Insurance operations have come a long way, but the road to efficiency is far from over. In 2025, insurance leaders are laser-focused on one thing: maximizing ROI through process automation.

The right process automation implementation and automation strategies not only streamline operations but also drive measurable returns. This guide breaks down how you can achieve that, covering everything from ROI measurement frameworks to actionable implementation strategies.

So, find out:

- What is insurance process automation ROI, and what is proper automation ROI measurement?

- What are insurance automation benefits and types? How do they affect the intake process?

- What does the right process automation implementation look like?

Understanding Insurance Process Automation

Implementing automation takes care of repetitive tasks so insurers can save time, cut costs, and deliver superior service. But not all automation is created equal. Here’s a look at the four key types:

Robotic Process Automation (RPA)

RPA focuses on handling repetitive, rules-based tasks like data entry, claims validation, and policy updates. Think of it as the workhorse of automation—fast, efficient, and error-free. For example, after process automation implementation, RPA bots can extract data from forms and input it into systems in seconds, reducing manual effort significantly.

Intelligent Automation

When RPA meets artificial intelligence (AI), you get intelligent automation as one of the insurance automation benefits. This type allows systems to make decisions by identifying patterns and analyzing data. It’s ideal for complex tasks like fraud detection or underwriting risk assessments, where decision-making needs to go beyond basic rules. This highly affects insurance process automation ROI.

Cognitive Automation

Cognitive automation takes things a step further by incorporating machine learning (ML) and natural language processing (NLP). This enables systems to process unstructured data and perform tasks that require a degree of understanding. For example, after process automation implementation, it can analyze sentiment in customer emails or automatically respond to inquiries based on context.

Workflow Automation

Workflow automation focuses on streamlining entire end-to-end processes, like claims processing or policy renewals. By integrating systems and removing bottlenecks it ensures seamless execution with minimal human intervention. This means faster turnaround times, improved accuracy, and happier customers.

