Digital transformation and InsurTech are changing the game, and choosing the right software can feel like a make-or-break decision. Pick the right one, and your company’s efficiency and customer experience will soar. Pick the wrong one, and you’re stuck in the slow lane.

So, whether you’re an insurance exec, an IT lead, or part of an InsurTech startup, figuring out whether to go for custom insurance software or stick with an off-the-shelf insurance software solution is key to staying ahead of the competition and ready for the future.

And let’s be honest, it’s not just about keeping up anymore but setting the pace. With the right software, you can streamline operations, simplify claims processing, and even predict customer needs before they arise.

In a world where clients expect instant results and seamless service, the right tech can be the difference between being a trusted market leader and an insurance company that’s always one step behind. So, choosing your software solution isn’t just another IT decision – it’s your ticket to staying relevant and thriving in the ever-evolving insurance landscape.

So, in this new article, we’ll

- break down the pros and cons of both options;

- help you figure out which one gives you the best insurance software ROI;

- and walk through real-world case studies that show how both approaches play out in the field.

Why It’s a Big Deal in the Insurance World

Insurance is no longer the paper-pushing, slow-moving industry it once was. These days, everything is going digital, and software is doing the heavy lifting. From policy management and claims processing to customer service and data analytics, it’s all about tech.

In fact, the global InsurTech market was valued at $5.45 billion in 2022 and is expected to expand at a compound annual growth rate of 52.7% from 2023 to 2030. So, the question isn’t if you should go digital. It’s whether you should go for a tailored, custom solution or a pre-built, off-the-shelf option.

Imagine software like the foundation of your house. A custom solution is like building your dream home from scratch. You get to decide every little detail – from the number of rooms to the exact shade of your kitchen tiles.

Custom software can be made to fit your company’s specific needs, making it easier to scale and integrate with your existing systems. Plus, 75% of insurers believe integrating digital ecosystems and investing in custom digital solutions will be critical to staying competitive in the next five years.

On the other hand, an off-the-shelf solution is like buying a ready-made house. It’s faster and cheaper to move into, but you may have to live with a kitchen layout or room size that doesn’t quite fit your needs. It’s great for getting up and running quickly, but flexibility might be limited.

Insurance companies use some form of off-the-shelf software to manage claims and policies, mainly because it speeds up implementation time. But, as businesses grow and evolve, many find themselves needing more flexibility, which is where custom solutions shine.

What’s the Deal with Custom Insurance Software (Insurance Technology Comparison)?

Custom insurance software is like getting a suit tailored just for you, as it is designed specifically to fit your business perfectly. Whether you’re focusing on policy management, claims processing, or customer service, a custom solution addresses your unique challenges head-on.

Сompanies opting for custom software collaborate with development teams to build something that checks every box for their specific requirements.

In other words, you don’t have to fit into something pre-made but create a system that works exactly the way you need it to.

Why custom software could be right for you

As I’ve already said, in insurance technology comparison, the biggest perk of custom software is that it’s designed specifically for your business processes. No more awkward workarounds or bending your workflow to fit an off-the-shelf product. Insurance companies cited the need for tailored functionality as the top reason for choosing custom software solutions.

But that’s not all. Here are some other benefits of custom insurance software.

It is scalable and flexible

Custom insurance software grows as your business grows. Whether you’re expanding to new regions, adding new insurance products, or adjusting to new regulations, in terms of insurance technology comparison, custom software can easily adapt. In fact, the custom software development market evaluated $28.2 billion in 2022, with a projected CAGR of 21.5% between 2023 and 2032.

Seamless integration

Already have systems like CRM tools, claims management platforms, or data analytics software in place? Custom software can integrate seamlessly with these existing systems, making it easier to streamline operations and avoid data silos.

Compliance from day one

Regulatory compliance is a huge issue in the insurance world, and failure to comply can result in hefty fines. With custom insurance software, you can build in compliance from the start. Whether it’s adhering to HIPAA, GDPR, or local insurance laws, custom solutions help ensure you’re covered from day one.

And the icing on the cake: more than 85% of businesses use custom software solutions to improve operations.

