The insurance world is at a crossroads, and the path forward is paved with technology. Insurance digital transformation is the backbone of how insurance companies are evolving to meet customer expectations and outpace the competition. From sleek mobile apps that let customers manage policies on the go to AI-powered tools that make claims processing faster than ever, the shift is undeniable.

But here’s the kicker: this isn’t just about catching up – it’s about staying ahead. Whether you’re an established player looking to modernize or a startup aiming to disrupt the market, understanding and leveraging digital trends is the key to success.

In this guide, we’ll take you through everything from game-changing digital insurance solutions like blockchain and IoT to the nuts and bolts of making transformation strategies stick. Along the way, you’ll discover how to overcome challenges like legacy systems and cultural resistance while building customer-centric solutions and robust cybersecurity frameworks.

Ready to dive in? Let’s explore how you can turn digital transformation from a daunting task into a golden opportunity. Buckle up – it’s time to future-proof your business.

The Current State of Digital Transformation in Insurance

Digital transformation has become a central focus for the insurance industry, driven by customer demand for seamless digital experiences and operational efficiency. Traditional insurers are racing to modernize processes, while InsurTech startups leverage innovation to disrupt the market.

Some stats

Approximately 60-70% of insurance companies globally are in the process of digital transformation and insurance technology adoption, although their maturity levels vary. This trend is influenced by increasing competition, customer expectations, and technological advancements.

The global insurance technology market is projected to grow at a CAGR of 16% through 2025, reaching $10 billion annually. This growth is driven by increased adoption of AI, automation, and customer-centric technologies by insurers to enhance operations and stay competitive.

Future projections

By 2025, the insurance digital transformation will be defined by customer-centric digital solutions that prioritize seamless, personalized experiences. Data analytics and AI in underwriting will also become InsurTech trends and essential tools, enabling insurers to assess risks more accurately, tailor policies to individual needs, and enhance operational efficiency.

Meanwhile, blockchain integration will revolutionize transparency and security in areas like claims processing and fraud prevention. The growing adoption of IoT devices as one of the InsurTech trends – from connected cars to smart home sensors – will further transform risk management, giving insurers real-time data to assess and mitigate risks proactively.

We’ll come back to these and other InsurTech trends a little bit later. Now, let’s move on to the force behind the progress of digital insurance solutions.

Key Drivers of Digital Transformation

Here’s a closer look at what’s pushing insurance digital transformation:

Shifting customer expectations

I can say from my own experience that today’s customers want quick, personalized, and convenient interactions. They expect mobile-friendly options to manage policies anytime, anywhere, and rely on self-service portals for control and ease of use.

On top of that, AI-powered chatbots are becoming the norm, delivering instant, around-the-clock support. Insurers who can’t meet these demands risk losing relevance and customer loyalty in a highly competitive market.

Pressure from InsurTech startups

InsurTech companies are shaking up the insurance world with fresh ideas and faster services. Their agility and innovation are pushing traditional insurers to step up their game by adopting cutting-edge tools and technologies.

The result? A rapidly changing industry where everyone, from startups to established giants, has to compete on a level of insurance digital transformation.

Operational challenges

Efficiency is no longer a luxury but a necessity. Streamlining operations by automating processes and using advanced tech are the forces behind insurance technology adoption. They’re critical to cut costs, reduce errors, and free up resources.

Regulatory and market pressures

Tighter regulations and economic instability are forcing insurance companies to adopt secure, compliant, and flexible digital systems. These solutions not only help reduce risks but also allow businesses to adapt quickly to industry changes, ensuring they remain competitive and resilient.

