Insurance digital transformation is a must-have step you need to take if you want to make your business competitive and meet up-to-date trends. That is why you must follow a digital strategy for the insurance company and transform your business.

We are not going to beat around the bush. We want you to get acquainted with digital transformation conception, why it is essential, steps to transform your business, trends, and success stories of other companies. So let’s not waste your time!

What Is Digital Transformation?

Many individuals think that digital transformation means a simple integration of new technologies into existing processes. However, it is a wrong opinion that can lead to massive trouble in any type of business. And insurance is not the exception. The usage of blockchain, artificial intelligence, or IoT doesn’t make your company digital. Technology is just a part of the transformation. And people play a significant role here.

Digital transformation is a redefining of methods of how employees work and the organization of working processes. Transformation must help employees interact with customers more effectively using modern technologies and data analysis.

The purpose of digital insurance transformation is relatively straightforward — the increase of the company’s performance level. Thus, insurers will be able to spend less, earn more, and beat the competition. And it is necessary to develop employees’ potential, where technologies will be an excellent auxiliary tool, and your insurance company will be transformed into an InsurTech company. There is an article about InsurTech in our blog you can also read.

Why Is Digital Innovation In The Insurance Industry Important?

There are many more benefits of starting a digital transformation in your insurance business than you can imagine. You will find below the list of significant advantages.

Faster access to the market. As everything becomes digital, your insurance agency starts providing online services, and everything goes faster and more productively. Therefore, your services become more competitive.

AI-based services. Predictive analytics, in particular, makes it possible for your business to make the right decisions and predict certain pitfalls that may appear in the future.

Automation. Primary business procedures become automated, and it saves time for your employees, it saves time for customers. Employees concentrate on more crucial tasks.

Synchronization. Digital transformation helps synchronize working processes, and it leads to sales and profits growth eventually.

Better customer experience. You create products specifically for customers. These products must meet their needs and expectations. Well-thought-out design and best-fitting features make your customer loyal and improve their experience. This part can be entrusted to an insurance software development company like Cadabra Studio that builds insurance websites and apps from scratch.

Cost-efficiency. Since many processes become automated and paperwork comes to naught, your business saves a lot of money but increases profits.

Enhanced claims processing. Finally, all claims and underwriting procedures are processed much faster, and the number of possible mistakes made by employees is almost negligible. Thus, machine learning algorithms can take the part of work, analyze claims and identify potential errors there. Besides, automation of routine processes leads to higher productivity of employees.

Hurry up to get the consultation of our business development managers for insurance software development. Contact Cadabra Studio!

Insurance Digital Transformation Trends

Whether you need life insurance digital transformation or health insurance digital transformation — there is no difference since you are recommended to pay attention to digital transformation trends to make your business up-to-date. And it is not so important what insurance type your agency provides. We will list major trends for you to consider.

Remote work. The COVID-19 pandemic in 2020 has changed our lives and made us adapt to these changes. Thus, many companies had to organize remote work of their employees without the productivity loss. As 2021 shows, remote work remains topical. That is why insurers have to use relevant software and apply management methods to improve remote work and avoid professional burnout.

Hybrid cloud architecture. Hybrid cloud architecture combines a few cloud architectures like private, cloud, and public clouds. HC architecture enables fast integration of new IT technologies; it provides rational usage of IT resources, scalability, etc. Insurance companies need to use HC architecture to optimize workflow and speed up many processes.

Qualified team management. As we noted above, it is highly recommended to manage the team wisely to let them fulfill their obligations correctly and willingly. Thus, it may be an excellent option to use internal software for teamwork encouragement and adequate collaboration. That is what you need to focus on when you are looking for the right keys to digital transformation.

Conversion increase. If you made your business available online, it doesn’t mean that you are done, and the most complicated part is over. You must turn into a digitally savvy insurer who converts all online visits into sales. When you improve sales funnels, your business grows (and profits as well).

If you want to know how to improve conversion, there is a guide on website conversion optimization we have prepared for you. Besides, note that your software’s UI/UX design directly impacts the conversion rate growth — if it is user-friendly, you contribute to lead generation.

The digital channel becomes the primary channel. Due to the same COVID-19 reason, more businesses go online, and physical channels become outdated. So you cannot provide your customers with high-quality services if you still didn’t digitally transform your business.

AI tools must be applied. Artificial intelligence becomes necessary for algorithmic risk assessment and for processing speed improvement. Moreover, AI makes it possible to automate many processes and make them more accurate.