But there’s a catch…

In an insurance technology comparison, custom insurance software costs more upfront. It isn’t cheap – building something from scratch requires a bigger upfront investment. It can cost anywhere from $100,000 to $500,000, depending on complexity. But despite the higher initial cost, 63% of insurance executives believe custom solutions deliver better ROI in the long run.

Also, developing a custom insurance system takes time. While an off-the-shelf solution might take just a few weeks to implement, custom software can take months to design, build, and deploy. But for many companies, the wait is worth it. In most cases, the long-term flexibility of custom software outweighs the slower time-to-market.

With custom software, you’re not just done after it’s built. You’ll need to plan for ongoing maintenance: updating features, fixing bugs, and ensuring security measures are up to date. However, having control over updates is a major advantage.

So, while custom insurance software comes with a higher price tag and takes longer to get up and running, the long-term benefits make it a solid investment for companies looking to future-proof their operations.

If you’re in it for the long haul and want a solution that can grow with your business, custom software might just be the way to go. Think of it as building a solid foundation that’ll support your business for years to come.

Want to create a well-tailored insurance solution with perfect features? Contact us today

What About Off-the-Shelf Insurance Software?

Off-the-shelf insurance software solutions are like buying a pre-made cake from the bakery. They come ready to go and are designed to handle the usual insurance tasks, such as policy management, claims processing, and insurance data analytics.

Since these platforms are built with industry standards in mind, they often come equipped with features that many insurance companies need right out of the box. This can make them an attractive option for those looking to streamline operations without diving into the complexities of custom development.

Why off-the-shelf insurance software might be a better option

One of the biggest perks of off-the-shelf software is that you can hit the ground running. With a ready-made solution, you can have your software up and running in no time, sometimes even within days. This quick setup is especially appealing for companies looking to solve immediate operational challenges without the lengthy development timeline that comes with custom solutions.

Cheaper upfront

In terms of insurance technology comparison, the initial investment for off-the-shelf software is typically lower. Instead of spending big bucks on a custom solution — which can range from $100,000 to $500,000 — you might only need to pay a fraction of that price. This can be a significant advantage for smaller companies or startups working with tighter budgets.

Updates are taken care of

When you choose off-the-shelf software, you don’t have to worry about regular maintenance and updates. The software provider handles this for you, ensuring that you’re always using the latest version with the newest features and security enhancements. This can save you time and resources that you’d otherwise spend managing updates in a custom system.

However…

According to Gartner’s report, 60% of off-the-shell software buyers express regret after purchasing products and not satisfied with their insurance software ROI. Why?

One of the downsides of off-the-shelf insurance software solutions is that they often come with limited customization options. You might find yourself having to bend your processes to fit the software rather than having the software adapt to your specific needs. This can lead to inefficiencies or even frustration among your team.

Here are some other pitfalls:

- Scalability issues. If your business is on the fast track to growth, off-the-shelf insurance software solutions might not be able to keep up and scale. Many ready-made systems are built with a one-size-fits-all approach, meaning they may struggle to accommodate rapid changes or increased complexity in your operations.

- Integration headaches. Another common challenge with off-the-shelf solutions is that they might not integrate seamlessly with your existing systems. If you’ve already invested in various tools for customer relationship management (CRM), claims processing, or data analytics, getting everything to work together can feel like trying to fit a square peg in a round hole. This can lead to data silos, inefficiencies, and, quite frankly, a lot of frustration.

- Generic user experience. Off-the-shelf software often has a one-size-fits-all user interface, which can lead to a less-than-stellar user experience and low insurance software ROI. Since it’s designed for a broad audience, it may not take into account the unique workflows and preferences of your team.

- Hidden costs. While the initial purchase price of off-the-shelf software may be lower, there can be hidden costs that sneak up on you. For instance, many insurance software solutions charge extra for additional features, integrations, or user licenses. You might also face costs related to training your staff to use the software effectively, which can add up quickly.

So, while off-the-shelf insurance software can be a quick and cost-effective solution in terms of insurance technology comparison, it’s important to weigh these pros and cons carefully. If you’re looking for something that will get you up and running fast without a hefty price tag, it might just be the way to go.

But if you foresee your business growing and evolving, you’ll want to consider whether a custom solution might ultimately serve your needs better in the long run. Like choosing between a pre-packaged meal and a home-cooked feast, the choice really comes down to your specific tastes and future plans.

