Digital transformation is no longer a choice but a necessity for insurance companies aiming to stay competitive and meet modern customer expectations. As digital technology reshapes the insurance industry, traditional insurers like RVOS Insurance face the challenge of integrating digital innovation while preserving their core values and community-focused service.

The Heart of a Century-Old Insurance Company

For over 120 years, RVOS Insurance has stood as a trusted pillar in Texas, offering tailored insurance solutions that reflect their deep-rooted commitment to community and tradition. Founded in 1901, RVOS has grown into a leading provider of insurance services for generations of Texans, specializing in farm, ranch, and home coverage while maintaining the personal touch that has kept customers loyal for decades.

This isn’t just an insurance company. It’s a community institution with roots as deep as Texas itself.

Community-Focused Approach

What makes RVOS unique is its community-focused approach to service. Unlike massive national insurance corporations that prioritize volume and standardization, RVOS built its foundation on understanding the specific needs of rural and agricultural communities in Texas. They became known as the insurer who truly understood the unique challenges of farm and ranch life.

“Our approach has always been about building relationships, not just selling policies,” explains RVOS leadership. “We’re part of the communities we serve.”

This community-first philosophy served RVOS well for more than a century. Their reputation for personalized service and deep understanding of their customers’ needs created a loyal client base that often spanned multiple generations of the same family.

The Turning Point – When Customer Loyalty Meets Modern Demands

As the world moved increasingly online, RVOS hit a snag. Their clients were asking for more convenience – things like managing policies and claims digitally – but RVOS didn’t have the digital tools for that. The contrast between their personal, face-to-face service model and the growing demand for digital access was becoming increasingly apparent.

It wasn’t just about keeping up with technology trends. RVOS had bigger goals: improve customer experience, reduce manual processes, and drive business growth – all while staying true to their community-focused roots.

The feedback from customers, particularly younger ones, was clear: they valued RVOS’s personalized service and community connection, but they also wanted the convenience of digital access. They wanted to manage their policies, file claims, and streamline claims processes without having to visit an office or make a phone call.

For RVOS’s leadership, this presented a challenging dilemma. They understood that embracing digital transformation initiatives was necessary for future growth, but they were concerned that moving too far into the digital realm might dilute the personal connection that had been their hallmark for generations.

“We needed to find a way to offer digital convenience without losing the human touch that makes RVOS special,” the leadership team realized. “Our customers weren’t asking us to change who we are – they were asking us to make our services more accessible.”

The decision to embark on a digital transformation journey wasn’t made lightly. RVOS needed to create a user-friendly digital platform that would make life easier for their customers while preserving their company’s identity and values. They needed technology that would enhance their personal service, not replace it.

But RVOS faced an additional challenge: as an insurance company with deep traditions, they didn’t have the in-house expertise to execute this kind of digital transformation. They needed a partner who would take the time to understand not just their technical requirements, but their company culture and the unique relationship they had with their customers.

Cadabra Studio – The Right Partner for a Delicate Mission

When RVOS began searching for a technology partner, they weren’t just looking for technical expertise. They needed a team that would understand the nuances of their business and respect the community values that had defined RVOS for over a century.

A Collaborative Approach

The collaboration with Cadabra Studio began with a series of virtual meetings, where the focus wasn’t immediately on technology solutions but on understanding the essence of RVOS’s business. These initial conversations weren’t dominated by technical specifications or platform requirements. Instead, they centered on RVOS’s relationship with their customers, their company values, and their vision for the future.

For Cadabra Studio, this wasn’t just another insurance software development project. It was about helping a centenarian company navigate a critical evolution without losing its identity. The Cadabra team approached the partnership with a guiding principle: technology should amplify trust, not replace it.

“We quickly realized that this project wasn’t about pushing the most cutting-edge technology,” explains the Cadabra Studio team. “It was about finding the right digital solutions that would enhance RVOS’s ability to serve their community while making life easier for both customers and employees.”

This human-first approach resonated with RVOS. They needed a digital transformation partner who would listen before coding, who would understand the delicate balance between innovation and tradition, and who could translate RVOS’s community-focused values into a digital experience.

The partnership was formalized with clear objectives: create a user-friendly portal that would allow customers to manage policies, file claims, and make payments online, while preserving the personal touch that had made RVOS successful for generations.

The Discovery Process – Understanding Customer Needs

Before a single line of code was written, Cadabra Studio embarked on a comprehensive discovery process to understand the specific needs of RVOS’s customers and internal team.

Virtual Discovery and Research

This discovery wasn’t conducted through in-person visits but through detailed virtual sessions and research. The Cadabra team conducted interviews with RVOS staff to understand the pain points in their current workflow. They analyzed customer feedback to identify what features would make the most difference in their experience.

The insights gathered painted a clear picture of the challenges faced by both RVOS customers and staff:

Customers were frustrated by the inability to access policy information or file claims online. Many had to take time out of their busy schedules to visit an office or make phone calls during business hours – particularly challenging for farmers and ranchers whose workdays didn’t always align with standard office hours.

