If you’re planning to enter the FinTech market or you are already an active player, then you probably heard something about such a trend as mobile-only banking. It gradually gains momentum and there are some obvious reasons for it. According to Statista, there were 950 million proximity mobile payment transaction users worldwide. And it is expected that there will be 1,31 billion users by 2023.

These figures speak for themselves. It means that the development of a mobile-only banking app can be a good option to start a new profitable business in the FinTech sector. This ultimate guide will cover all the details of the mobile banking application development, its benefits, steps, and crucial issues to consider.

What Is A Mobile-Only Bank App?

Mobile-only banking app is a financial app for payment transactions and other finance-related operations that is available only on mobile devices. It means there are no brick and mortar departments, everything is available online, customer support as well. It is a new generation of banks that provide customers with high-quality services and even more interesting conditions.

Koto app is mobile-only banking that is created based on the basis of Ukrainian first virtual bank Monobank — it was launched successfully in 2017.

How Does A Mobile Banking App Work?

In fact, you have a habitual banking app, but the app is everything you have. A mobile-only banking app allows you to perform all financial operations on your mobile device only. You may create accounts, manage them, transfer money to other users, check balance, and so on. Also, mobile-only banks offer a debit physical card to withdraw money or use for making purchases in stores.

One more important note: a mobile-only bank is a bank that is backed by a financial institution. That is, you conclude an agreement with a specific bank (but collaborate with a trustworthy bank that is well-known), and it ensures proper management of users’ funds and security issues. So, you should consider it if you think about a mobile-only bank startup building.

Mobile-only bank provides users with 24/7 customer support. And it is another thing you need to pay rapt attention to. If you want your customers to be loyal and increase the retention rate, make sure that you have a reliable tech support team that will always be in touch with each customer. In case users have any questions, they should get answers immediately.

Advantages Of Mobile-Only Bank App

Before we proceed to the description of development steps, we would like to pay attention to the benefits of mobile-only banks. Why do you need to use it as your startup idea? You will find all the advantages below.

Convenience. Time is money, you know. Many people work a lot, and they don’t have much time to visit banks. Mobile-only banking apps help users deal with payments and transactions quickly and easily. Thought-out UX makes it possible to navigate through the app smoothly.

24/7 access. Users don’t need to wait when the banking branch opens the next day. Mobile-only banks are always available, regardless of day or night. It is especially important for anyone who is used to working a lot.

High security. Mobile-only bank apps are usually protected with a multi-level authentication system, including biometrics like a fingerprint scanner (in case it is integrated into a smartphone). If any malefactor tries to log in your app, you will be notified and you can change your password/block cards using PC.

Finance tracking. Using an online banking app, it is much more convenient to track all finances, income and outcome, plan your daily/weekly budget. Thus, financial operations are always under control.

Optimization. No papers, no branches, costs reduction. The process becomes optimized as well as eco-friendly since tons of papers are not used. Also, founders don’t need to spend money on office rent, hardware purchases, etc. But it will be required to estimate the budget for a mobile banking development, remember.

Minimizations of errors. Mobile-only banks provide an opportunity to automate some financial processes. Also, users can cancel an operation within 30 seconds after confirmation.

Cashback. Common banking apps provide this feature as well, however, the amount may be different. With cashback, users may get paid a specific percent of each purchase.

Cash withdrawal from any ATM. Users don’t need to look for specific ATMs only since they may withdraw cash from any ATM. However, a bank fee can be charged. At the same time, an institution that backs your mobile-only bank may have mutually beneficial agreements with some other banks and it allows customers to withdraw money without fees.

The Functionality Of A Mobile-Only Banking App

Feature-list means a lot for your future mobile-only banking app. The software development company will include MVP features your banking app cannot function properly. But you can also think about additional features that will improve the app and make it more competitive. We will list must-have features for your mobile-only bank to keep an eye on.

Account creation. Users may create an account that is linked to a phone number and cards. The authorization process must be secure and quick at the same time. For the first time, it is necessary to fill in the correct personal information.

Account management. A feature that includes small features like account balance review, user activity history, switching between cards, and so on. This feature helps navigate through the app naturally.

Payments and transactions. Mobile-only banks cannot exist without this feature, of course. This core feature allows users to make payments or transactions flawlessly at any time. You can also integrate a QR code scanner to make payments or perform other financial operations quickly.

Geolocation. It is required not only for the user’s location but also for finding nearby ATMs or terminals if users need to withdraw cash and vice versa — put money on their account.

Customer support. Support specialists are to be available round the clock to help users solve all arising issues. So keep in mind that you will have to hire and train the support department to provide users with a reliable service.