How to Choose: Key Factors to Think About

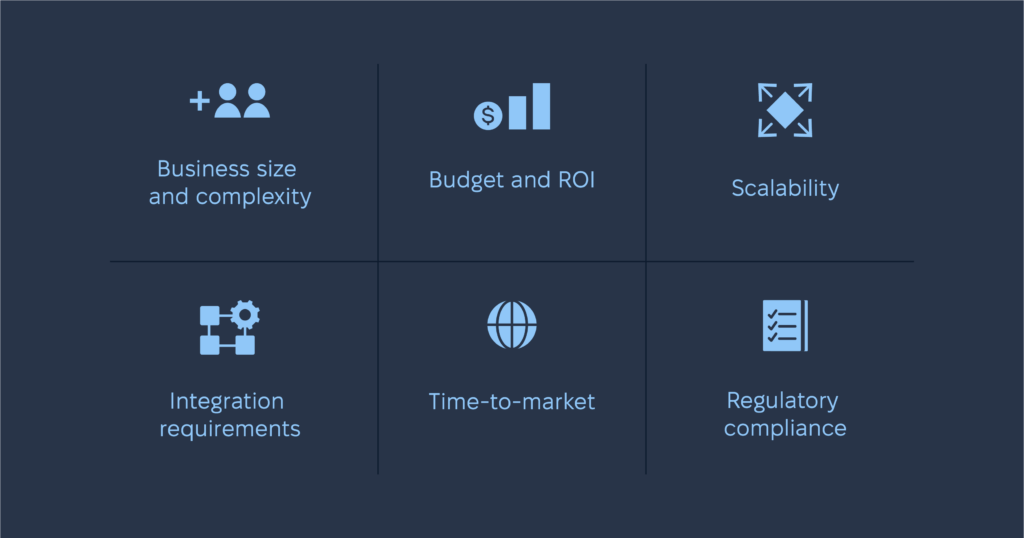

Here’s a quick breakdown of the main factors to consider when deciding between custom and off-the-shelf software:

- Business size and complexity. Larger companies with complex needs often lean toward custom insurance software solutions. Smaller companies may find off-the-shelf options work just fine for them.

- Budget and ROI. While custom software has a higher upfront cost, it may offer a better insurance software ROI in the long run by improving efficiency and customer satisfaction. Off-the-shelf is cheaper to start but may require more workarounds.

- Scalability. Custom software can grow with your business, but off-the-shelf insurance software solutions may hit a ceiling sooner.

- Integration requirements. If you’ve got a lot of systems in place, custom software can be designed to integrate with everything smoothly. Off-the-shelf options may struggle here.

- Time-to-market. If speed is a top priority, off-the-shelf wins, hands down. But if you can afford to take your time, custom software might be the better bet.

- Regulatory compliance. Custom solutions can be built with your specific compliance needs in mind. Off-the-shelf software may require extra customization to meet industry regulations.

Real-Life Examples: Custom vs. Off-the-Shelf in Action

I’d like to discuss the two most illustrative examples here.

Off-the-shelf example

Guidewire is a big name in off-the-shelf insurance software, offering comprehensive solutions for policy administration, claims management, and billing. Major players in the industry, including Nationwide, Zurich Insurance, and Liberty Mutual, have tapped into Guidewire’s capabilities to streamline operations. For example, Zurich Insurance managed to slash its claim resolution times by nearly 40% after adopting Guidewire.

But, like any software, Guidewire has its quirks. Even though it’s modular, you might still need to do some heavy customization to really make it fit your business, and that can come with a price tag – higher implementation costs and longer timelines. There’s also a good chance you’ll need to bring in some outside help or train your in-house team, which could hike up maintenance costs.

Custom insurance software example

Here, I’d like to tell you about the insurance online portal we’ve developed. This project really shows off the advantages of tailored insurance software solutions. The portal was built to make life easier for users and to streamline the company’s internal processes.

With a friendly interface, customers can easily manage their policies, file claims, and get real-time updates. On the back end, insurers get a robust system for handling policy management, claims processing, and data analytics.

What sets this portal apart is that it was designed to fit the company’s unique needs, making it super scalable and adaptable for future changes. The results? A 30% boost in customer satisfaction thanks to a smoother claims experience, plus a 40% increase in operational efficiency with better tools for the team.