The adoption of digital technology was seen as a crucial step in enhancing customer empowerment and providing a more seamless experience.

One customer story stood out: a rancher who had to drive 45 minutes to the nearest RVOS office to file a claim for a damaged fence, losing valuable time that could have been spent repairing the damage. If he could have filed that claim from his smartphone while still at the site of the damage, it would have saved him hours and simplified the process.

Internally, RVOS agents were spending excessive time on manual data entry and paperwork – time that could have been better spent building relationships with customers and providing the personalized service that was RVOS’s hallmark.

“We realized that digital transformation wasn’t about replacing the human element of RVOS’s service,” notes the Cadabra team. “It was about freeing their team from tedious manual processes so they could focus on what they do best – building personal connections with their customers.”

This discovery phase revealed an important truth: the right digital solution wouldn’t diminish RVOS’s community focus; it would enhance it by removing friction from customer interactions and giving staff more time for meaningful engagement.

Benefits of Digital Transformation – Unlocking New Potential

Digital transformation in the insurance industry is more than just a trend; it’s a gateway to unlocking unprecedented potential. By embracing digital technologies, insurance companies can revolutionize their operations and customer interactions, leading to a host of benefits.

Enhanced Customer Experience

One of the most significant advantages is the improved customer experience. Digital transformation allows insurance companies to offer personalized and seamless experiences, which in turn boosts customer satisfaction and loyalty. Imagine a customer who can manage their policy, file a claim, and make payments all from their smartphone – the convenience is unparalleled.

Operational Efficiency and Innovation

Efficiency is another critical benefit. Advanced technologies like automation and artificial intelligence streamline insurance operations, reducing manual errors and enhancing productivity. This means that tasks that once took hours can now be completed in minutes, freeing up valuable time for more strategic activities.

In a competitive insurance market, staying ahead is crucial. Digital transformation equips insurance companies with the tools to remain competitive by offering innovative solutions and services that meet evolving customer expectations. For instance, usage-based insurance and telematics are new business models that cater to modern needs, providing personalized premiums based on real-time data.

Data-Driven Insights and New Revenue Streams

Data analytics is a game-changer in the insurance sector. By collecting and analyzing vast amounts of customer data, insurance companies can gain valuable insights that inform business decisions and improve risk management. This data-driven approach not only enhances operational efficiency but also helps in crafting more accurate and fair policies.

Lastly, digital transformation opens up new revenue streams. With the advent of new business models, insurance companies can explore opportunities like microinsurance, which offers affordable policies to low-income individuals, or peer-to-peer insurance, which leverages social networks for risk sharing.

In essence, digital transformation is not just about adopting new technologies; it’s about reimagining the insurance business model to unlock new potential and drive growth.