Push notifications. Users must be notified about all actions in mobile banking apps. Payment receipt, a reminder about transactions, promo notifications — users must see all updates on screens.

Split bill. It is not an MVP feature, but it is pretty interesting. Users may split their bill with friends, and each selected friend receives payment requests. It’s a good feature if users visit restaurants together with friends, for example.

Shake to pay. Users may transfer funds to each other, just shaking their phones. If two persons shake their devices simultaneously, Bluetooth on both devices identifies another shaking device as the one to transfer money.

Gamification. This feature will increase the loyalty of users. Let them use your mobile-only bank through kind of games. For example, if customers use certain services daily, they may get rewards. And customer experience is improved due to such interesting models.

Dynamic CVC2. When users activate this feature in confidentiality settings, CVC2 is changing every hour. It adds one more security layer and prevents user account from being hacked.

3D secure authentication. It will also contribute to the stronger protection of your mobile-only bank. 3D authentication is a fraud prevention measure that implies three layers of protection — password, SMS, fingerprint scanning. But authentication methods may be different, we just cover it as an example.

Onboarding. Make users feel comfortable. Explain to them how everything works, what your online bank offers them, what features, etc. Describe why your app is beneficial and why a customer needs to use it. Remember that users are your friends you should always care about.

How To Start Mobile-Only Banking

It is time to find out how to launch mobile-only banking, and what steps you should take during mobile banking application development. In some cases, steps may differ from the ones mentioned below, however, we know they will be useful for you.

