The insurance game is changing, and it’s happening fast. Insurance customer experience (CX) is an absolute must for this race. With the digital revolution in full swing, insurers face both massive opportunities and tough challenges as they work to redefine how they connect with their customers.

This guide is your go-to resource for navigating this transformation. We’ll cover

- the key drivers of digital CX innovation;

- explore challenges and powerful solutions;

- outline an actionable roadmap to stay ahead.

If you’re looking for an insurance CX transformation guide, this one’s for you.

Why Does It Matters? Some Stats on the Insurance Sector

- The global InsurTech market was worth $5.45 billion in 2022 and is set to grow at a staggering 52.7% CAGR through 2030.

- Customers are demanding faster, personalized, and frictionless insurance customer experience. Auto, home, and life insurance claims dominate globally, while 36% of Americans considered purchasing life insurance in 2021 alone.

- 35% of insurers automated customer service in 2023.

- Claims and processing came next, with underwriting leading the charge at 47% adoption.

The Evolution of Insurance Customer Experience

Insurance customer experience (CX) has undergone a major facelift. What was once a slow, paper-chase process is now a fast-paced, digital-first world where customers expect smooth, instant interactions.

This evolution is about completely flipping the script on how insurers connect with customers in a tech-savvy, on-demand world.

Traditional vs. digital CX

Remember the “good ol’ days” of insurance providers? You’d book an in-person meeting or sit on hold for hours. Then fill out paper forms – maybe even fax them (yep, fax machines still existed at one point). And don’t even get started on claims. Weeks, sometimes months, of back-and-forth just to get paid.

Today? That’s just not going to fly. Customers expect:

- Self-service and access to manage policies or file claims anytime, anywhere (like ordering pizza online, but less cheesy).

- Real-time communication. Whether it’s a text update or a chatbot responding instantly, they want answers now.

- Mobile-first design where everything should be as simple as scrolling through Instagram.

The old model was all about making things convenient for insurers. Today’s digital CX is all about the customer – after all, they’re calling the shots.

Customer behavior changes

Customers are no longer just “digital-first” but digital natives. They’ve grown up with apps that let them order food, book flights, and buy stuff in two taps. So, why should insurance companies be any different? Here’s what they really want:

- 24/7 accessibility;

- real-time updates;

- high and focused personalization.

If insurers can’t keep up with expectations, customers will quickly shop around until they find someone who can.

Modern CX benchmarks

- seamless omnichannel experience;

- self-service;

- hyper-personalization;

- proactive support;

- frictionless claims.

Every benchmark is essential, so let’s talk about them in more detail.

Read how we implemented benchmarks and improve insurance digital customer experience in our Shield Insurance Website Design case study

Key Components of Digital Insurance CX

Omnichannel insurance customer experience

Today’s customers are everywhere – on mobile, the web, in apps, and sometimes even in person. The key is to meet them where they are and ensure their experience flows seamlessly across channels.

Whether they’re checking their policy on an app, chatting with a bot on the website, or calling a customer support rep, they should never feel like they’re starting from scratch. The omnichannel insurance customer experience allows them to easily pick up where they left off, no matter how they choose to interact.

Self-service capabilities

Customers love independence, so self-service options are essential in today’s insurance world. Whether managing policies, making payments, or filing claims, giving them the freedom to handle things anytime without picking up the phone boosts satisfaction. It’s like letting customers take the wheel, with support ready if they need it.

Hyper-personalization

Customers are done with generic experiences. They want interactions that feel personal and relevant. That means using data to offer tailored recommendations, proactive support, and policies that fit their unique customer needs.

Whether it’s suggesting coverage based on driving habits or giving them a heads-up on policy renewals, showing customers you get them as individuals goes a long way, and they’ll stick around for it.

Proactive support and real-time communication

Insurance can already be stressful, so no one wants to be left in the dark when they need answers. Real-time communication, whether through chatbots, live chats, or automated text updates, ensures customers never have to ask, “Where’s my claim?”

A frictionless claims insurance customer experience is all about making the process as smooth and straightforward as possible, with minimal back-and-forth. The key is speed and transparency — customers want fast responses, clear instructions, and quick resolutions.