Challenges of Digital Transformation – Navigating the Storm

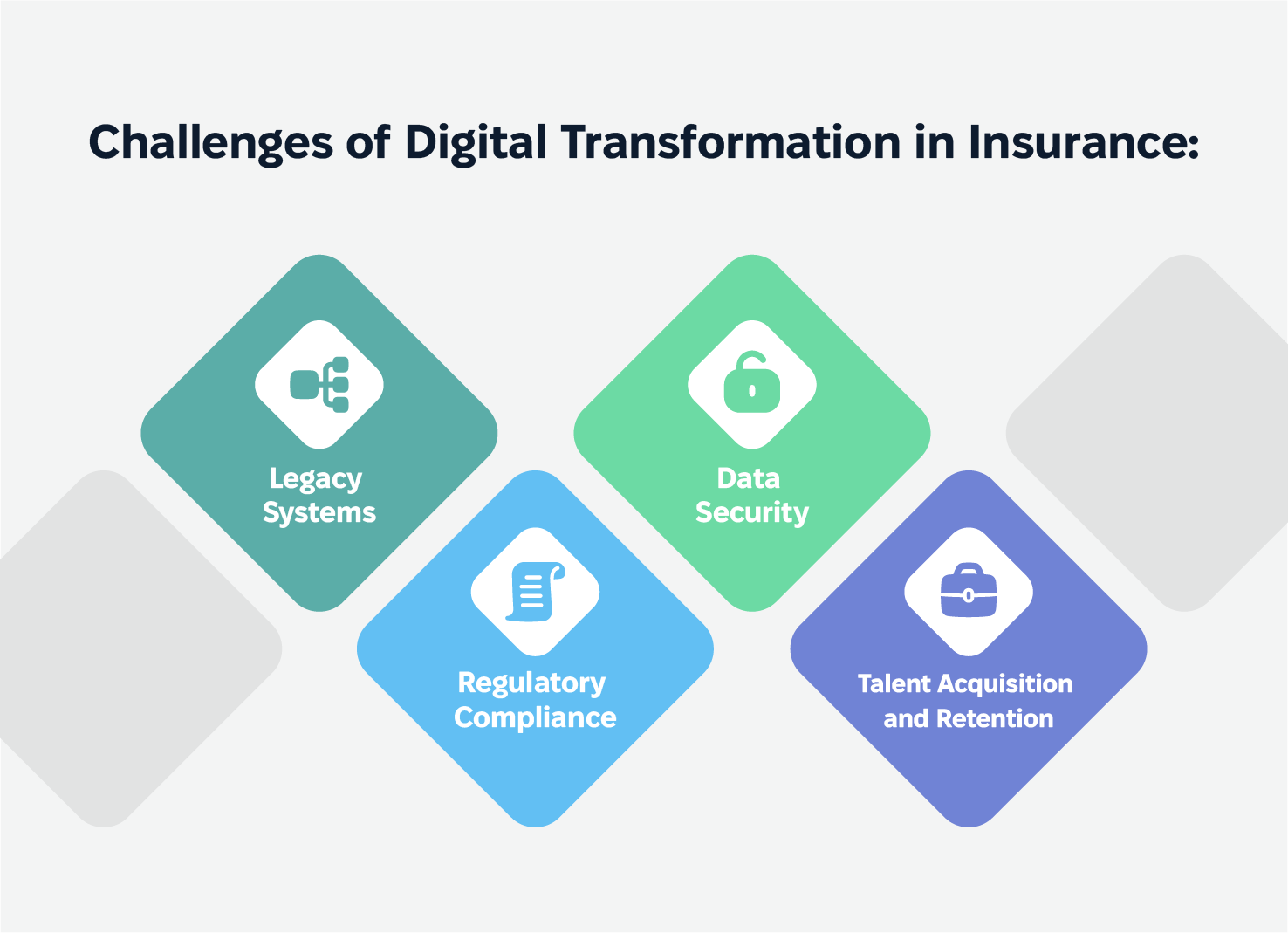

While the benefits of digital transformation are compelling, the journey is fraught with challenges that insurance companies must navigate carefully.

Legacy Systems and Data Security

One of the primary hurdles is dealing with legacy systems. Many insurance companies operate on outdated infrastructure that isn’t compatible with modern digital technologies. Integrating new systems with these legacy platforms can be a complex and costly endeavor, requiring meticulous planning and execution.

Data security is another significant concern. The shift to digital operations involves the collection and analysis of vast amounts of customer data, which can pose security risks if not managed properly. Ensuring robust data protection measures and compliance with data privacy regulations is paramount to maintaining customer trust.

Regulatory Compliance and Talent Acquisition

Regulatory compliance adds another layer of complexity. The insurance industry is heavily regulated, and digital transformation can sometimes outpace the existing legal framework. Insurance companies must navigate this evolving landscape carefully, ensuring that their digital initiatives comply with all relevant laws and regulations.

Talent acquisition and retention are also critical challenges. Digital transformation requires specialized skills in areas like data analytics, artificial intelligence, and cybersecurity. However, attracting and retaining such talent in a competitive market can be difficult. Companies need to invest in training and development to build a workforce capable of driving digital innovation.

Change Management

Change management is perhaps the most daunting challenge. Digital transformation often requires a fundamental shift in business processes and culture. Resistance to change can be a significant barrier, and companies must engage in effective change management strategies to ensure a smooth transition. This involves clear communication, training, and support to help employees adapt to new ways of working.

Navigating these challenges requires a strategic approach, but the rewards of successful digital transformation make the effort worthwhile. By addressing these obstacles head-on, insurance companies can pave the way for a more efficient, customer-centric, and competitive future.