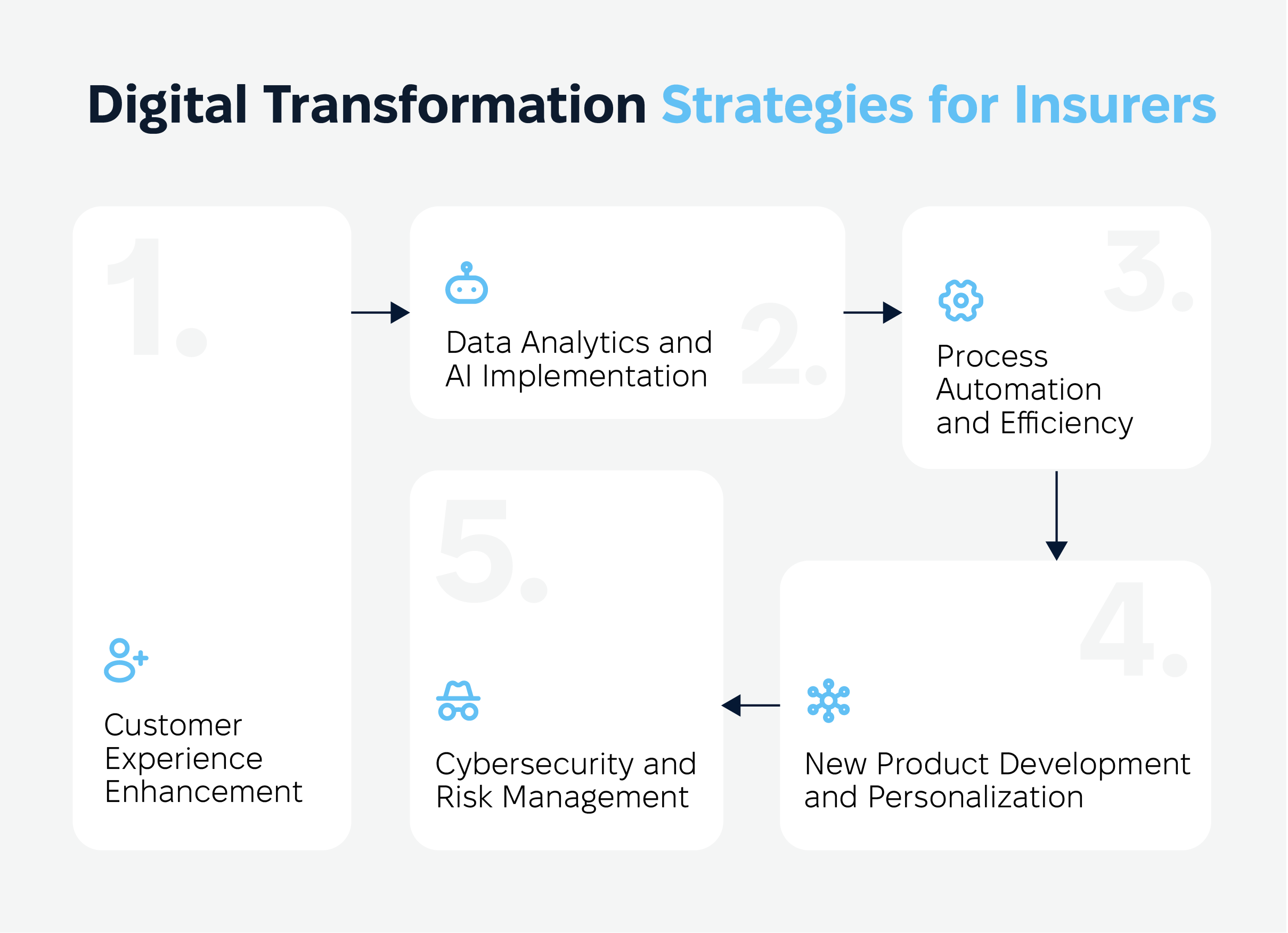

Digital Transformation Strategies for Insurers

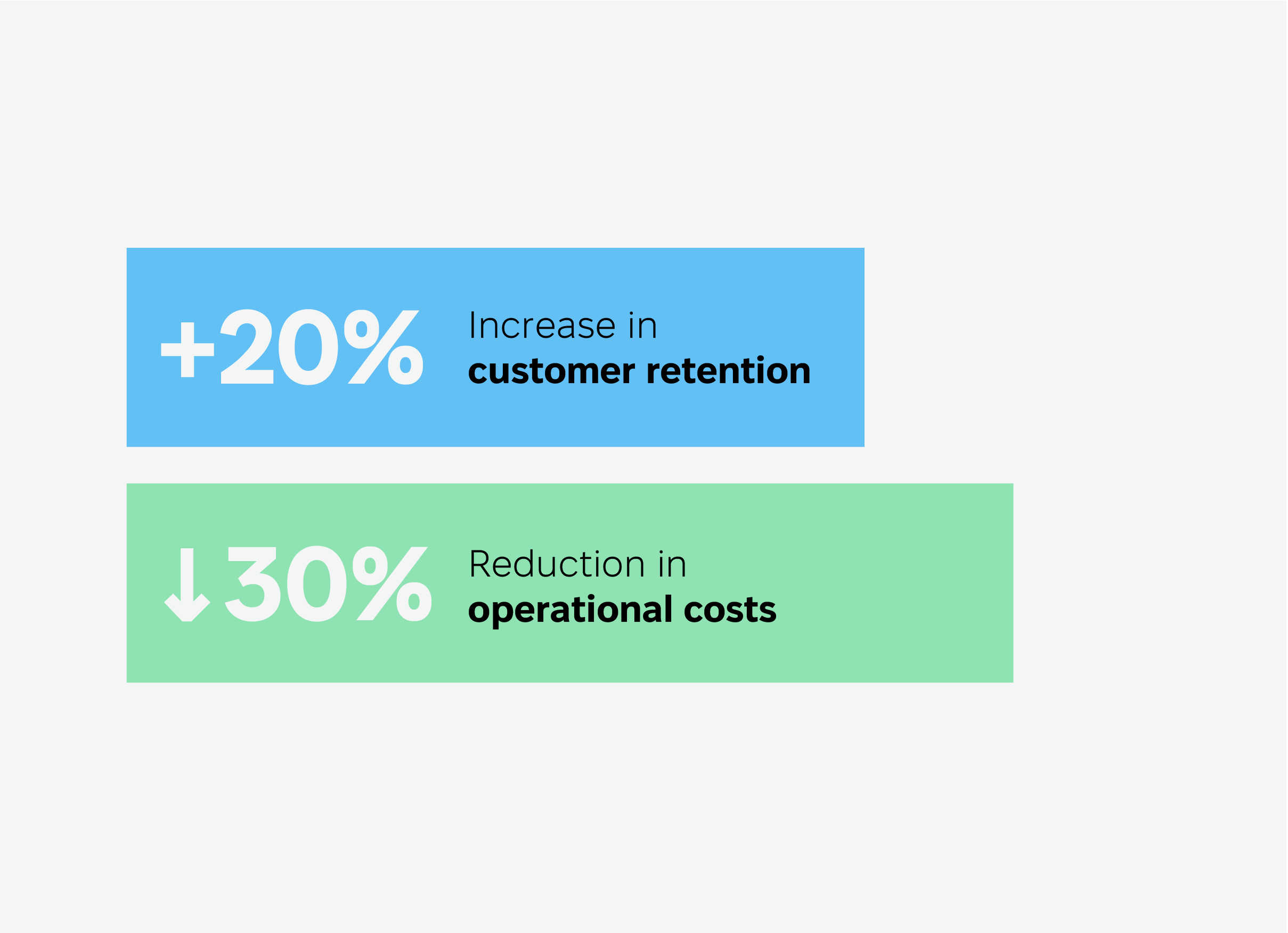

Insurers that have implemented comprehensive digital transformation strategies have reported significant benefits, including up to a 20% increase in customer retention and a 30% reduction in operational costs. Here’s how you can use technology to stand out in the market:

1. Making customer experiences better

InsurTech trends like AI-powered chatbots are changing the game by offering around-the-clock support that answers customer questions instantly. On top of that, data analytics tools help insurers design personalized policies that address individual needs, building trust and loyalty.

To take it further, insurers are using omnichannel platforms that connect communication across social media, apps, and email. This makes it easy for customers to switch between channels without missing a beat, creating a smooth, consistent experience.

2. Using AI and Analytics to work smarter

AI and predictive analytics insurance technology adoption are critical to refine risk assessments, anticipate customer needs, and make better decisions that boost efficiency and profits.

Another big win? Fraud detection. Advanced algorithms spot red flags and unusual patterns in real-time, saving money and maintaining trust with honest customers.

3. Automating insurance processes for efficiency

Automating repetitive tasks like claims processing speeds up service and cuts costs. Robotic process automation (RPA) also frees up employees to focus on strategic projects that drive growth.

Successful insurance digital transformation is also about streamlining onboarding and policy management with tools like digital ID verification and automated updates. This not only reduces errors but also makes life easier for customers and staff.

4. Launching innovative products and personalization

New tech is helping insurers create products that fit modern lifestyles. For instance:

- Usage-based insurance (UBI) adjusts rates based on customer behavior, thanks to IoT devices.

- Dynamic pricing models offer flexibility, so policies can adapt to changing needs.

