According to a McKinsey report, AI-driven automation can reduce claims processing time by up to 50%, significantly improving efficiency. It also can create a policy tailored specifically to a client’s lifestyle, as an AI-powered system understands their needs better than any human agent could. This isn’t science fiction – it’s happening right now.

In our guide, we’ll explore how AI development services change the insurance industry. Whether you’re an insurer looking to improve efficiency or a business exploring AI-driven risk assessment, predictive analytics plays a crucial role in AI’s real-world applications and its impact on the future of insurance.

Introduction to AI in the Insurance Sector

The insurance sector is undergoing a significant transformation with the integration of artificial intelligence (AI) technology. AI is revolutionizing the way insurance companies operate, from claims processing to underwriting and risk management. The use of AI in the insurance sector is enabling companies to make more informed decisions, improve customer experiences, and reduce costs.

One of the key advantages of AI technology is its ability to handle large volumes of data. The insurance sector is inherently data-intensive, and AI algorithms excel at analyzing historical data to identify patterns and make accurate predictions. This capability allows insurance companies to perform more precise risk assessments and make better pricing decisions. For instance, AI can analyze a vast array of data points, including past claims, customer behavior, and external factors, to determine the likelihood of future claims.

Moreover, AI-powered virtual assistants are transforming customer service in the insurance industry. These virtual assistants provide 24/7 support, answering policy inquiries, assisting with claims, and offering personalized policy recommendations. By leveraging natural language processing, these AI tools can understand and respond to customer queries in real-time, significantly enhancing the customer experience.

The Role of AI in Insurance

AI is shaking things up in the insurance world. With machine learning, natural language processing, and predictive analytics, insurers can make smarter decisions in real time and manage risks more effectively. In fact, 70% of insurers expect to deploy predictive AI models within the next two years.