Decision-Making Framework for Insurance Companies

Choosing between custom and off-the-shelf insurance software requires a thoughtful approach based on what your business really needs. Here’s a quick framework to help you decide:

- Identify SMART goals

Start by figuring out what you want to achieve. Are you looking to streamline policy management, improve claims processing, or boost customer experience? If your needs are pretty specific, a custom solution could be your best bet. But if they’re more general, off-the-shelf software might do the trick and save you some time.

- Check your current setup

Take a good look at your existing IT systems. Custom software can fit seamlessly into what you already have, while off-the-shelf insurance software solutions might need some tweaks to work well. Consider how much effort and cost you’re willing to put into integrating new software with your current setup.

- Weigh the costs

Do a quick cost-benefit analysis. Custom software usually comes with higher upfront costs but can pay off in the long run with its tailored features. Off-the-shelf options might be cheaper initially, but watch out for extra costs from licensing and updates.

- Think about flexibility

How well can each option grow with your company? Custom software is usually built with future changes in mind, making it easier to adapt. Off-the-shelf insurance software solutions may have limitations when you need to scale up quickly.

- Mind compliance

In the insurance game, regulations are constantly shifting. Custom software lets you build in specific compliance needs from the start. While off-the-shelf vendors try to keep up with changes, you need to make sure their updates actually fit your requirements.

- Get input from everyone

Don’t forget to consult with people across different departments – IT, compliance, underwriting, and claims. Getting feedback from all sides will help you pick a solution that everyone can live with and minimize any pushback during the transition.

- Test it out

Before going all-in, run a proof of concept (PoC) to see how each option performs in real life. This will give you insights into usability and potential integration issues, helping you make a more informed choice.

Trends to Watch: The Future of Insurance Software

The insurance landscape is shifting faster than a cheetah on roller skates, and both custom and off-the-shelf software are racing to keep pace. Emerging technologies transform how insurers operate and interact with customers. There’s a software solution for every type of business model, whether you’re leaning toward a tailored approach or opting for a pre-built platform.

The rise of AI

AI is taking the insurance industry by storm, and for a good reason. Insurers that integrate AI-driven analytics into their operations are not only improving their efficiency but also enhancing customer experiences.

For example, chatbots powered by AI can provide 24/7 customer support, answering questions about policies or claims status at any hour—no more waiting for business hours! A 2023 market study by McKinsey & Company underscores this potential, revealing that insurers leveraging AI saw up to a 60% reduction in claims processing times and a 20% drop in operational costs for underwriting.

Blockchain’s impact

Blockchain technology is another game-changer, providing an extra layer of security and transparency in insurance transactions. It’s like having a secure vault where every transaction is logged and can’t be tampered with.

Custom insurance software can easily integrate blockchain to streamline processes like policy issuance and claims management. This means faster payouts and fewer disputes, as all parties have access to the same verified information.

IoT integration

The Internet of Things (IoT) is another exciting trend that can’t be overlooked. With smart devices becoming more common, insurers can collect real-time data from policyholders.

For instance, wearable devices can monitor health metrics for life insurance policies, leading to personalized premiums based on actual behavior rather than just demographic data. This kind of integration is more feasible with custom software, which can be tailored to pull in data from various IoT devices and analyze it for insights.

The move towards predictive analytics

Predictive analytics is becoming a key player in decision-making for insurance companies. By analyzing historical data, insurers can forecast trends and risks, allowing them to create more tailored policies and pricing strategies. Custom insurance software is typically better positioned to incorporate these advanced analytics, enabling you to tailor algorithms to fit your specific business model.

Conclusion: So, What’s the Right Choice for You?

At the end of the day, the decision comes down to your specific needs, budget, and long-term goals. Custom insurance software gives you the flexibility, scalability, and unique features your business might need to stay competitive. But if you’re looking for a quick fix, off-the-shelf insurance software solutions can still deliver results, especially for less complex operations.

Whichever path you choose, make sure it’s the one that sets your company up for success – not just today, but in the long run. And if you’re leaning toward custom software and need a team of experts, we’ll be pleased to help you create the perfect solution.

Ready to get started? Let’s talk about your custom insurance software needs today.