How does AI work in insurance? For example, accurate fraud detection. According to the Crowe report, fraud costs over $5 trillion, a sum more than 80% greater than the UK’s entire GDP. In contrast, machine learning can detect fraudulent transactions that have specific distinctions. And the number of frauds can be decreased substantially.

Also, credit risk prediction is possible due to AI. British startup called SPIN Analytics created the RiskRobot tool to help financial institutions automate their credit risk management process.

Therefore, AI integration into existing insurance processes is a trend to take into account.

How To Start An InsurTech Company

We reached the section concerning tips on how to deal with digital transformation and steps to launch an InsurTech company. It will help you organize the process of digital transformation and move step by step.

Build A Strategy

The digital transformation strategy must include an analysis of customers, their needs, and the analysis of shortcomings your business has at the moment. It will be preferable to keep on communicating with customers during the digital transformation processes so that you can receive feedback and let your customers understand that you value them. They play the most critical part in the process.

Then, when you identify all the weak sides you need to deal with, try to eliminate them as soon as possible using modern technologies. That is what digital transformation also allows you to do.

Note! You don’t need to delve into all these steps if you want to save your time and focus on more crucial tasks. Cadabra Studio is a company that will implement all these steps for you — contact us!

Elaborate On Customer Journeys

You must study the customer journey from beginning to end. Customer journey is the visualized way customers go when they start looking for the product you offer until the purchase moment. When you build an insurance website or mobile app, you must imagine that you are a customer and make the search and purchase process more straightforward and familiar. At Cadabra Studio, we pay a lot of attention to building customer journey maps and making them as habitual as possible.