Mobile-first approach

Gone are the days of sitting down at a desktop to handle insurance. Nowadays, customers are doing everything on their smartphones, making a mobile-first approach essential.

Whether it’s submitting claims or asking questions, your digital tools need to be just as easy to use on a small screen as they are on a desktop. The smoother and more intuitive the mobile experience, the better the customer satisfaction.

Read about how we worked with insurance digital customer experience here

Digital Solutions Driving Insurance CX Transformation

1. Customer portals and mobile apps

Customer portals and mobile apps are the backbone of digital insurance engagement. They give customers the freedom to manage their policies and access support whenever they need it.

Why they’re essential:

- 24/7 access;

- mobile convenience;

- real-time updates.

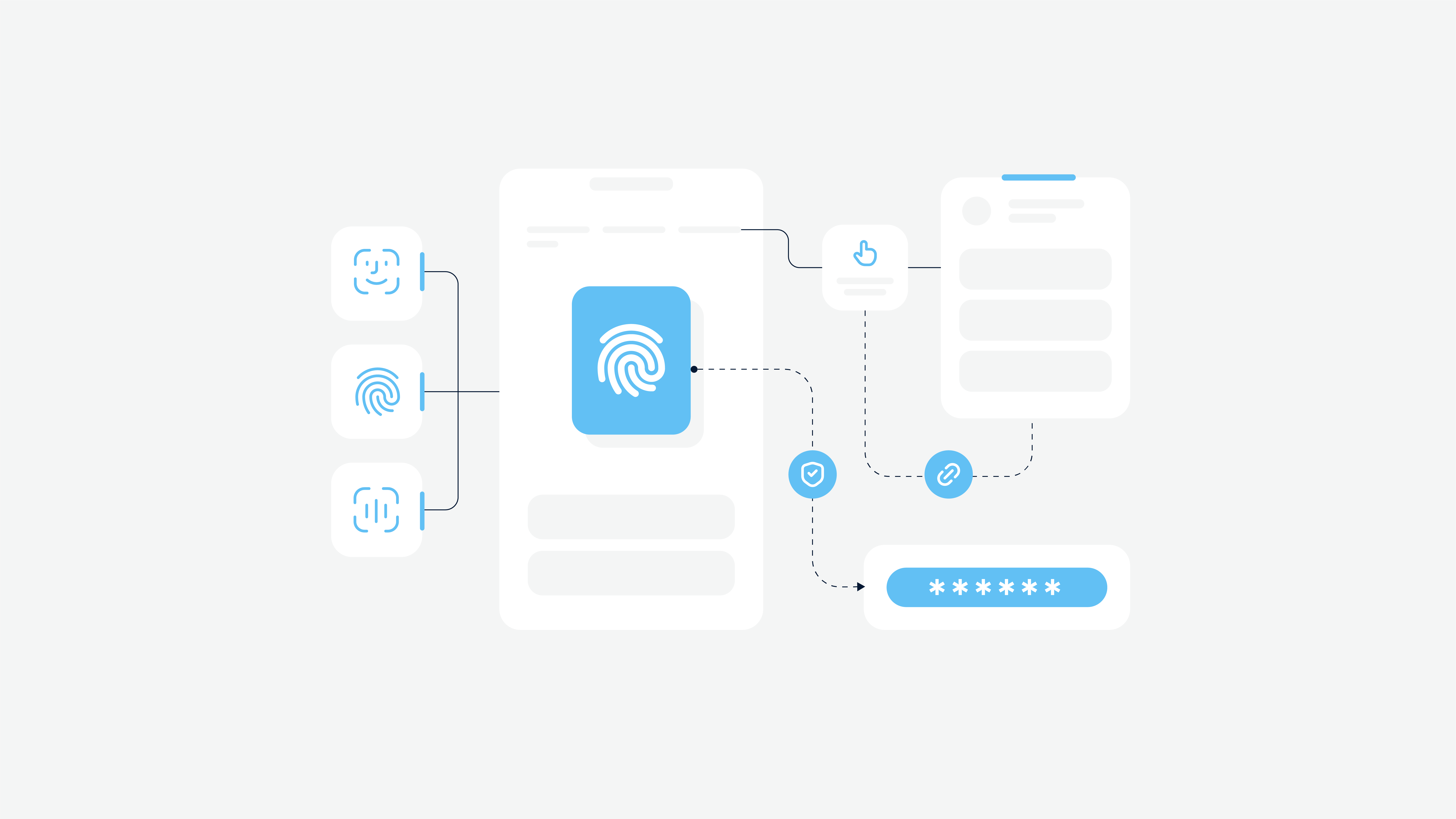

2. AI-powered personalization

AI is transforming the way insurers understand and organize customer relationship management by harnessing data to deliver hyper-personalized insurance customer experience.

What it looks like:

- tailored recommendations;

- dynamic pricing – usage-based insurance models adjust premiums based on individual driving behavior.

- proactive alerts –automated reminders for policy renewals or coverage updates.

Example:

For instance, Lemonade Insurance uses AI to offer instant quotes, adjust coverage, and process claims – all tailored to individual users. This creates an experience that’s fast, efficient and feels uniquely personal.

By the way, between 2021 and 2023, Lemonade more than doubled its revenue. The company saw its earnings skyrocket from $128 million in 2021 to $430 million in 2023 – all thanks to an innovative approach.

3. Claims automation

Automation is making claims processing smoother, faster, and less painful. How?

- AI and image recognition. AI tools analyze damage through photos (e.g., from car accidents or property damage), speeding up the assessment process.

- Fraud detection. Machine learning models help identify potential fraud, ensuring that claims are handled fairly and accurately.

- Automated workflows. Automation cuts down on human error and speeds up processing time by eliminating manual steps.

Example:

InsurTech company Hippo automates the claims triage process, notifying customers of the next steps within minutes of an incident report. This dramatically cuts down on wait times and boosts customer satisfaction.

4. Virtual assistants and chatbots

Virtual assistants and chatbots are becoming the first line of customer support, offering instant help for routine inquiries 24/7.

- quick answers;

- guided support;

- escalation – if the chatbot can’t solve the problem, it routes the customer to a human agent for more complex issues.