Another one from hot InsurTech trends that can be a part of your strategy is embedded insurance – bundling coverage with other purchases, like cars or electronics. It’s a simple, convenient way to reach more customers and add value to everyday transactions.

5. Building stronger cybersecurity

As insurers go digital, cybersecurity has to keep up. AI tools are now monitoring for threats and helping prevent breaches before they happen. And staying compliant with data protection laws builds trust while protecting sensitive information.

A newer approach is the zero-trust framework, which requires everyone to access systems to verify their identity – no exceptions. Paired with regular employee training, this strategy is a strong defense against increasingly sophisticated cyber threats.

Get Your Free Consultation

Our experts will analyze your insurance transformation needs and discuss a roadmap

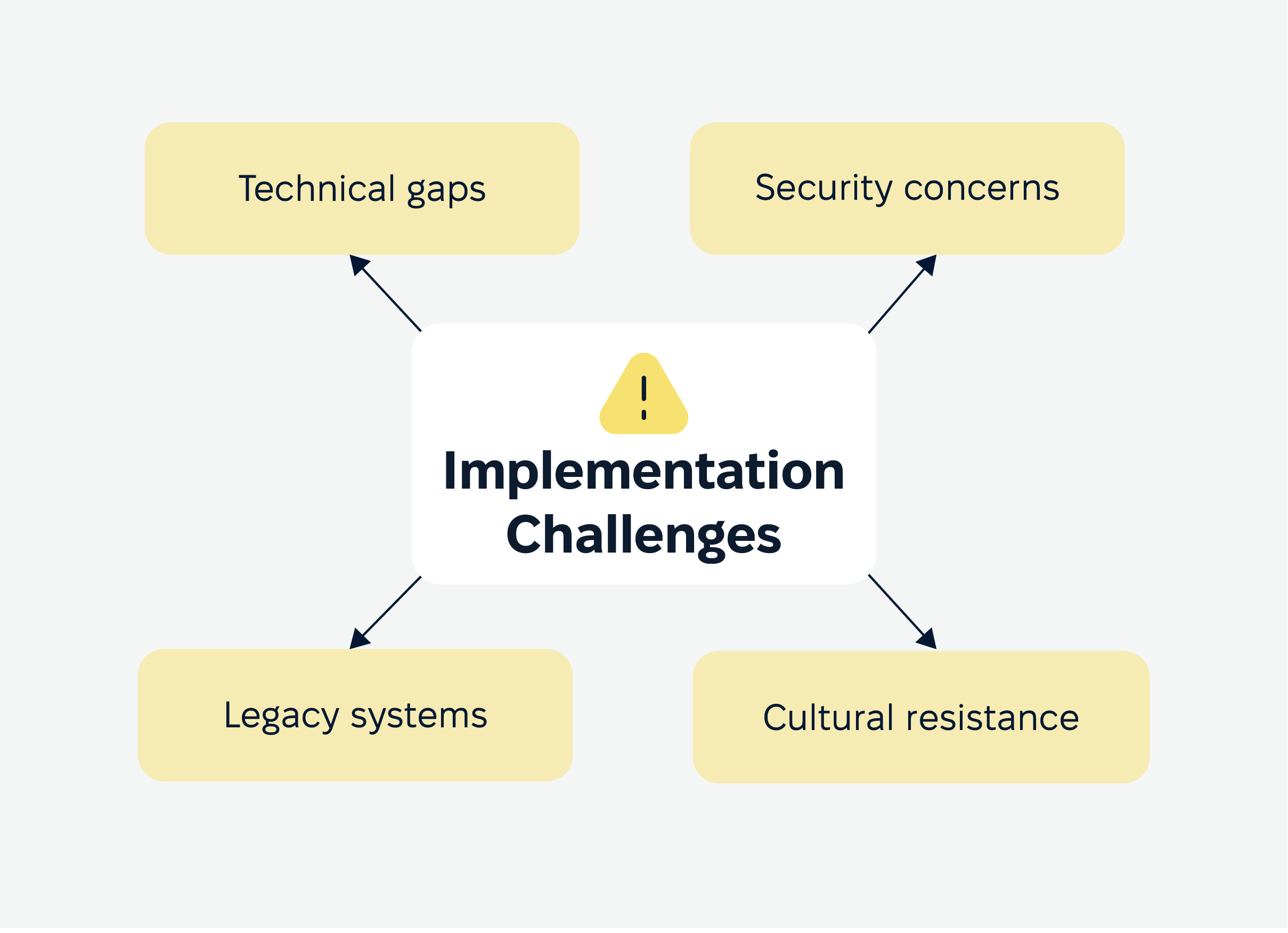

Implementation Challenges in Digital Transformation for Insurers

Tackling legacy systems

Outdated legacy systems are one of the biggest roadblocks to insurance technology adoption. These systems often struggle to integrate with modern technologies like AI, blockchain, and cloud computing.