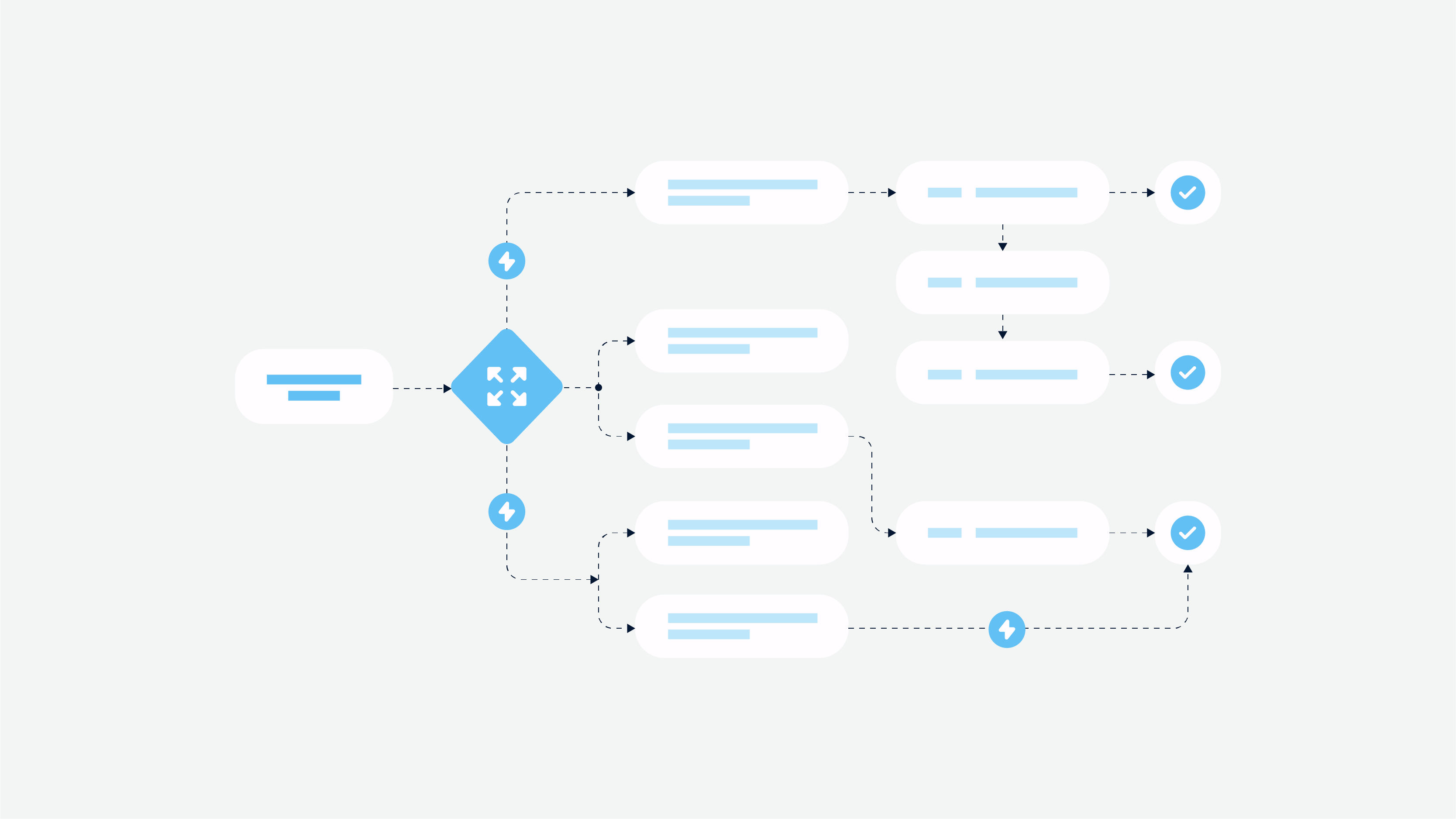

Use Digital Transformation Framework

The digital transformation framework is a roadmap of vital strategies and steps you need to apply during the DT process. But these frameworks may be different, and you need to find the one appropriate for your specific case. There are such digital transformation frameworks like Gartner, McKinsey, Accenture frameworks — these are the most famous ones. When you use the proper framework, you can make sure that you won’t miss something.

Turn To Processes Automation

Finally, you need to automate existing processes, integrate live chat functions, create automated billing processes, etc. Everything listed is achieved during the transformation process when you go online, and software is developed.

You need assistance from a software development company like Cadabra Studio since we have vast insurance software creation expertise. You can find more details in the article about insurance software development services where development tips are described.

Need an insurance project from scratch or a redesign of the existing one? Contact Cadabra Studio to go on!

Insurance Digital Transformation Success Stories

Many insurance projects can boast about their successful digital transformation and how they provide their services on a new level. But the main thing you must consider is that your company may be the next one on this list if you do everything wisely.

Neos

Neos is the company involved in property insurance. It went online and started using IoT (Internet of Things) to let customers control their property and predict possible emergencies. Leak detectors, wireless cameras, smoke sensors, and a mobile app — this combination provides customers with a higher level of service, and Neos insurers can offer better policies.

When the company decided to digitally transform their business and chose IoT as the primary way to attract new customers — they entered a new era. If you aren’t aware of IoT, we recommend reading our article describing how IoT may revolutionize your business.

Cuvva

This InsurTech company has changed car insurance services and started delivering new insurance policies on a pay-as-you-go basis. It means that if you rent a car, you can insure it even for one hour. Thus, when you don’t need expensive and long-term insurance, you can use the Cuvva mobile app and use temporary insurance.

Note! As you can see, digital transformation implies the delivery of more flexible and convenient services to customers. When you transform your business, you should not only build a new app — you must create with exciting new features to satisfy your customers.

Everledger

Everledger is one of the first InsurTech companies that transformed their business and integrated blockchain technology into working processes. Everledger is a tool that insurance companies may use for more accurate underwriting due to blockchain capabilities.