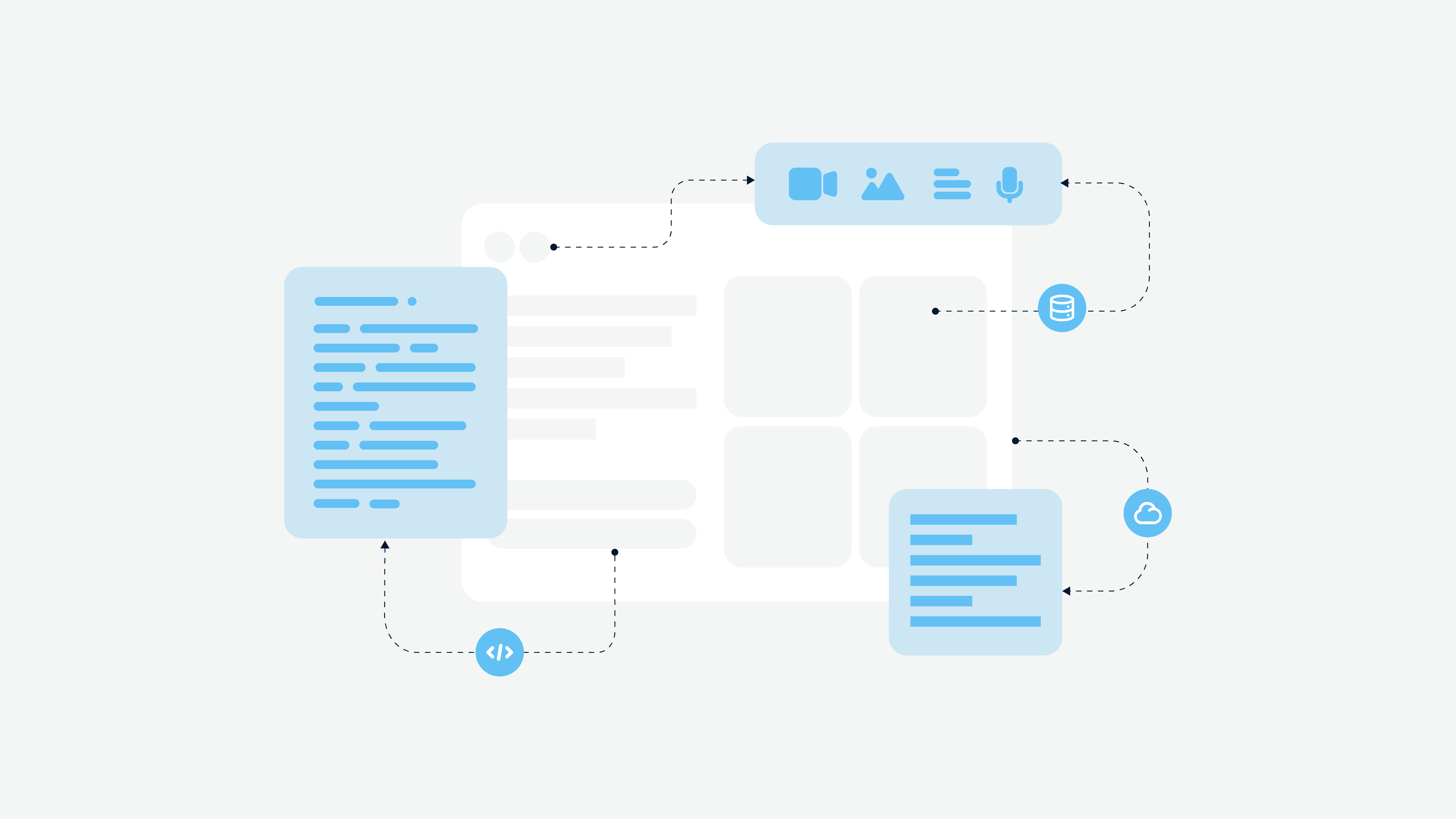

5. Digital document management

The insurance industry has long been plagued by mountains of paperwork, but digital document management is eliminating these inefficiencies and streamlining processes.

6. Integration digital insurance solutions

Insurance CX transformation relies on integrating new tools with legacy systems, ensuring everything works seamlessly together.

- Middleware and APIs to connect older systems with modern tools.

- Unified platforms with a 360-degree view of the customer for personalized and efficient service.

- Cross-system data sharing for up-to-date information across all touchpoints.

Read more on boosting your insurance digital customer experience in our Online portal for clients of the insurance company Case Study

Implementation Strategy

Transforming the insurance customer experience (CX) is no small feat, but with a solid, practical implementation strategy, you can get there. Here’s the roadmap to make it happen:

Assessment framework

Before jumping into action, you need to know where you stand. Start by digging into your current CX.

- Customer journey mapping: Walk in your customers’ shoes and pinpoint where things go off track — whether it’s a slow claims process or confusing communication.

- Customer feedback collection: Tap into customer surveys, analytics, and even employee feedback to get the full picture.

- Gap analysis: Identify what’s missing — maybe it’s faster claims or better digital self-service options.

Technology selection

- Scalable & flexible: Choose digital insurance solutions that can grow with you. You want tools that work for you today but also evolve as your business does.

- Customer-focused features: Make sure you’re prioritizing things like self-service portals, chatbots, and personalized tools that make life easier for your customers.

- Proven vendors: Don’t go with the first shiny new thing that comes your way. Partner with vendors that have a proven track record in the insurance space.

Integration approach

- Middleware & APIs: Use middleware and APIs to link your legacy systems with new platforms, creating a smooth flow of data across the board.

- Phased rollouts: Rome wasn’t built in a day. Roll out your new tools in phases to minimize disruption and iron out any kinks along the way.

- Unified data: Centralize customer data (personal and financial information as well) so that no matter how a customer interacts with you — whether through a website, app, or call center — it’s all consistent.

Change management

Don’t forget to support your customers through clear tutorials and assistance to make the shift easier for them. Remember, people are just as crucial as the technology; the smoother the transition for your team and customers, the better the results will be.