Phased modernization is a practical solution where insurers replace legacy components in stages while keeping core operations running smoothly.

For example, insurers might start by moving non-critical tasks like customer self-service portals to the cloud, gaining early wins before tackling more complex systems. API integration can also bridge the gap between old and new systems.

Overcoming cultural resistance

Cultural resistance to change is another common hurdle in insurance digital transformation. Employees may doubt the effectiveness of new technologies or feel uneasy about shifting away from familiar workflows. Strong leadership is key to breaking down these barriers.

You can foster a culture of innovation by sharing success stories, offering hands-on demonstrations, and incentivizing early adoption.

Bridging technical skill gaps

Technology is evolving faster than many organizations can keep up, leaving insurers with significant skill gaps. Without the right expertise, digital projects can stall. To address this, insurers are ramping up efforts to reskill and upskill employees or looking for reliable outsourcing partners, focusing on critical areas like data analytics, cybersecurity, and AI.

Mitigating security risks

Going digital increases cybersecurity risks, especially with the volume of sensitive customer data insurers handle. A robust security strategy is essential to mitigate these threats. AI-powered tools can detect and respond to threats in real-time, while multi-layered measures like encryption and regular audits add extra protection.

Compliance with standards like GDPR or ISO 27001 is a must in insurance technology adoption to meet regulatory expectations, but a proactive approach is just as important. Regular cybersecurity drills and training programs can turn employees into the first line of defense, equipping them to recognize and respond to phishing and other attacks.

Emerging Technologies Shaping Insurance

Blockchain: cutting out the middlemen

Blockchain in insurance digital transformation is like a digital handshake that you can trust. It creates a secure, tamper-proof way to manage data, especially when it comes to claims.

This is one of the InsurTech trends that keep everyone on the same page, speeding up payouts and cutting back on paperwork. And with smart contracts, insurance can practically run itself. These self-executing agreements handle payouts or renewals automatically when the conditions are met, taking the hassle out of the equation.

IoT: data that talks back

From my perspective, this is another one of the most critical InsurTech trends. The Internet of Things (IoT) is bringing a whole new level of personalization and risk management:

- Home insurance: Smart sensors can catch a water leak or fire before it turns into a disaster.

- Auto insurance: Telematics lets insurers reward safer drivers with lower rates through usage-based insurance (UBI).

- Health insurance: Wearable tech tracks health stats, helping insurers offer discounts while encouraging healthier lifestyles. It’s like getting a fitness coach baked into your insurance.

Hybrid cloud: the best of both worlds

Hybrid cloud systems let digital insurance solutions mix private and public clouds, balancing tight security with easy scalability. Need to ramp up during busy seasons or handle new tech? No sweat. This setup keeps things running smoothly and flexibly without breaking the bank.

AI and machine learning: smarter, faster, better

AI and ML are rewriting the rulebook for insurers:

- Underwriting and risk: AI in insurance technology adoption digs into mountains of data to spot patterns and predict risks better than ever.

- Fraud busting: AI flags sketchy claims before they get paid out, saving money and time.

- Customer service: Got a question at midnight? AI chatbots are there with instant answers, no wait times.

- Personalized policies: In insurance digital transformation, AI tailors insurance to your exact needs, making everything feel less cookie-cutter and more “just for you.”

APIs: building connections

APIs are like the glue among InsurTech trends. They connect systems, letting insurers offer real-time quotes, power smarter chatbots, and collaborate with other platforms. This tech fuels quick innovation and makes sure services stay customer-friendly and future-proof.

Smart contracts: hands-free insurance

Blockchain-based smart contracts take the guesswork out of digital insurance solutions for agreements. Think travel insurance that pays out automatically when a flight’s delayed. No paperwork, no chasing down claims. It’s insurance that works behind the scenes.