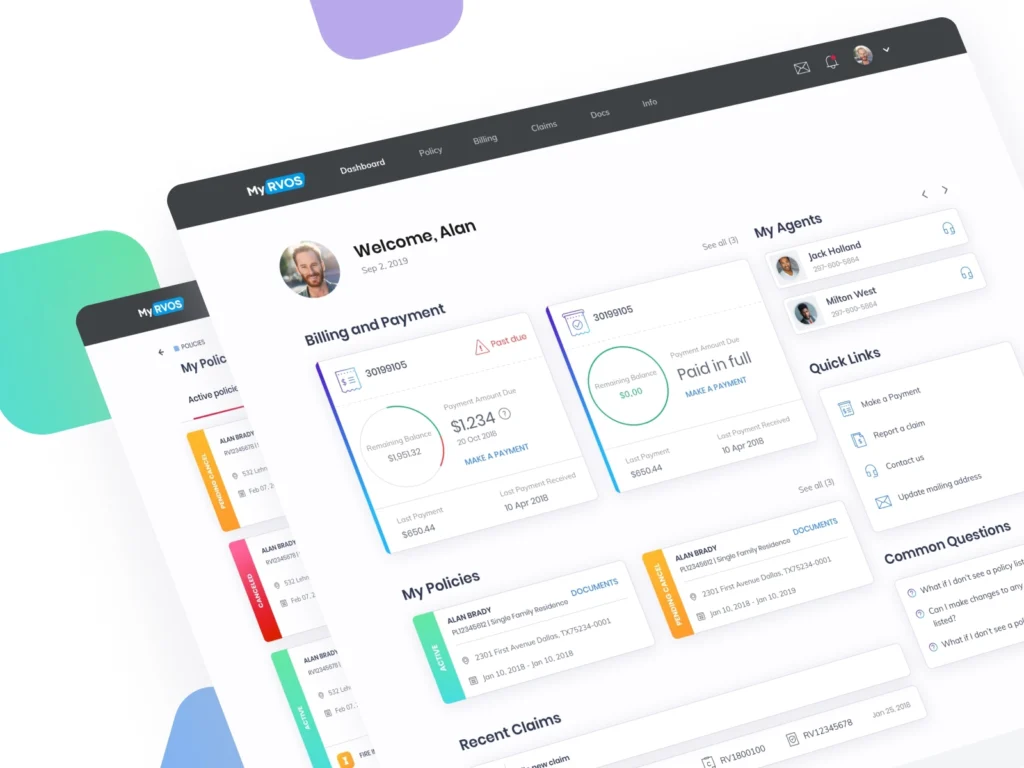

RVOS Insurance

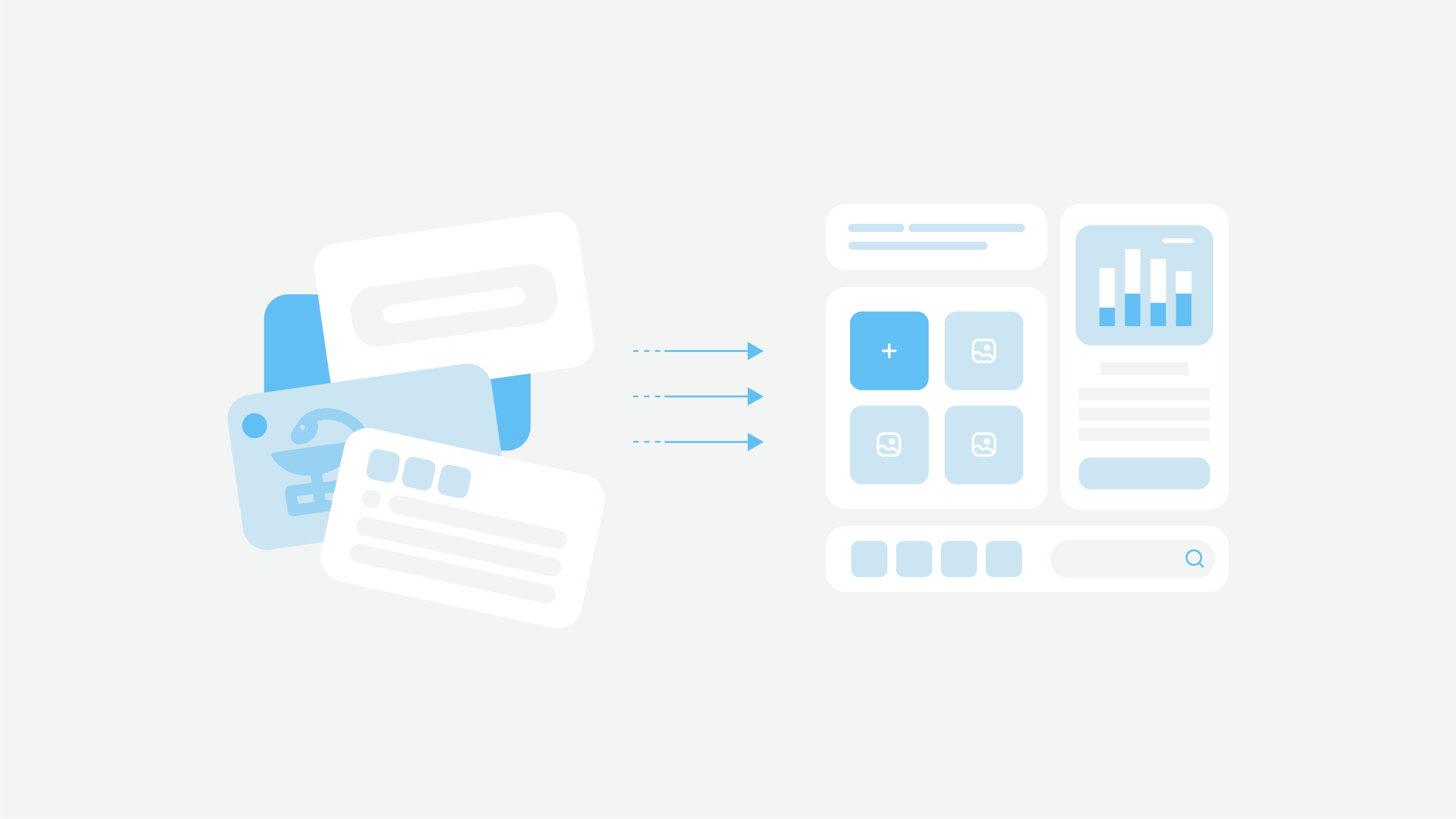

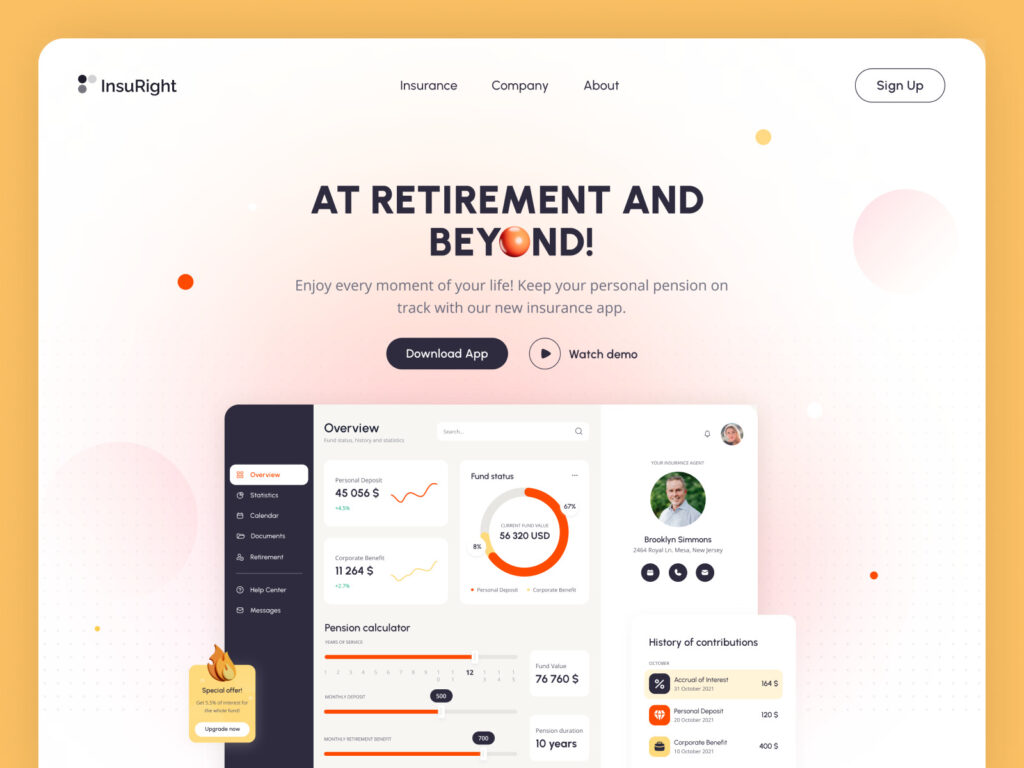

Although this company has existed for almost 120 years in the US market, it has a website, but it lacked a customer web portal. The company representatives contacted Cadabra Studio to build an advanced customer service that will meet the company’s branding and spirit.

Our developers and designers did their best to build a portal using modern techniques and the best UI/UX practices. And we managed to do everything our client wanted. The case study about the RVOS project will show you everything in detail. Also, you can check our portfolio containing the RVOS project — it will provide you with large images of a web portal.

Conclusion

Wrapping up, we can say that digital transformation is necessary if you don’t want to lag behind and save your business. You need to find the right approach and offer your customers what they want. And Cadabra Studio will help you with the transformation process as much as we always do.

The development of a website or mobile app should always come along with one important feature — it must be user-friendly. So the development process requires skills and takes time. Contact Cadabra Studio if you don’t want to waste your time.