- Team training;

- customer support.

- phased adoption.

Success Metrics

- Customer metrics: Track things like Net Promoter Score (NPS), customer satisfaction (CSAT), and retention rates. If customers are happy, you’re on the right track.

- Operational efficiency: Measure improvements in things like claims resolution time and reduced manual workloads. Automation and streamlining should pay off here.

- Adoption rates: Check how many customers are using the new digital tools – are they embracing the app or self-service portal?

ROI and Business Impact

With faster claims processing, automated systems can reduce processing times by up to 25%, which significantly improves customer satisfaction. A boost in Net Promoter Scores (NPS) by 30% is common after insurance CX transformation, showing stronger customer loyalty and more recommendations from satisfied customers.

Automation can also cut manual workloads by up to 40%, freeing up your team to handle more complex tasks, while self-service portals allow customers to manage routine inquiries themselves. This not only speeds up service but also helps control operational costs.

By moving to digital, you can reduce customer service costs by up to 20% through self-service features, and going paperless slashes printing, storage, and mailing expenses.

Common Challenges and Digital Insurance Solutions

Legacy system integration

A lot of insurers are still running on outdated systems that just don’t play nice with newer tech, creating silos and inefficiencies.

The solution:

Bridge the gap with middleware and APIs to make old systems and new tech work together. Gradually modernize your setup by upgrading non-critical processes first.

Why it works:

This allows you to ease into new technology while preserving what’s already working.

Data silos

Customer data often lives in separate systems, making it tough to deliver a unified and personalized experience.

The solution:

Consolidate your data with a centralized platform like a Customer Data Platform (CDP) and create data governance to ensure consistency.

Why it works:

A single, unified data view lets you tailor the insurance customer experience and make interactions smoother and more relevant.

User adoption

New tools are only useful if people actually use them. Resistance from employees or customers can slow things down.

The solution:

Make your tools easy to use, provide hands-on training, and run engagement campaigns to show why the new tools are worth the switch.

Why it works:

When your users feel confident with the new tech, they’re more likely to embrace it, making for a smoother experience all around.

Security concerns

With more digital tools comes greater exposure to cyber risks, and that can raise serious security concerns.

The solution:

Lock things down with end-to-end encryption, stay in line with data protection regulations like GDPR, and keep up with regular security audits.

Why it works:

Dependable security measures help protect sensitive customer info and build trust—both of which are essential in today’s digital world.

Regulatory compliance

The insurance industry is heavily regulated, and getting compliance wrong can lead to hefty fines or legal headaches.

The solution:

Design regulation-compliant systems, get legal teams involved early on, and use automated tools to stay on top of changing regulations.

Why it works:

Addressing compliance upfront avoids risks, keeps you on the right side of the law, and preserves customer trust.

Future Trends in Insurance CX

1. Emerging technologies

- Blockchain: think of it as the ultimate “truth serum” for insurance – no sneaky stuff, just clear, trustworthy policy management and claims.

- IoT (Internet of Things): from pay-as-you-drive car insurance to smart homes that ping you (and your insurer) when there’s trouble, IoT is making insurance more personalized than ever.

- AI & Machine Learning: goodbye, guesswork. These tools mean faster claims, smarter policies, and advanced data analytics that make insurers feel like fortune-tellers.

Why it matters: Tech is a win-win for insurers and customers. You get happier clients, streamlined operations, and maybe even some new ways to make money.

Notice: The insurance industry ranked second globally for generative AI’s impact, trailing only banking, which had 54% more potential for automation.

2. New customer’s expectations

- Proactive support: customers want insurers to anticipate needs, such as suggesting policy adjustments based on life events or providing real-time risk alerts.

- Omnichannel accessibility: seamless communication across channels — mobile apps, chatbots, and in-person support — is now the standard.

- Simplified processes: frictionless experiences, from purchasing policies to filing claims, are non-negotiable.

Why it matters: Happy customers stick around, tell their friends, and won’t run off with the next flashy competitor.