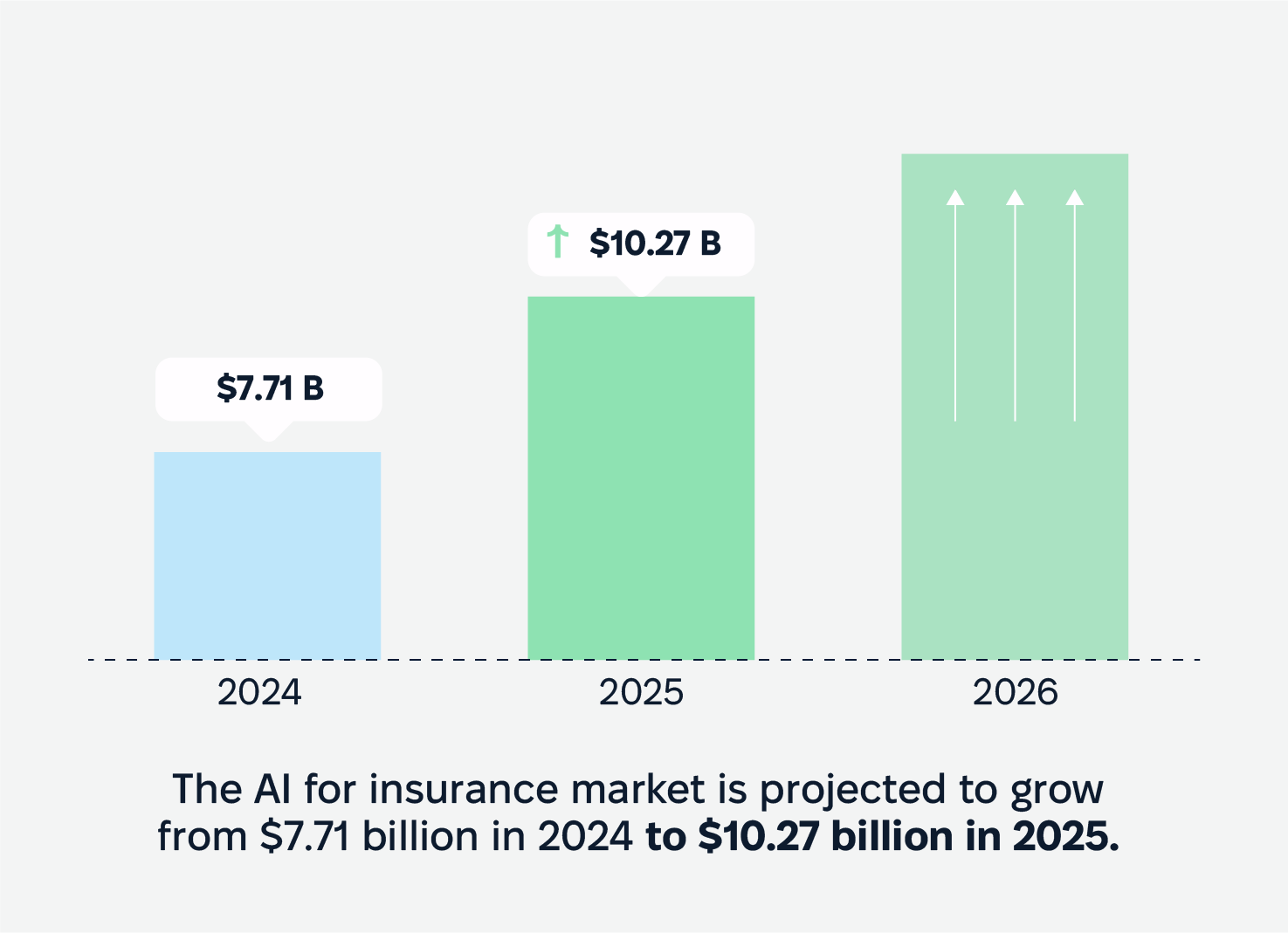

The AI for insurance market is projected to grow from $7.71 billion in 2024 to $10.27 billion in 2025. However, this rapid adoption isn’t without challenges. AI has surged to the top of the risk list for the insurance sector in 2025, so we need to be careful in implementation and oversight.

Key Benefits AI Brings to Insurers

-

Faster insurance processes: AI technology slashes the time it takes to underwrite policies and claims management, turning what used to take weeks into just minutes. That means less waiting for customers and more efficiency for insurers.

-

Smarter risk assessment: With AI-driven analytics, insurers can make more accurate pricing and coverage decisions based on real-time data. This helps avoid overpricing low-risk customers or underestimating high-risk ones.

-

Better fraud detection: AI spots suspicious activity way faster than humans can, saving companies millions. It can analyze patterns, detect anomalies, and flag potential fraud before payouts happen.

-

Happier customers: Chatbots and AI assistants provide instant support and personalized policy recommendations, making insurance feel less like a hassle. Customers get answers 24/7 without long wait times.

-

Lower costs: Automating routine tasks cuts operational expenses and boosts profitability. Insurers can reinvest these savings into better services, competitive pricing, and innovation.

-

Improved customer engagement: AI tools enhance customer engagement by providing personalized experiences and proactive communication, leading to higher satisfaction and loyalty.

AI in Insurance Use Cases

The numbers and benefits are great. However, it’s much easier to understand the essence of AI in the insurance industry with real-world use cases. Therefore, I would like to talk about a few of the most illustrative options in more detail. Predictive analytics is one of the key use cases of AI in the insurance industry.

Automated Underwriting and Risk Assessment

Let’s start with risk profiles. Traditionally, underwriting required extensive human effort to assess risk factors. Now, AI streamlines this process by analyzing large datasets, including credit scores, medical records, and behavioral data.

Machine learning models and predictive analytics can evaluate an applicant’s risk profile in real time, enabling quicker and more accurate underwriting decisions. For instance, the insurance platform Swiss Re utilizes AI for detailed life insurance risk assessments, streamlining the underwriting process.

Predictive Analytics in Underwriting

AI-powered predictive models analyze historical data to forecast future risk probabilities. This allows insurers to better assess potential claims (including false claims), adjust policy pricing, and identify high-risk applicants with greater precision.

Claims Processing and Fraud Detection

Nobody likes waiting weeks for an insurance payout. AI is speeding up claims processing by using predictive analytics to handle paperwork, verify documents, and even estimate damage costs automatically.

For example, computer vision technology can analyze images of a car crash or a flooded basement and calculate repair expenses in seconds. No need to wait for a human adjuster to show up. Trupanion, a pet insurance provider, uses AI insurance solutions in its web-based vet portal to automate invoice processing. This means pet owners don’t have to pay upfront and wait for reimbursement – their claims get processed instantly.

Identifying Fraudulent Claims Using AI

Fraud is a massive problem in the insurance industry, costing companies billions every year. AI helps insurers crack down on fraud by spotting red flags in claims data – like patterns of exaggerated injuries or suspiciously similar claims from different people. Machine learning algorithms analyze behavior and flag anything unusual for further review, making it harder for fraudsters to slip through the cracks.

Customer Experience and Personalization

AI-driven chatbots provide 24/7 customer support. They handle policy inquiries, assist with claims, and offer policy recommendations. Virtual assistants enhance customer engagement and the user experience by quickly resolving common issues.

Progressive Insurance launched a chatbot featuring “Flo,“ the company’s well-known commercial spokesperson, allowing consumers to interact and receive assistance in a user-friendly manner.