Usage-based insurance: pay for what you use

Why pay more when you can pay smart? Usage-based insurance (UBI) uses tech like telematics to track your driving or lifestyle habits, then sets your premium based on what you actually do. Drive safe? You save. It’s that simple – and it’s catching on.

Case Studies: Successful Insurance Transformation

One great example of an insurance company embracing digital transformation is Shield Insurance, which worked with us to completely revamp its website. The redesign was focused on creating an intuitive, sleek platform that improved user experience and made it easier for customers to manage their policies.

The result? Site visits went through the roof, tripling in volume, and conversions skyrocketed by 233.95%. This project clearly demonstrates that you can’t underestimate the power of a well-designed website in driving both traffic and engagement.

The Shield Insurance project also embraced automation, streamlining tasks like claims processing. This not only helped reduce costs but also improved service quality, showing how important it is to work smarter, not harder. The company improved its digital presence while meeting the demands of tech-savvy customers.

The case of Shield Insurance proves that a solid digital strategy, backed by smart design and automation, can lead to real business growth. It’s all about getting the right tools in place to meet customer expectations and stay ahead of the curve in an industry that’s constantly evolving.

Preparing for 2025: Action Steps

1. Creating a strategic roadmap

To ensure effective insurance digital transformation, you have to establish a well-defined roadmap with clear objectives, measurable KPIs, and realistic timelines. This involves

- conducting a gap analysis to identify current technological shortcomings,

- prioritizing initiatives that offer the highest ROI,

- continuously revising strategies based on market trends and internal progress.

By aligning business goals with technological capabilities, insurers can position themselves to adapt quickly to disruptions and seize emerging opportunities.

2. Investing in talent

A digital-first approach requires a workforce skilled in emerging technologies such as AI, blockchain, and IoT. Insurers should prioritize working with experts in data analytics, cybersecurity, and agile methodologies.

Strategic hiring of tech-savvy professionals ensures that your insurance digital transformation team is equipped to handle the evolving demands of the industry. Partnerships with educational institutions and certification programs can further support talent development.

3. Building strategic partnerships

Collaborations with InsurTech experts, technology providers, and other industry players are vital for driving innovation and staying competitive. These partnerships give insurers access to digital tools, help them adopt digital solutions faster, and open doors to new markets.

Joint ventures also allow companies to share the risks and costs of large-scale digital transformations, creating a more sustainable path to innovation. For example, partnering with a data analytics provider can enhance customer insights while reducing the in-house resources needed for development.

4. Designing customer-centric services

Meeting user’s expectations means developing intuitive digital platforms, offering AI-powered support, and creating tailored products that align with individual needs. Leveraging advanced analytics and predictive technology, insurers can not only anticipate client demands but also provide services like dynamic pricing and proactive risk notifications.

This approach enhances customer engagement, fosters loyalty, and strengthens brand positioning in an increasingly crowded marketplace. Keeping clients at the heart of the matter ensures insurers stay relevant and competitive.

5. Enhancing cybersecurity infrastructure

As digital adoption grows, so do the risks of cyberattacks. Insurers need to implement AI-driven cybersecurity solutions that can identify and neutralize threats in real-time, ensuring the safety of customer data and insurance operations.

Regular security audits, ongoing employee training, and investments in secure systems are essential for creating a strong defense against ever-evolving threats. After all, when it comes to cybersecurity, it’s better to be safe than sorry.

Big Picture

Insurance digital transformation is a paradigm shift essential for survival and growth in 2025 and beyond. By embracing InsurTech innovation, addressing implementation challenges, and adopting forward-thinking strategies, insurers can position themselves as leaders.

Insurers must adopt a proactive mindset. This involves prioritizing continuous learning, fostering strategic collaborations, and keeping customers at the heart of innovation. Companies that adapt to emerging digital technologies like blockchain, IoT, and AI while

Tech breakthroughs and trends aren’t just upgrades but game-changers for digital insurance solutions. They make the insurance sector faster, cheaper, and way more customer-focused. By jumping on the blockchain, artificial intelligence, IoT, and hybrid cloud train, insurers can stay ahead of the curve and give customers the modern, seamless experiences they expect.

So, whether you’re an industry pro or just someone who wants insurance that actually works for you, this is where things are heading. Buckle up – it’s going to be an exciting ride!

Cadabra Studio is here to guide you through this journey. Contact us to explore tailored digital insurance solutions that empower your organization to thrive in the digital era.