3. Market evolution: the industry’s building ecosystems, not silos

The industry is shifting from standalone services to integrated ecosystems.

- Ecosystems: Insurers are collaborating with partners like health providers, automotive companies, and home security services to offer comprehensive digital insurance solutions. For example, bundling car insurance with vehicle maintenance or health insurance with wellness programs.

- Embedded insurance: Seamless integration of insurance into other platforms (e.g., buying travel insurance directly within a booking app) simplifies access and expands reach.

Why it matters: Partnerships = more value for customers and staying ahead of the competition.

4. Innovation opportunities

- Gamification: Reward customers for smart moves like safe driving or hitting fitness milestones. It’s fun, engaging, and builds loyalty.

- Microinsurance: short-term, event-specific coverage is perfect for younger, budget-conscious customers.

- Sustainability: Green insurance options, such as incentives for using eco-friendly vehicles or homes, align with growing environmental consciousness.

- AI claims assessments: Using video and photo uploads for instant claims decisions improves the claims insurance customer experience dramatically.

Why it matters:

Innovation keeps insurers relevant in a changing market and opens up new doors.

The future is customer-centric

The secret sauce for staying on top in insurance? Tech that wows, customer experiences that stick, and partnerships that deliver more than customers expect. Those who nail this trifecta won’t just survive – they’ll thrive.

And if you’re still doing things the old way? Well, let’s just say the competition might eat your lunch.

Actionable Implementation Framework

Let’s start with a short step-by-step guide.

- Conduct a CX audit. You can’t fix what you don’t understand. Dig into your customer journeys, identify the pain points (those “ugh” moments), and assess how mature your CX game really is. Tools like surveys, analytics, and good old-fashioned feedback will give you the dirt you need.

- Define a vision and align stakeholders. What’s the goal? Faster claims? Sky-high NPS? Get crystal clear on what success looks like. Then, make sure the whole squad – execs, team leads, and everyone in between – are on the same page.

- Choose technology partners. Not all tech is created equal. Look for vendors who understand insurance, play nice with your systems, and can grow with you. Think portals, automation, and AI that actually gets your customers.

- Test the waters with pilots and gather feedback. Start small. Maybe the claims process or a single policy renewal feature. Gather feedback (yes, even the brutally honest stuff) from both your team and your customers. Fix what’s broken, polish what works.

- Scale with continuous optimization. Roll out proven digital insurance solutions organization-wide while continuously analyzing performance metrics and refining processes.