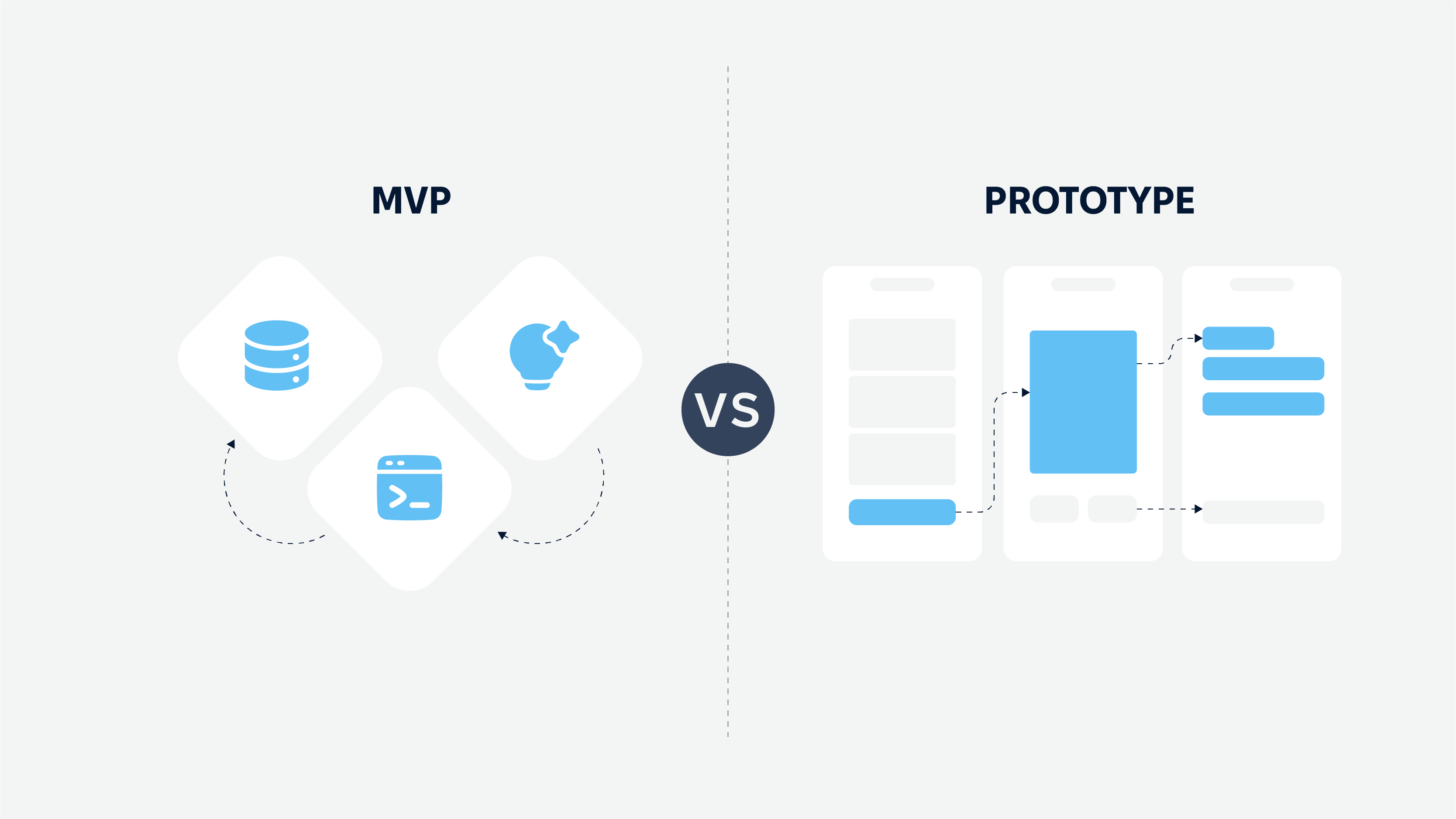

MVP Comes First

You need to take into account all the basic features your mobile-only bank will include. When you find a software development company, you will have a list of features that should be added to your app. If you want to add some additional features to your basic functionality, discuss it with developers.