Key Application Areas

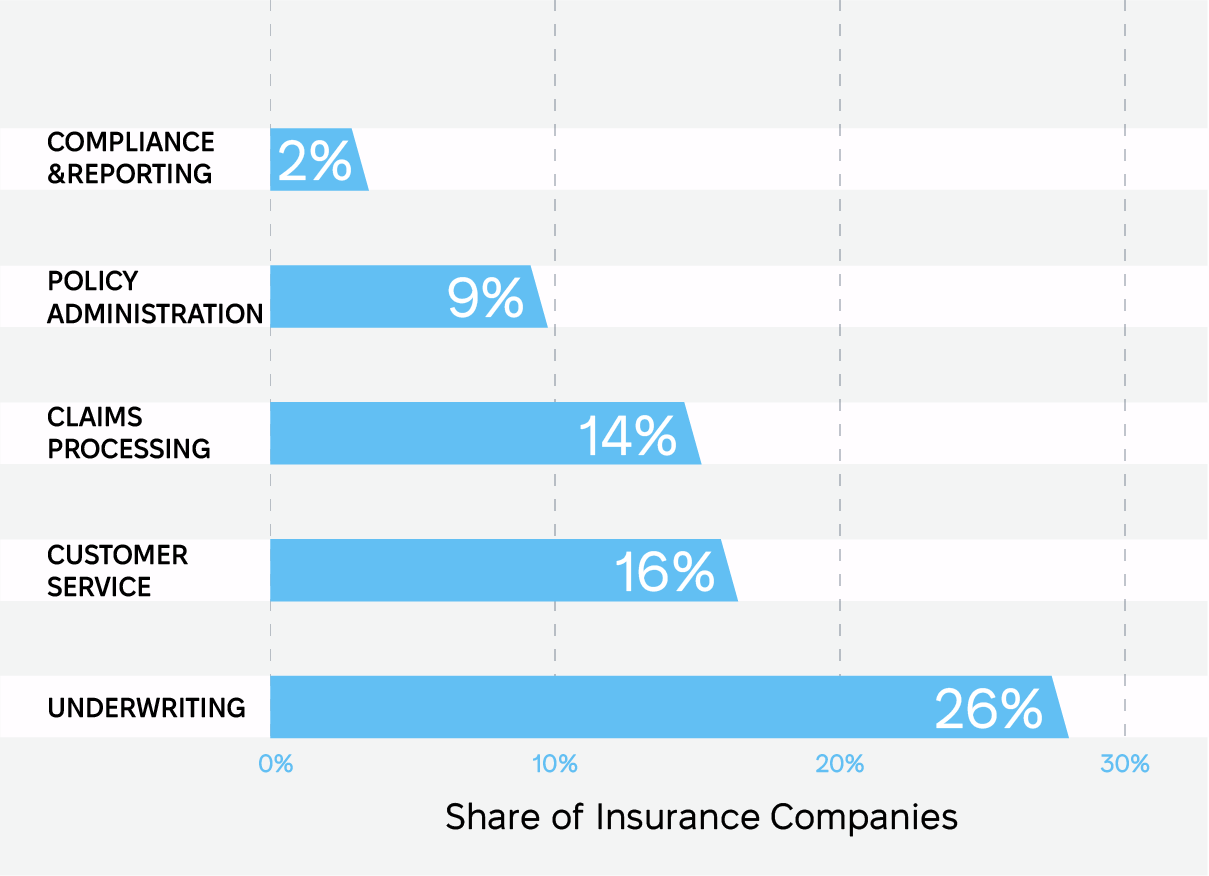

Automation isn’t just about replacing manual work but about optimizing manual processes, improving accuracy, and delivering better customer experiences. In the insurance sector, it can transform several critical operations.

According to Statista, in 2023, leading at 26%, underwriting was one of the most important areas of automating assessing risks and determining policy terms. Customer service has 16% of the share and claims processing accounts for 14%, showing its prominence in ensuring timely payouts and managing policyholder expectations.

Let’s take a closer look at the process automation implementation and key application areas.

Claims processing

Claims processing is the lifeblood of any insurance business but is often one of clients’ biggest pain points due to manual inefficiencies and human errors. Automation here can:

- Speed up adjudication: By automating repetitive tasks like document verification and fraud detection, claims can be processed in hours instead of days.

- Reduce errors: Automation eliminates manual data entry errors, ensuring more accurate payouts.

- Improve customer satisfaction: Faster, error-free claims handling boosts customer trust and retention rates, which highly improves insurance process automation ROI.

Underwriting

Underwriting requires assessing risk with precision, a process often bogged down by the sheer volume of data. Automation can:

- Streamline data gathering: Automated tools pull data from multiple sources, like credit scores and public records, in real time.

- Enhance decision-making: AI-driven analytics identify patterns and anomalies, supporting more accurate risk assessments.

- Save time: Automated workflows cut underwriting timelines significantly, allowing underwriters to focus on complex cases.

Policy administration

Policy administration involves creating, renewing, and managing policies—a time-consuming process prone to inefficiencies. This process automation implementation can:

- Automate policy issuance: Automatically generate policies based on predefined rules, reducing manual effort.

- Simplify renewals: Send automated reminders and process renewals seamlessly without human intervention.

- Ensure data consistency: Synchronize policy details across systems to eliminate discrepancies.

You can highly improve insurance process automation ROI with it.

Customer service

Insurance customers and brockers expect quick, personalized service. Automation in customer service enables:

- 24/7 support: AI-powered chatbots handle routine inquiries like policy details, claims status, and premium payments.

- Personalized interactions: Tools like Natural Language Processing (NLP) analyze customer queries to deliver tailored responses.

- Reduced wait times: Automation ensures customers get instant answers to common questions, freeing up human agents for complex issues.

Compliance & reporting

Regulatory compliance is a critical yet resource-intensive function that also affects insurance process automation ROI. Automation helps insurers:

- Generate real-time reports as a part of insurance automation benefits: Automate the creation of audit trails and compliance reports to meet regulatory deadlines.

- Reduce manual errors: Ensure accuracy in financial and operational reporting through rule-based workflows.

- Stay compliant: Monitor regulatory changes and automatically adjust processes to remain in compliance with laws like GDPR or HIPAA.

ROI Measurement Framework

To justify automation investments, you need a clear automation ROI measurement framework. Here’s how you can make it happen:

Start with analyzing cost reduction metrics

- Labor cost savings as an automation ROI measurement: Automate repetitive tasks to reduce dependency on full-time equivalents (FTEs).

- Error reduction impact: Minimize costly human errors.

- Processing time value: Faster processing means happier customers and more efficient operations.

- Operational efficiency gains: Streamline workflows and reduce bottlenecks.

Go to revenue impacts an automation ROI measurement

- Customer satisfaction benefits: Improved service leads to higher retention rates.

- Market competitiveness: Stay ahead by adopting cutting-edge technologies.

- New business capability: Free up resources to focus on innovation.