Personalized Policy Recommendations

Insurance AI digs into customer data to suggest policies that fit like a glove. By analyzing a person’s risk profile, lifestyle, and preferences, insurers can offer tailored coverage options. This not only boosts customer satisfaction but also makes people more likely to sign up.

Smarter Policy Pricing and Market Predictions

With AI-powered pricing models and predictive analytics, policy rates can shift in real-time based on fresh data. By keeping tabs on market trends, customer behavior, and risk factors, insurers can set competitive prices without sacrificing profits.

Also, AI doesn’t just look at what’s happening now. It forecasts what’s coming next. It analyzes economic shifts, regulatory updates, and consumer habits so that insurers can adjust their strategies ahead of time and stay one step ahead of the competition.

Challenges of Implementing AI in Insurance

Implementing artificial intelligence in insurance software has its pitfalls. Let’s dive into some of the bumps on the road and see how they impact the industry.

Data Privacy and Compliance: Guarding the Treasure Trove

Handling heaps of sensitive customer information means insurers must play by the rules set by data protection laws like GDPR and CCPA, ensuring robust data security measures are in place. In fact, in 2023, nearly 40% of financial services experts pointed to data issues – think privacy concerns and scattered data locations – as the main hurdles in their AI journey.

To keep things above board, insurers need to ensure their AI systems respect these privacy laws and have rock-solid cybersecurity in place.

Tackling Old-School Systems: Out with the Old, In with the New

Many insurance companies are still running on legacy systems, making it tricky to plug in new AI tools. Upgrading this infrastructure is no small feat, but it’s crucial for a smooth AI rollout. Plus, finding and keeping AI experts is another significant challenge, as highlighted by industry professionals.

Ethical AI: Walking the Tightrope

Ethical considerations in AI decision-making need to be transparent and fair. There’s a real concern about biases creeping into algorithms, which could lead to unfair practices or pricing. The UK’s Financial Conduct Authority has even warned that AI could make some people “uninsurable,” highlighting the need for responsible AI use in insurance.

The Road Ahead: Challenges and Opportunities

While AI offers exciting possibilities for the insurance industry, it’s clear that challenges like data privacy, system integration, and ethical considerations need careful attention. By addressing these issues head-on, insurers can harness AI’s potential while keeping customer trust and regulatory compliance intact.

AI-Powered Insurance Products and Services

AI is enabling the development of innovative insurance products and services that cater to individual customer needs. One notable example is usage-based insurance policies, which use AI to offer personalized premiums based on a customer’s driving habits or health data. This approach not only provides fairer pricing but also encourages safer behavior among policyholders.

In addition to personalized products, AI is streamlining underwriting processes. Traditional underwriting often involves manual data entry and extensive human effort. However, AI-powered systems can automate data collection and analysis, making the underwriting process faster and more accurate. This reduces the time it takes to issue policies and improves the overall customer experience.

AI is also revolutionizing claims management. By analyzing claims data, AI algorithms can identify patterns and detect false claims, helping insurance companies reduce costs and improve efficiency. For instance, AI can flag suspicious claims for further investigation, ensuring that fraudulent activities are caught early. Additionally, AI-powered chatbots facilitate quick and easy claims processing, allowing customers to file claims and receive updates without human intervention.

The Impact of AI on the Insurance Workforce

The integration of AI in the insurance sector is poised to have a profound impact on the workforce. While AI is expected to automate certain tasks, it will also create new job opportunities in areas such as data science, machine learning, and AI development. Insurance companies will need to invest in training and upskilling their employees to ensure they have the necessary skills to work with AI technology.

However, there are concerns about potential job displacement due to AI automation. According to a report by the McKinsey Global Institute, up to 30% of insurance industry jobs could be automated by 2030. This highlights the need for insurance companies to carefully manage the transition to AI, ensuring that employees are supported and retrained for new roles.

Despite these challenges, the integration of AI in the insurance sector offers numerous benefits. AI can improve customer experiences, reduce operational costs, and enhance efficiency. As the technology continues to evolve, we can expect even more innovative applications of AI in the insurance sector, driving further transformation and growth.

By addressing these aspects, the new sections will provide a comprehensive overview of AI’s impact on the insurance industry, maintaining the article’s informative and engaging tone.

Future Trends in AI and Insurance

AI-Powered InsurTech Startups

InsurTech startups are on the rise, using AI to transform how insurance works. They’re automating policies, streamlining claims, and boosting customer engagement, pushing traditional insurers to keep up.

The global InsurTech market hit $25.97 billion in 2024 and is projected to skyrocket to about $496.56 billion by 2033, with a whopping annual growth rate of 38.8%.

Even though overall InsurTech funding dipped by 4% in 2024, AI-focused startups bucked the trend, raising an extra $5 million on average compared to their non-AI counterparts.