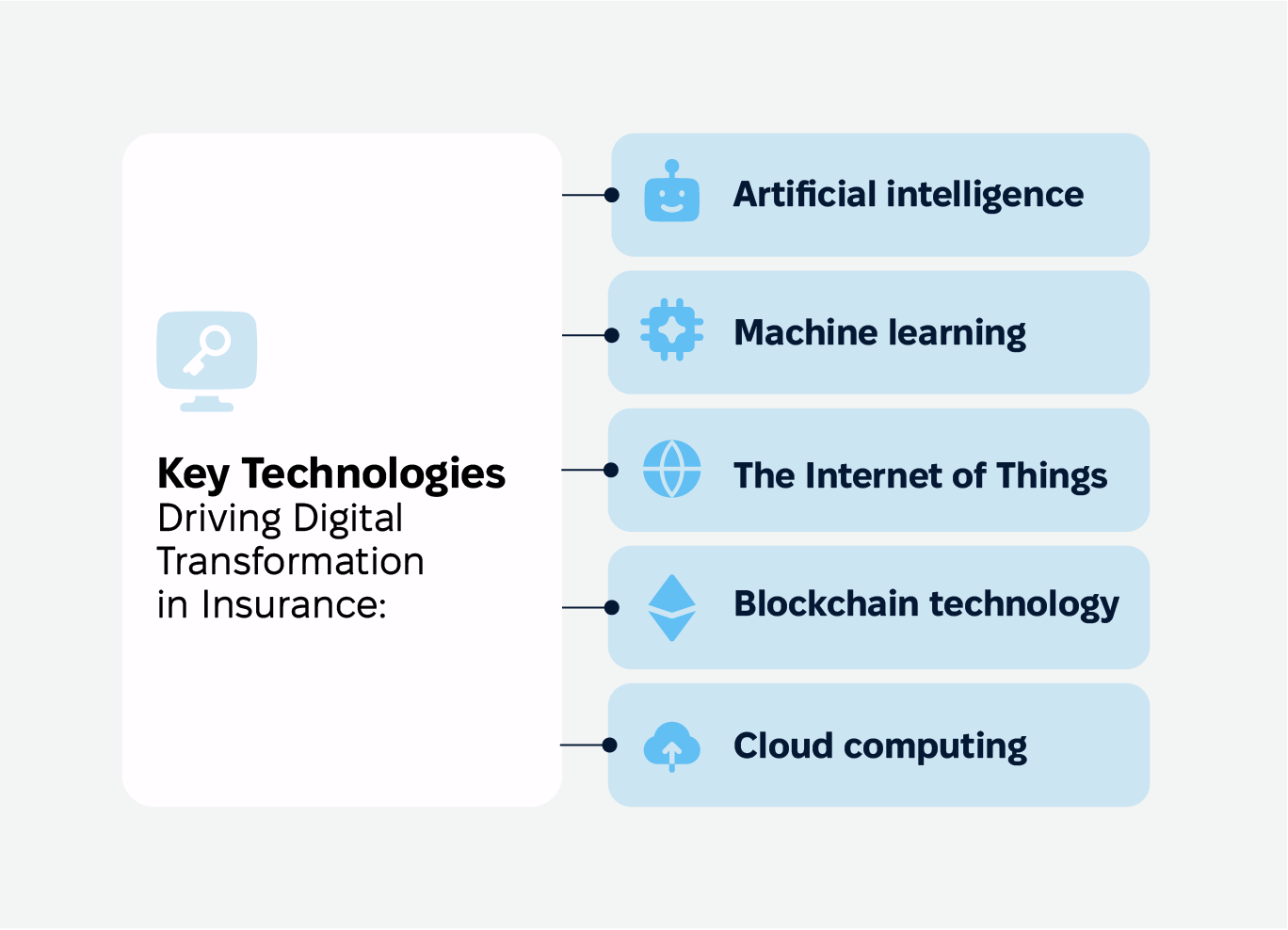

Key Technologies Driving Digital Transformation – The Tools of Tomorrow

The insurance industry is undergoing a seismic shift, driven by key technologies that are transforming how companies operate and serve their customers. These advanced technologies are not just tools; they are the building blocks of the future of insurance.

Artificial Intelligence and Machine Learning

Artificial intelligence (AI) is at the forefront of this transformation. AI is being used to automate claims processing, reducing the time and effort required to handle claims. It also enhances risk assessment by analyzing vast amounts of data to identify patterns and predict potential risks. Moreover, AI-powered chatbots and virtual assistants are improving customer experience by providing instant, personalized support.

Machine learning (ML) complements AI by enabling insurance companies to analyze large datasets and derive actionable insights. ML algorithms can identify trends and anomalies that might be missed by human analysts, helping companies make more informed decisions. For example, ML can be used to detect fraudulent claims by analyzing historical data and identifying suspicious patterns.

Internet of Things and Blockchain Technology

The Internet of Things (IoT) is another game-changer. IoT devices and sensors collect real-time data that can be used to assess risks more accurately and provide personalized services. For instance, telematics devices in vehicles can monitor driving behavior and offer usage-based insurance premiums, rewarding safe drivers with lower rates.

Blockchain technology is revolutionizing the insurance sector by increasing transparency and security in transactions. Blockchain can be used to automate claims processing and policy issuance through smart contracts, ensuring that all parties adhere to agreed terms without the need for intermediaries. This not only speeds up processes but also reduces the potential for fraud.

Cloud Computing

Cloud computing provides the scalable and flexible infrastructure needed for digital transformation. By leveraging cloud services, insurance companies can store and process large amounts of data efficiently, enabling them to deploy digital solutions quickly and cost-effectively. Cloud computing also supports collaboration and remote work, which are increasingly important in today’s business environment.

These technologies are not just driving digital transformation; they are reshaping the insurance industry. By adopting AI, ML, IoT, blockchain, and cloud computing, insurance companies can enhance their operations, improve customer experience, and stay competitive in a rapidly evolving market.