- Employee productivity gains: Empower teams to focus on strategic work.

And finally – investment considerations

- Technology costs: Upfront software and hardware expenses.

- Implementation expenses: Integration and consulting fees.

- Training requirements: Upskilling teams to work with new tools.

- Maintenance costs: Ongoing support and upgrades.

ROI Calculation Methodology

Calculating ROI for insurance process automation captures both direct and indirect benefits as an automation ROI measurement. While the basic formula remains simple, the insights you draw from it must be comprehensive to build a compelling business case.

Direct cost savings

Direct cost savings are the most tangible outcomes of automation and are often the first metric leaders focus on.

FTE reduction/reallocation

Automation can take over repetitive and time-consuming tasks, allowing insurers to reduce full-time equivalent (FTE) roles or reassign employees to higher-value activities. For example:

- If automation eliminates manual claims validation, the time saved translates directly into labor cost reduction.

- Reallocation enables teams to focus on customer-facing roles, driving up service quality without additional hires.

Error elimination savings

Manual errors are costly—both financially and in terms of customer trust. Automated systems reduce errors in:

- Claims processing, leading to fewer disputes and faster resolution times.

- Compliance reporting, minimizing fines and penalties from inaccurate filings.

Processing time reduction

Faster processes mean quicker revenue realization. For instance:

- Automated underwriting can cut decision times from weeks to days, enabling faster policy issuance.

- Improved claims handling reduces customer churn caused by delays.

Indirect benefits

This automation ROI measurement often makes the strongest case for automation as it amplifies value beyond the immediate cost savings.

Customer satisfaction impact

Automation speeds up response times and ensures accuracy, enhancing the customer experience. Satisfied customers:

- Are more likely to renew policies.

- Share positive feedback, driving new business through referrals.

Employee satisfaction

Reducing repetitive tasks boosts morale and engagement among employees, leading to:

- Higher productivity.

- Lower turnover rates, reducing hiring and training costs.

Market positioning

Investing in automation signals innovation and competitiveness, making insurers more attractive to customers and partners.

- Enhanced brand reputation opens up opportunities for premium pricing or partnerships.

ROI Formulas

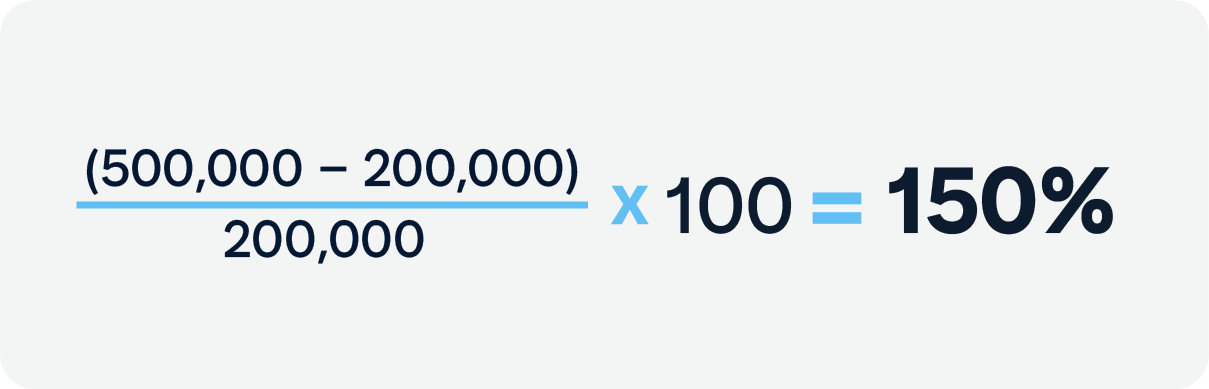

Start with this straightforward formula for automation ROI measurement:

Example: If automation saves $500,000 annually and costs $200,000 to implement, ROI is:

For a deeper analysis, you may include indirect benefits like improved customer retention rates or market share growth and time-based savings to account for long-term gains versus upfront costs.

Do not forget about Long-Term Value Assessment

Automation isn’t a one-time benefit. To assess its ongoing value, consider:

- Scalability: How additional processes can be automated over time.

- Future cost avoidance: Reduced risk of non-compliance or operational inefficiencies.