Generative AI

Generative AI is making big moves in insurance, from drafting policies to assessing claims and chatting with customers. It’s automating document creation, leveraging predictive analytics, and supercharging data analysis, simplifying complex processes.

A recent study found that 8 out of 10 insurers plan to invest in generative AI within the next year. For example, Allstate has started using generative AI models like OpenAI’s GPT to craft nearly all its customer emails after claims are filed. These AI-generated emails are less jargony and more empathetic, aiming to enhance communication and reduce frustration among customers and claims reps.

New Rules and Regulations for AI

As AI becomes more common in the insurance and financial services industry, regulatory compliance is becoming increasingly important as regulators are stepping up to set new standards. Companies need to stay ahead of these evolving rules to ensure they’re using AI responsibly. For instance, Connecticut proposed a law to restrict health insurers from using AI to make care decisions, ensuring a human touch in patient evaluations.

Additionally, the New York State Department of Financial Services issued guidelines emphasizing that insurers must ensure their AI-driven underwriting or pricing practices aren’t unfairly discriminatory.

In a nutshell, AI is driving innovation in insurance, with startups leading the charge and generative AI transforming operations. But with these advancements come new responsibilities, and staying on top of regulatory changes is crucial for insurers aiming to harness AI’s full potential.

How Cadabra Supports AI Implementation in Insurance

At Cadabra Studio, we help companies rethink their entire approach to digital transformation by enhancing customer engagement. Our expertise in AI-driven solutions has helped insurers streamline operations, improve customer experience, and stay competitive in a developing industry. Let’s take a look at two standout success stories.

Bringing a 100-Year-Old Company into the Digital Age

Our client has been serving US homeowners for more than 100 years, but like many legacy insurers, they faced a growing challenge: adapting to the digital world. That’s where Cadabra Studio stepped in.

We built an intuitive, customer web portal that made managing policies, filing claims, and making payments seamless with specific AI tools. The result? A 30% boost in customer engagement and a 25% drop in support requests, proving that digital transformation isn’t just about keeping up – it’s about gaining an edge.

Read more: Reinventing Customer Engagement: How Cadabra Studio Helped RVOS Insurance Go Digital

Reinventing Risk Management

As a global leader in risk management, our client knew that traditional processes wouldn’t cut it in the digital-first era. They needed a modern overhaul, and we helped make it happen.

By reimagining their business models and integrating smart AI automation, we empowered the company to scale faster, make data-driven decisions, and deliver a frictionless customer experience.

Wrapping It Up

AI is transforming the insurance industry, making processes faster, smarter, and more customer-friendly. But with great innovation comes great responsibility. Insurers need to tackle challenges like data security, ethical AI use, and system integration while staying ahead of the competition. The good news? With the right approach, AI can be a paradigm shift.

Companies that integrate AI into their operations are gaining a competitive edge. AI-powered solutions help reduce administrative costs, detect and prevent fraud more effectively, and provide personalized customer experiences that improve retention.

Ensuring regulatory compliance, insurers can also leverage AI-driven analytics to refine risk assessments, optimize pricing strategies, and streamline claims processing, making their services more efficient and reliable. They also can enhance decision-making, increase operational efficiency, and deliver better value to their customers.

Ready to Bring AI Into Your Insurance Business?

From better risk management to fraud prevention and enhanced customer engagement, AI has the power to reshape the way you work. And you don’t have to navigate this shift alone.

We specialize in AI-driven solutions tailored for the insurance industry. Let’s build smarter, AI-powered insurance solutions together.

FAQs

How does AI improve insurance underwriting?

Predictive analytics enhances underwriting by analyzing vast amounts of data: medical records, financial history, social factors, and even real-time data from IoT devices. This allows insurers to assess risk more accurately, price policies more competitively, and reduce processing time from weeks to minutes.

Can AI completely automate claims processing?

Predictive analytics can handle routine claims efficiently, from fraud detection to automated approvals. However, complex cases, disputes, and claims requiring human judgment still need expert oversight. The best approach combines AI automation with human expertise for accuracy and fairness.

Is AI in insurance secure and compliant?

Data security is crucial for AI to be secure and compliant, but it depends on how it’s implemented. Insurers must use strong encryption, strict access controls, and transparent AI models to meet regulations like GDPR and CCPA. Regular audits and bias detection are also key to maintaining trust and compliance.

What is the future of AI in insurance?

Predictive analytics is set to become an even bigger part of insurance, driving automation, personalizing policies, and strengthening fraud prevention. As regulations evolve, insurers will need to balance innovation with compliance, ensuring AI remains ethical, transparent, and beneficial for both companies and customers.