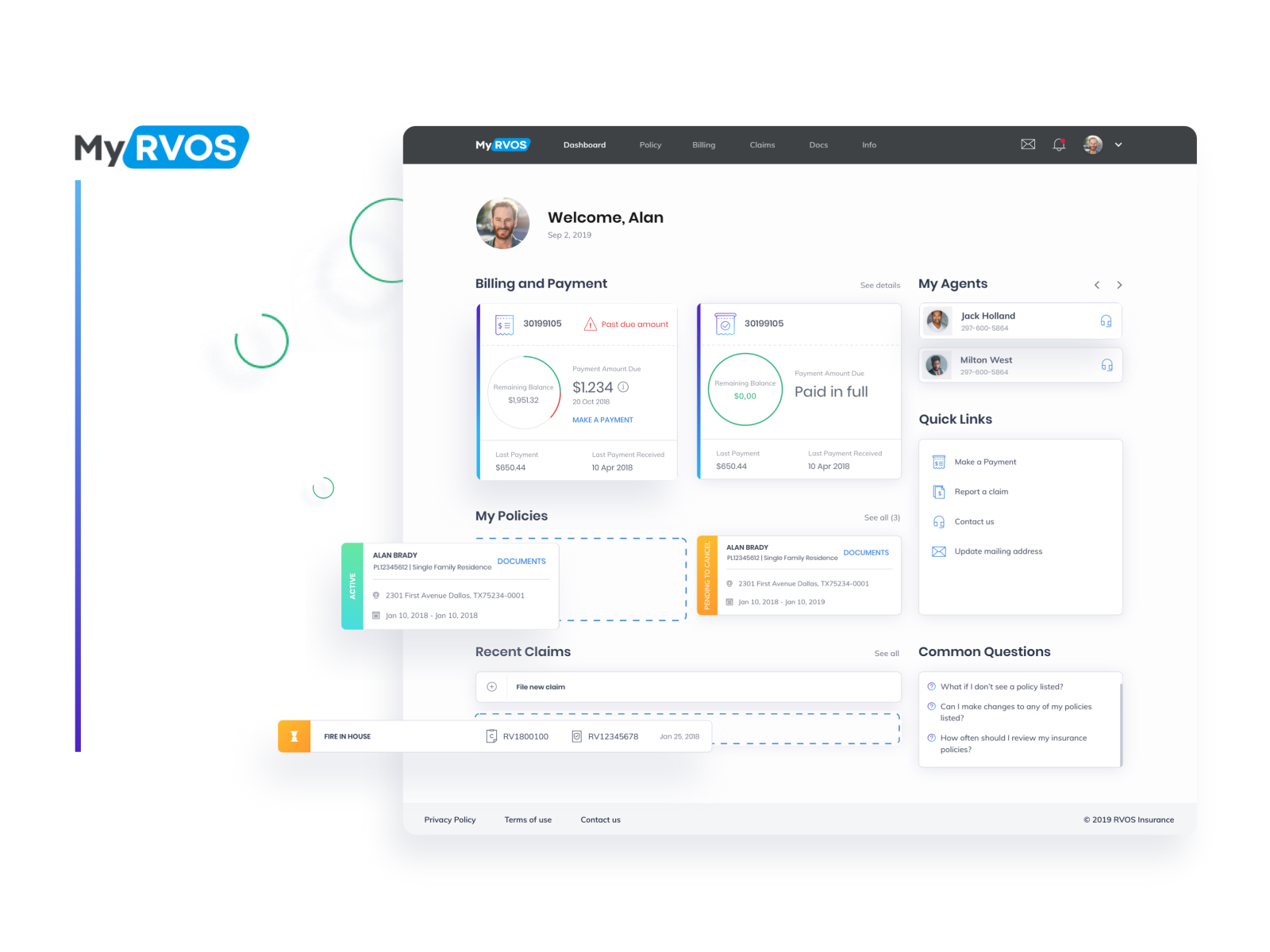

Building the Digital Bridge – Crafting RVOS's New Portal

With a clear understanding of RVOS’s needs, Cadabra Studio began the process of designing and developing the insurance technology for the digital portal. The project kicked off with detailed wireframes and prototypes, all developed remotely and shared through collaborative online tools.

Designing a User-Friendly Interface

The design process focused on creating an intuitive, user-friendly interface that would make it easy for customers of all ages and technical abilities to manage their insurance needs. Particular attention was paid to ensuring the platform would be accessible on mobile devices – essential for customers who might need to file claims while in the field or away from home.

Behind the scenes, the technical challenge was significant. Cadabra’s development team had to integrate the new portal with RVOS’s existing systems, some of which had been in place for decades. This required careful planning and expert implementation to ensure data integrity and system security.

The technology stack chosen for this project was robust and future-proof: JavaScript and React Native for the frontend, providing a responsive and user-friendly interface across devices; Java and PostgreSQL for the backend, ensuring solid data handling and integration capabilities; and blockchain technology (Ethereum) to secure payment processing, adding an extra layer of protection for sensitive financial transactions.

Throughout the development process, the Cadabra team maintained regular communication with RVOS, sharing progress updates and gathering feedback through virtual meetings. This collaborative approach ensured that the final product would truly meet RVOS’s needs and reflect their values.

Portal Features and Functionality

The portal was designed to offer a full range of self-service features while preserving opportunities for personal connection:

Policy management: Customers could view policy details, make changes, and process renewals online.