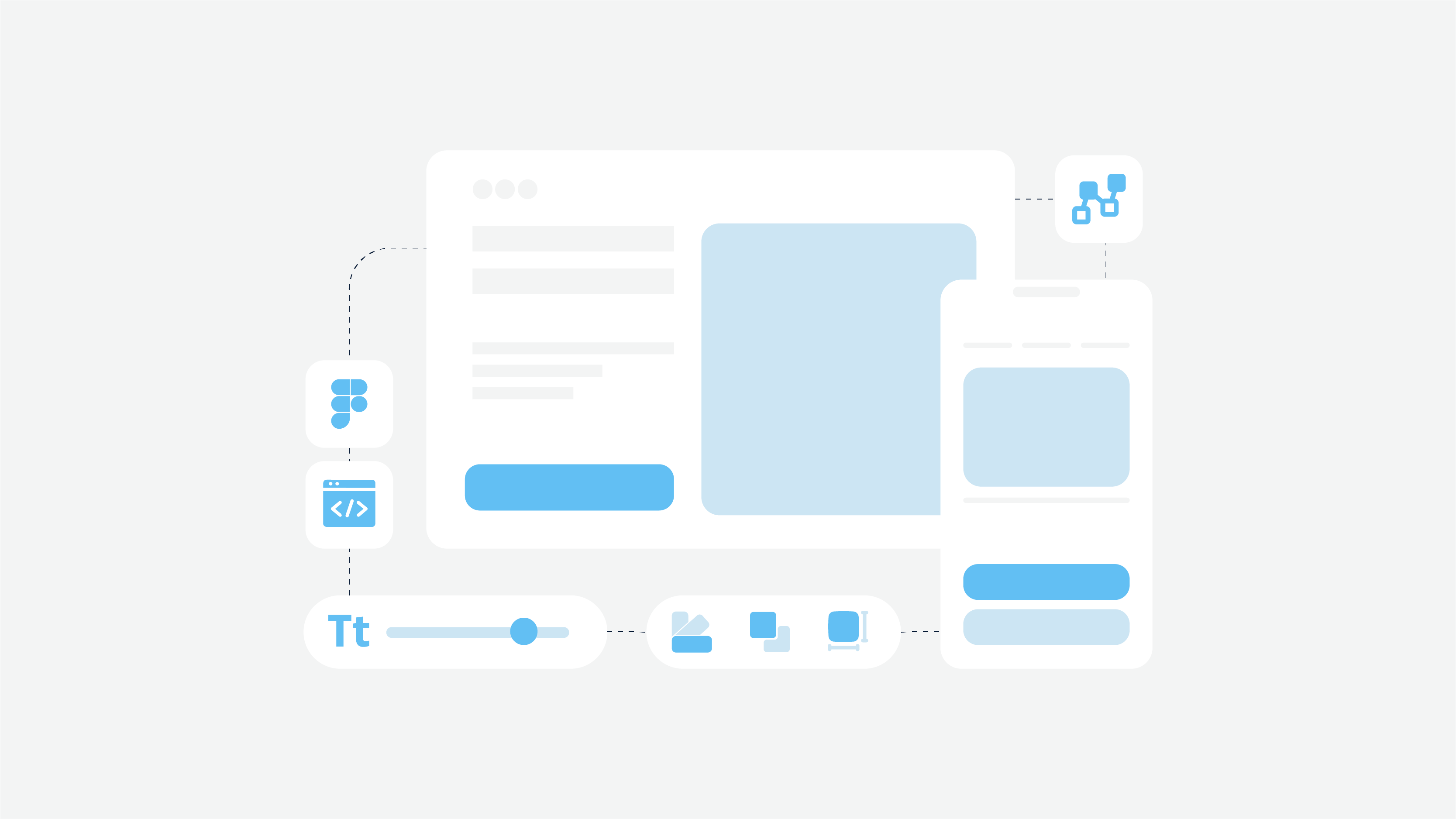

Think Through UX

User experience is more than important for any app, not only for a mobile banking app. Your potential users shouldn’t have any “how to” questions. That is, everything should be absolutely clear in your app. The more straightforward your app is, the greater the chance customers will keep on using it. To create a perfect UX along with UI, you should hire a skilled design and development company.

Development Process

Once the estimate is complete and a contract is signed, developers start creating your product. But before you should choose a development platform — iOS, Android, web, or all of them. Let us give you a piece of advice: landing page of your digital bank app is a must, it will contain an introduction of your bank app and CTA to download it.

This article may be interesting for you: What is a Development Platform

As for a mobile platform, it is up to you. For a start, we recommend you to create iOS app and test it, collect feedback from first users. If it gains popularity, Android app version is your next step. But if you want to cover a larger audience, your app should be available for both mobile operating systems, mind it.

Test The Stability

It is the responsibility of developers and QA engineers, however, you shouldn’t ignore it as well. The banking app must function flawlessly, without failures. QA specialists should perform load and stress testing to make sure the app works properly. The performance of the app must be on a high level since negative experience is the last experience, mind it.

Don’t Forget About Security

The banking app is a tidbit for hackers and other malefactors. That is why your app should be encrypted and protected with relevant security standards. For example, your app should have two-factor (or 3D, as we mentioned above) authentication, encrypted payment data, fingerprint verification, one-time passwords, remote access in the case of loss.

Security is highly crucial, and your customers shouldn’t worry about the safety of their funds. Skimping on security will lead to business failure, and your reputation may take a serious hit.

Beta-Testing And Feedback

And last but not the least step in the mobile banking app launching process — testing, beta-testing and feedback collection. Testing means proper verification of the whole functionality by a QA department. Then, you can release the app as a beta-version and let customers use it, ask them to leave their feedback.

It is a very good practice since you will be able to modify your app to release a final improved product. And voila — now you can take all the credit.

Legal Issues And Compliance To Consider

Apart from the development process, a mobile-only banking app also requires compliance with some financial regulations and resolution of specific legal issues. Therefore, our goal is to describe and list all the steps for you to undertake if you want to do a transparent and legal business.

Register Your Business

To start your financial business, you need to register your business and choose the entity. For example, you choose a limited liability corporation (LLC). It is a good option as you will be able to protect your business if everything is organized properly and legally.

Sign An NDA

A non-disclosure agreement (NDA) will let you keep your idea from being stolen and copied. As a rule, all software development companies know the value of an idea. And they sign an NDA with customers to make sure all confidential data is protected. Pay attention to it when you discuss your idea with software developers.

This article may be interesting for you: nda for software development (template is included)

Protect Intellectual Property

Your app should be different from existing banking apps, so originality means a lot. Your app will have a specific name, logo, design, and branding in general. Protect everything from copy and register your trademark. You will need to spend some money on it, however, it is a preferable case than kick yourself when somebody uses your ideas.

Personal Data Privacy

One more important point to pay rapt attention. Your mobile-only banking app processes sensitive personal information, and you should protect it and comply with relevant regulations. For instance, if your app is targeted at EU-based citizens, your app must comply with the General Data Protection Regulation (GDPR).

GDPR entered into force in May 2018. You need to check out how it works and ensure compliance. Otherwise, you may be fined. Also, a banking app should meet Payment Card Industry Data Security Standard (PCI-DSS) requirements in case you will issue payment cards. To become PCI compliant, it is necessary to get PCI certification.

This article may be interesting for you: GDRP Compliance Checklist

Consider Local Regulations

This point is tightly connected with the one above. It is just a kind of reminder that you must follow all regulations of the government you create an app for. Remember that rules and regulations are different in each country, and even in each state (if we talk about the USA). For that reason, examine existing laws and rules of a target region.

The process seems rather complicated, doesn’t it? But when you do everything accurately, keep up with all the requirements, you will not fail. You will be rewarded for your efforts.

To make your app competitive and eye-catching, find out more about top web design trends in 2021. It is time for you to build a great problem-solving product and keep up with up-to-date trends. Contact us and we will assist you in it!