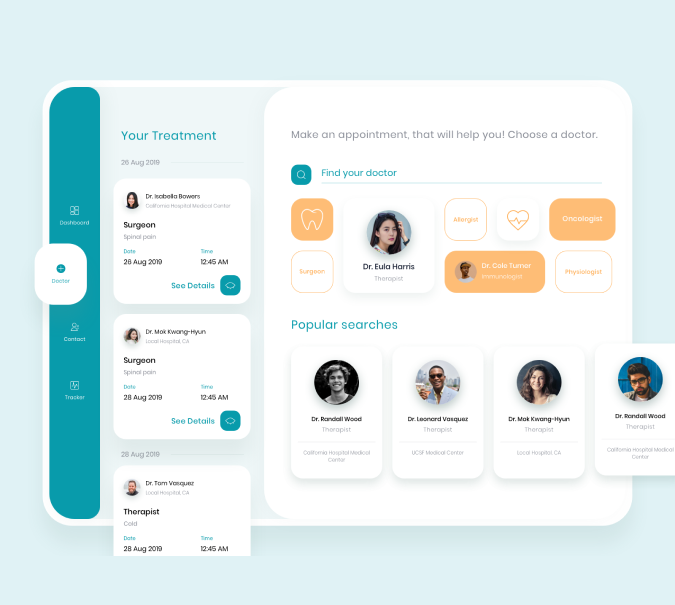

- surveys can be created and conducted among all the patients or some groups to collect feedback;

- multiple online forms and applications can help eliminate process bottlenecks and speed up fast medical help;

- the patients can share and see documents, images and videos within the portal.

02

/02

Want more studies like these?

Choose Insurance App Development Services

Our insurance mobile app developers do their best to create safe and easy-to-use insurance solutions for policy providers.

-30-50%

application launch time due to mature processes.

-5-40%

IT operating costs due to gaining access to professional expertise.

100%

IT service availability due to proactive IT maintenance and 24/7 support.

Benefits of Our Insurance Application Development Services

All insurance applications we develop allow your clients to have helpful resources and tools at their fingertips 24/7.

Improving user experience

Choosing the right tech stack

Identifying app development blockers

Ensuring security compliance

How To Get Insurance Application Development Services

We are open to sharing our experience in developing insurance mobile solutions to help you! Feel free to engage our team by performing a few following steps:

01

Contact the manager

Apply for the call with our business developers and discuss the basic requirements for your app.

02

Privacy guarantee

Let’s sign NDA to make sure that the personal data isn’t disclosed.

03

Choose the perfect interaction

Define a cooperation model that satisfies your expectations.

04

Planning

Get from us a rough estimation and develop a plan to proceed.

You May Also Like

Frequently Asked Questions

We prepared answers to the most common requests on insurance app development. However, if we missed something, we can discuss it on the call!

The project cost will depend on the chosen mobile platforms, the app complexity, the selected tech stack, the time frame, and many other factors. It also depends on the required team size. The faster your app needs to reach the market, the more programmers and designers you’ll need to hire.

It allows the customers to get an easy-to-use self-service interface with the below capabilities:

- Manage Profile: Users can manage their data, including contact details, submitted claims, and more through this module.

- Policy Management: It displays the digital version of the insurance details, past payments, and current/past policy documents. Besides, it allows policyholders to use the insurance mobile app features to search for other available policies, get quotes, and opt-in for policies that suit their budget and interest.

- Premium Payment: With an integrated payment gateway, this module allows insurers to pay their premiums through available methods. Here, they can even set instructions for automated payments and reminders for the upcoming premium payments.

- Claim Management: Customers can submit and track their claims on a real-time basis through this module. For instance, in cases such as an accident or a house robbery, they can quickly take a photo and upload it with the app’s required documents.

- Help & Support: We enable the in-app calling feature and live chat support. It allows the customers to connect with service staff for their queries related to the policies, premiums, claims, and more.

Additionally, we implement other features, including advanced search, ID scanning, online signature capture, one-touch emergency help, service center locator, and more.

A mobile app eliminates the need to use traditional channels, where agents and brokers can reach out to target customers. Even business leaders acknowledge the need to integrate mobile application technology into their operations.

Our team helps connect your app idea with a good business app using the right tools and technologies. Let’s discuss!