Claims processing: A streamlined system allowed customers to file claims, upload photos, and track claim status from any device.

Payment processing: Secure payment functionality made it easy to pay premiums and manage payment methods.

Document access: All important insurance documents were available in digital format for easy access.

Communication tools: The portal included multiple ways for customers to contact their RVOS agent, ensuring that personal help was always just a click away.

Each feature was designed with both efficiency and the human element in mind. The goal wasn’t to replace personal service but to enhance it by making routine transactions simpler and more convenient.

A Portal with Heart – Launch Day and Customer Reactions

After months of development and testing, the new RVOS customer portal was ready to launch. The roll-out was conducted carefully, with a focus on ensuring a smooth transition for both customers and staff.

The launch wasn’t marked by flashy marketing campaigns or grand announcements – true to RVOS’s community-focused approach, it was introduced to customers through personalized communications that explained how the new portal would make their insurance experience more convenient while maintaining the personal service they valued.

Positive Customer Feedback

Initial customer reactions exceeded expectations. Older customers, who might have been expected to resist the digital transition, appreciated the simplified processes that saved them time and effort. A senior policyholder sent feedback noting, “I didn’t think I’d use this online system, but it’s actually easier than calling in for simple things. And when I do need to speak to someone, my agent is still there.”

Younger customers, particularly those who had grown up with digital services, were enthusiastic about the platform’s mobile-friendly design and comprehensive functionality. The ability to manage their insurance needs from anywhere, at any time, aligned perfectly with their expectations for modern service providers.

One of the most telling success stories came from a family who experienced storm damage to their home. Instead of the traditional process that would have required multiple phone calls and possibly an office visit, they were able to file their claim entirely through the portal, uploading photos and documentation from their kitchen table as they assessed the damage. The streamlined process reduced stress during an already difficult situation and allowed for faster claim processing.

Perhaps the most significant indicator of success was the noticeable decrease in support calls – not because RVOS was providing less support, but because customers could now find answers and complete tasks independently through the portal. When customers did reach out, it was often for more complex issues that truly benefited from personal attention, allowing RVOS agents to provide higher-value assistance.

The portal struck the perfect balance – it provided the convenience of digital service while preserving the personal connection that had been RVOS’s hallmark for over a century.

Internal Transformation – Empowering the RVOS Team

While the customer-facing benefits of the new portal were immediately apparent, the internal transformation at RVOS was equally significant.

Automation and Efficiency Gains

The automation of routine processes freed RVOS staff from the burden of manual data entry and paperwork processing. This shift had a profound impact on their daily work experience and their ability to serve customers effectively.

Agents who had previously spent hours on administrative tasks could now dedicate that time to more meaningful customer interactions. Instead of being buried in paperwork, they were able to focus on providing the personalized guidance and support that had always been RVOS’s strength.

One agent noted, “Before the portal, I was spending almost half my day on data entry and filing. Now I can use that time to really understand my customers’ needs and help them find the right coverage.”

Knowledge Sharing and Collaboration

The digital transformation also created opportunities for knowledge sharing across generations within RVOS. Younger team members, more familiar with digital tools, helped their experienced colleagues navigate the new system, while veteran agents shared their deep understanding of customer needs and insurance expertise. This collaborative learning strengthened team bonds and ensured that RVOS’s institutional knowledge was preserved even as their processes evolved.

The portal’s backend systems provided RVOS staff with better access to customer data and policy information, enabling them to provide more informed and efficient service. When customers did call or visit an office, agents could quickly access their complete history and address their needs without delays or multiple transfers.

Perhaps most importantly, the digital transformation changed how RVOS team members viewed technology. Rather than seeing digitalization as a threat to their traditional service model, they embraced it as a tool that enhanced their ability to deliver on RVOS’s core promise of community-focused insurance protection.

Business Models and Opportunities – Embracing New Horizons

Digital transformation is not just about adopting new technologies; it’s about reimagining business models to seize new opportunities and meet changing customer expectations. The insurance industry is ripe for innovation, and several new business models are emerging as a result of digital transformation.

Usage-Based Insurance and Telematics

Usage-based insurance is one such model. By leveraging data from IoT devices and telematics, insurance companies can offer personalized premiums based on actual usage. For example, drivers who exhibit safe driving behavior can be rewarded with lower premiums, while those who drive less frequently can benefit from pay-as-you-go insurance. This model aligns premiums more closely with individual risk profiles, providing fairer pricing and incentivizing safer behavior.

Telematics is another transformative opportunity. By collecting data from vehicles, telematics enables insurance companies to offer personalized services and improve risk assessment. For instance, real-time data on driving habits can help insurers identify high-risk drivers and offer targeted interventions to reduce accidents. Telematics also supports usage-based insurance, creating a more dynamic and responsive insurance model.