Timeline considerations

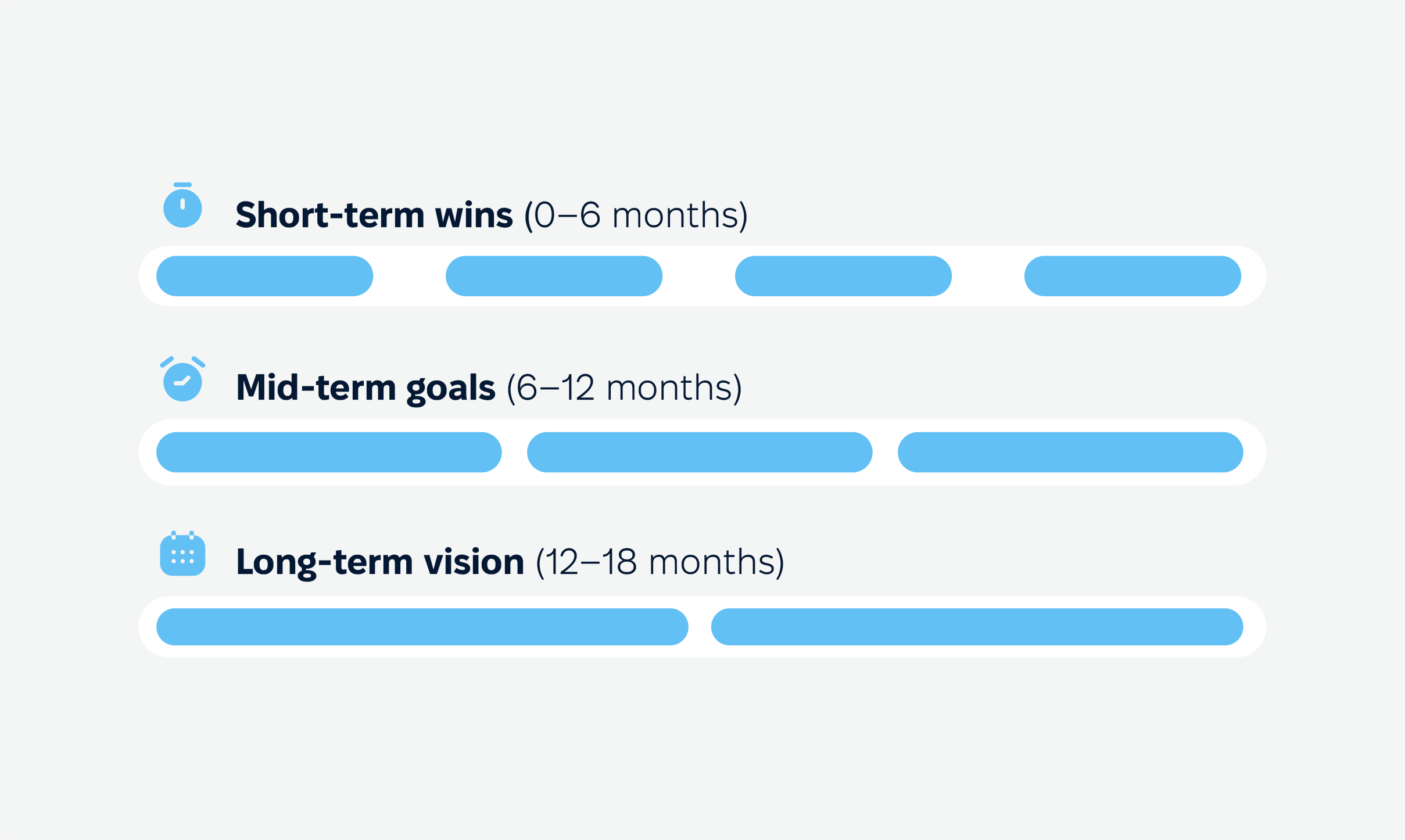

- Short-term wins (0–6 months): pilot self-service portals, enhance mobile app experiences, and automate key processes like claims triaging.

- Mid-term goals (6–12 months): scale successful pilots, integrate systems, and implement AI-driven personalization.

- Long-term vision (12–18 months): fully operationalize an omnichannel strategy, unify data platforms, and achieve measurable improvements in customer satisfaction and operational efficiency.

For this process, you’ll need to get on board

- Skilled personnel: CX specialists, IT teams for seamless integration and troubleshooting, and managers. In a nutshell – cross-functional teams.

- Tech that can handle the heat: scalable platforms for engagement, automation, and centralized data. And security to protect sensitive customer info – trust is non-negotiable.

How to know you’re crushing it?

- You get a customer-first design. Every choice you make should scream “we care about you.” That means intuitive interfaces, lightning-fast claims, and digital insurance solutions that feel tailor-made.

- Leadership, as it needs to back the insurance CX transformation, not just with words but with funding and alignment across departments.

- You have measurable wins: track KPIs – NPS, digital adoption rates, claims speed, and cost savings. Numbers don’t lie.

Need professional consultation to bring your business to the next level? Get our free insurance CX transformation consultation, and let’s make your vision come true.

Wrapping It All Up

The insurance world is at a turning point, and the stakes have never been higher. People are demanding more positive customer experience – faster claims, personalized experiences, and seamless digital insurance solutions. The good news? The tools and strategies to meet these expectations are here, and the companies that embrace them are already pulling ahead.

But CX digital transformation isn’t just about adopting the latest tech or automating processes. It’s about rethinking how you connect with your customers and build trust in an industry that thrives on it. From AI-driven personalization to mobile-first digital insurance solutions, the opportunities to deliver exceptional customer experiences are endless.

Now it’s your turn. Ready to lead the charge in reshaping insurance CX? The future is digital, and it’s yours to create – so let’s get started!