Peer-to-Peer Insurance and Microinsurance

Peer-to-peer (P2P) insurance is an innovative approach that leverages social networks and online platforms to provide insurance services. In a P2P model, groups of individuals pool their premiums to cover each other’s claims. This community-based approach can reduce costs and increase transparency, as members have a vested interest in minimizing fraudulent claims. P2P insurance also fosters a sense of community and trust among policyholders.

Microinsurance is another promising opportunity enabled by digital transformation. By offering small, affordable insurance policies, microinsurance can provide coverage to low-income individuals and families who might otherwise be unable to afford traditional insurance. Digital platforms make it easier to distribute and manage microinsurance policies, expanding access to underserved populations and promoting financial inclusion.

Insurtech and Innovation

Insurtech, a term that combines “insurance” and “technology,” represents the broader trend of using digital technologies to create innovative insurance products and services. Insurtech startups are disrupting the industry by offering new solutions that address specific pain points, such as streamlined claims processing, personalized coverage options, and enhanced customer engagement. Established insurance companies can collaborate with insurtech firms to leverage their expertise and accelerate their own digital transformation efforts.

These new business models and opportunities are reshaping the insurance industry, creating more personalized, efficient, and inclusive services. By embracing digital transformation, insurance companies can not only stay competitive but also better serve their customers and meet the evolving demands of the market.

The Results For RVOS Insurance

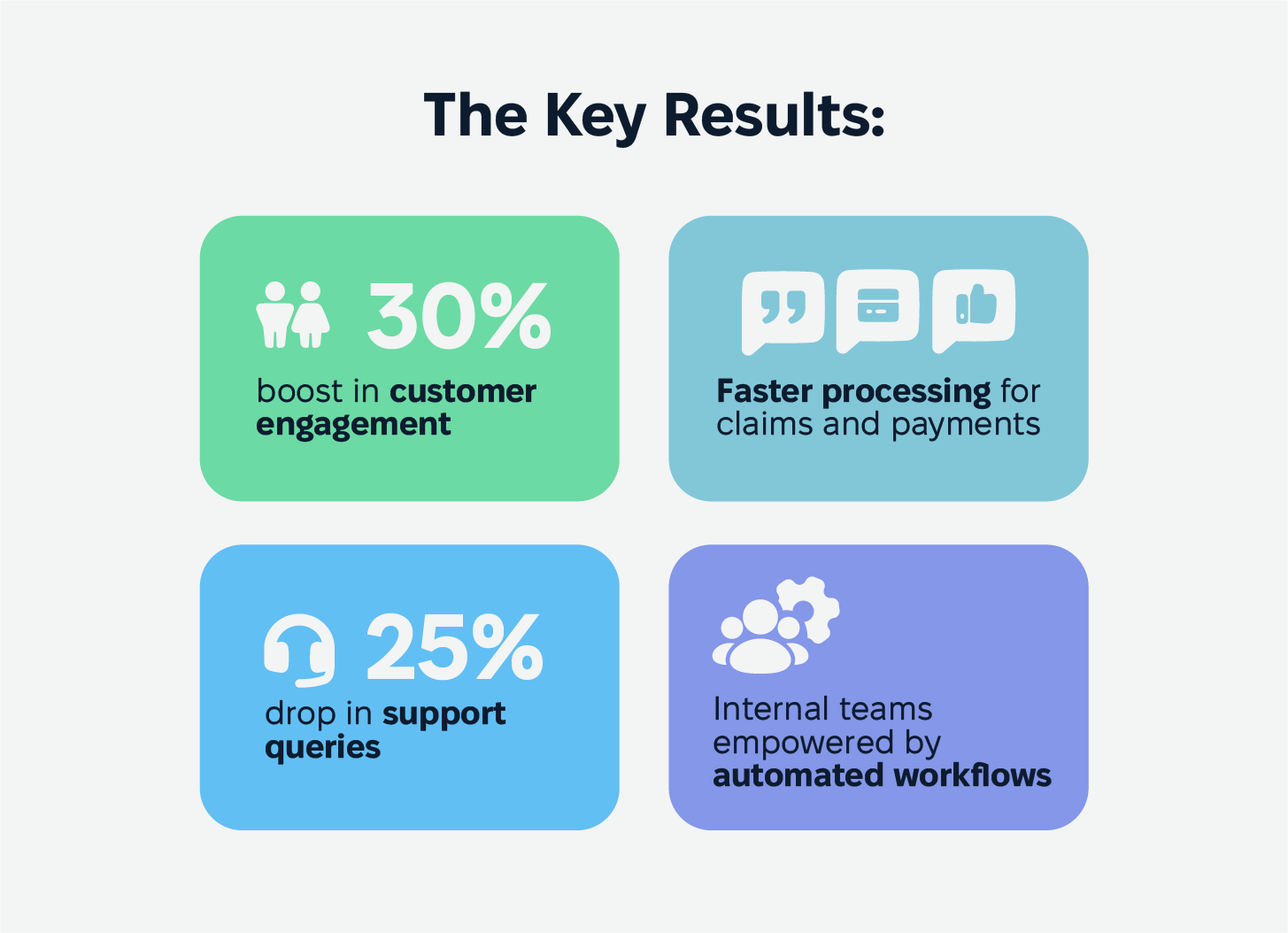

The impact of RVOS’s digital transformation went beyond anecdotal success stories – the data told a compelling story of positive change across multiple metrics.

Customer Engagement and Support

Customer engagement saw a remarkable 30% boost following the implementation of the portal. This wasn’t just about more frequent interactions; it reflected deeper, more meaningful engagement as customers explored their coverage options and took a more active role in managing their insurance needs.

Support queries dropped by 25%, indicating that customers were successfully finding the information they needed through the portal. This reduction in routine questions allowed the support team to focus on more complex customer needs that truly benefited from their expertise.

Operational Efficiency

Claims processing and payment transactions became significantly faster, improving both operational efficiency and customer satisfaction. What once took days could now be completed in hours or even minutes, depending on the complexity of the request.

But perhaps the most telling results weren’t captured in metrics alone. They were evident in the strengthened relationships between RVOS and their customers – relationships that now seamlessly bridged the physical and digital worlds.

A customer who had been with RVOS for decades summed it up perfectly: “It still feels like RVOS – they just made it easier to work with them.”

This sentiment captured the essence of successful digital transformation in insurance: using technology not to replace the human connection, but to enhance it by removing friction and adding convenience.

For RVOS, the digital portal wasn’t just a technical achievement – it was a strategic asset that positioned them for the future while honoring their past. They had successfully navigated the challenging waters of digital transformation without losing sight of the community values that had defined them for over a century.

Lessons for the Insurance Industry – Wisdom from RVOS's Journey

RVOS’s digital transformation journey offers valuable insights for other insurance companies facing similar challenges. Their experience highlights several key principles that can guide successful innovation in an industry often resistant to change:

Listen Before You Transform

RVOS’s success began with understanding their customers’ actual needs, not assumptions about what digital transformation should look like. By listening carefully to both customer frustrations and aspirations, they created a solution that addressed real pain points rather than simply following industry trends.

Automation Changes Everything

By automating routine tasks, RVOS freed their team to focus on what humans do best – building relationships and providing personalized guidance. The lesson is clear: digital tools should enhance human capabilities, not replace them. When repetitive processes are handled by technology, people can deliver more value through judgment, empathy, and expertise.

Stay True To Your Roots

Throughout their digital journey, RVOS never lost sight of their core identity as a community-focused insurer. Their portal wasn’t designed to minimize human interaction but to make it more meaningful. For established insurance companies, successful digital transformation doesn’t mean abandoning your heritage – it means finding new ways to express your foundational values through modern channels.

Growth Is In The Details

RVOS didn’t just create a functional portal; they crafted a thoughtful user experience that considered the specific needs of their customer base. From the layout of information to the simplified claims process, every detail was designed to solve real problems and create a frictionless experience. This attention to detail transformed a technical implementation into a powerful tool for business growth.

These insights apply not just to century-old insurers but to companies at any stage of development. Whether you’re a traditional provider taking your first steps toward digitalization or an InsurTech startup looking to disrupt the industry, the fundamental principle remains the same: technology should serve people, not the other way around.

RVOS: Pioneering the Future While Honoring a Century of Tradition

Today, RVOS stands at a pivotal point, deeply rooted in Texan heritage yet equipped with digital capabilities for long-term success in a competitive market.

By embracing digital transformation, RVOS positions itself among leading insurance companies, setting new benchmarks in customer service and operational efficiency. The portal developed with Cadabra Studio not only enhances service for current customers but also attracts new generations of policyholders. This unique value proposition combines the trust of an established insurer with the convenience of modern digital services.

This balance was achieved through thoughtful collaboration with Cadabra Studio, focusing on preserving RVOS’s special qualities while creating growth opportunities.

RVOS’s digital transformation story is a reminder for insurance companies: embracing technology can strengthen connection to core values. With the right approach and partner, digital innovation can enhance strengths rather than replace them.

In the personal world of insurance, successful digital transformations amplify who you are and why you matter. That’s the true measure of success, achieved by RVOS in their journey from traditional insurer to digital innovator.

The next chapter of your insurance company’s story awaits. Will you take the step toward a digital future that honors your past while opening new growth possibilities?

Ready to start your digital transformation journey? Contact US Today

Frequently Asked Questions (FAQs)

1. What is digital transformation in the insurance industry?

Digital transformation in the insurance industry involves integrating digital technologies to revolutionize how insurance companies operate and deliver value, focusing on enhancing customer experience and operational efficiency.

2. How do insurance companies benefit from digital transformation?

Insurance companies gain operational agility, reduce costs, and explore new business opportunities by automating processes and offering personalized services through advanced technologies.

3. What are the key technologies in the insurance sector?

Key technologies include artificial intelligence, machine learning, blockchain, IoT, and cloud computing, which enhance digital capabilities and improve customer experiences in the insurance sector.