Example of automation ROI measurement

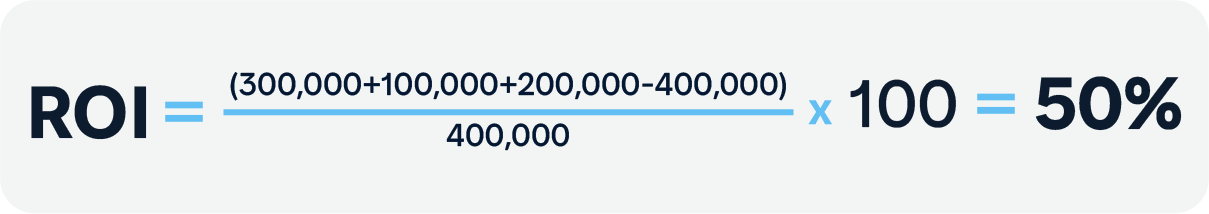

Let’s say an insurer implements an AI-powered claims processing system:

- Direct savings: Reduces FTEs by 10%, saving $300,000 annually.

- Error elimination: Cuts claims rework by 25%, saving $100,000 annually.

- Customer satisfaction: Boosts policy renewals by 10%, adding $200,000 to revenue.

Initial investment: $400,000 (technology, training, and implementation).

Using basic ROI:

Factoring long-term gains (future scalability and reduced churn), the ROI increases significantly, making automation a strategic win.

Need assistance in automation ROI assessment? We’re here for you. Book a free consultation now

Implementation Strategy for Maximum Insurance Process Automation ROI

Rolling out insurance process automation isn’t rocket science, but it does need a smart game plan. You want quick wins to prove it’s worth it, but you also need a strategy that scales and keeps delivering results. Here’s how you make it happen.

Process selection

The foundation of a strong implementation strategy lies in selecting the right processes to automate.

High-Impact processes in insurance process automation ROI

Focus on workflows that pack the biggest punch for efficiency, speed, and cost savings. Think:

- Claims processing: Faster payouts, fewer errors, and happier customers. Who doesn’t love that?

- Compliance reporting: Reduce the headaches of regulatory paperwork and avoid those costly fines.

Quick wins of insurance process automation ROI

Go after the low-hanging fruit first—the easy wins that show immediate ROI. These are processes where a little automation goes a long way:

- Automating boring, repetitive data entry. (Say goodbye to carpal tunnel.)

- Simplifying policy renewals with smooth, seamless workflows.

Complexity assessment

Not all processes are created equal, so assess them based on:

- Feasibility: Is it simple, rules-based work, or does it need some brainpower (AI/ML)?

- Resources: Do you have the budget, time, and skills to pull it off

- Impact: Does this align with the big-picture goals, or are you just automating for the sake of it?

Technology selection

You can’t build a house without the right tools, and the same goes for automation. You need technologies that’ll become your insurance automation benefits.

Start with tool evaluation

Look for tech that:

- Grows with you (scalability is key—you don’t want to outgrow it in six months).

- Has a proven track record in insurance (don’t reinvent the wheel).

- Provides real-time analytics so you can keep tabs on ROI like a hawk.

Finding a good partner makes all the difference

Work with vendors who:

- Know insurance inside and out—no need for a crash course.

- Offer solid support after implementation (because hiccups will happen).

- Have flexible pricing and customization options. One size never fits all.

Do not forget about integration requirements

Make sure your shiny new tech plays nice with your current systems, like:

- Policy admin platforms

- Claims management tools

- CRM systems and customer communication tools

If it doesn’t integrate, you’ll spend half your time fixing the mess instead of reaping the benefits.

Implementation approach to insurance process automation ROI

A phased and iterative approach minimizes risks and maximizes value.

1. Phased rollout

Start small—really small. Pick one department or process to pilot your automation. Testing the waters this way helps you gather data and make improvements before going all-in. Once you see positive results and work out the kinks, start expanding to more complex workflows. It’s like dipping your toes in first, then diving in when you’re ready.

2. Pilot programs

Pilots are like test drives for your automation efforts. Running these in controlled environments allows you to test your ROI assumptions and tweak your strategies without the full risk. Track key performance indicators (KPIs) such as error rates, processing times, and cost savings. If those numbers look good, you can confidently scale up. If not, you’ll have learned valuable lessons to refine the process before pushing forward.

3. Scaling strategy

Once you’ve seen success in your initial pilot and rollout phases, it’s time to scale. But don’t rush—develop a clear roadmap. Focus on automating high-value areas first, and ensure that your team is prepared for the challenges ahead, such as resistance to change or skill gaps. Build the right training programs to smooth the transition and make sure you have the right resources in place to support a company-wide shift to automation.

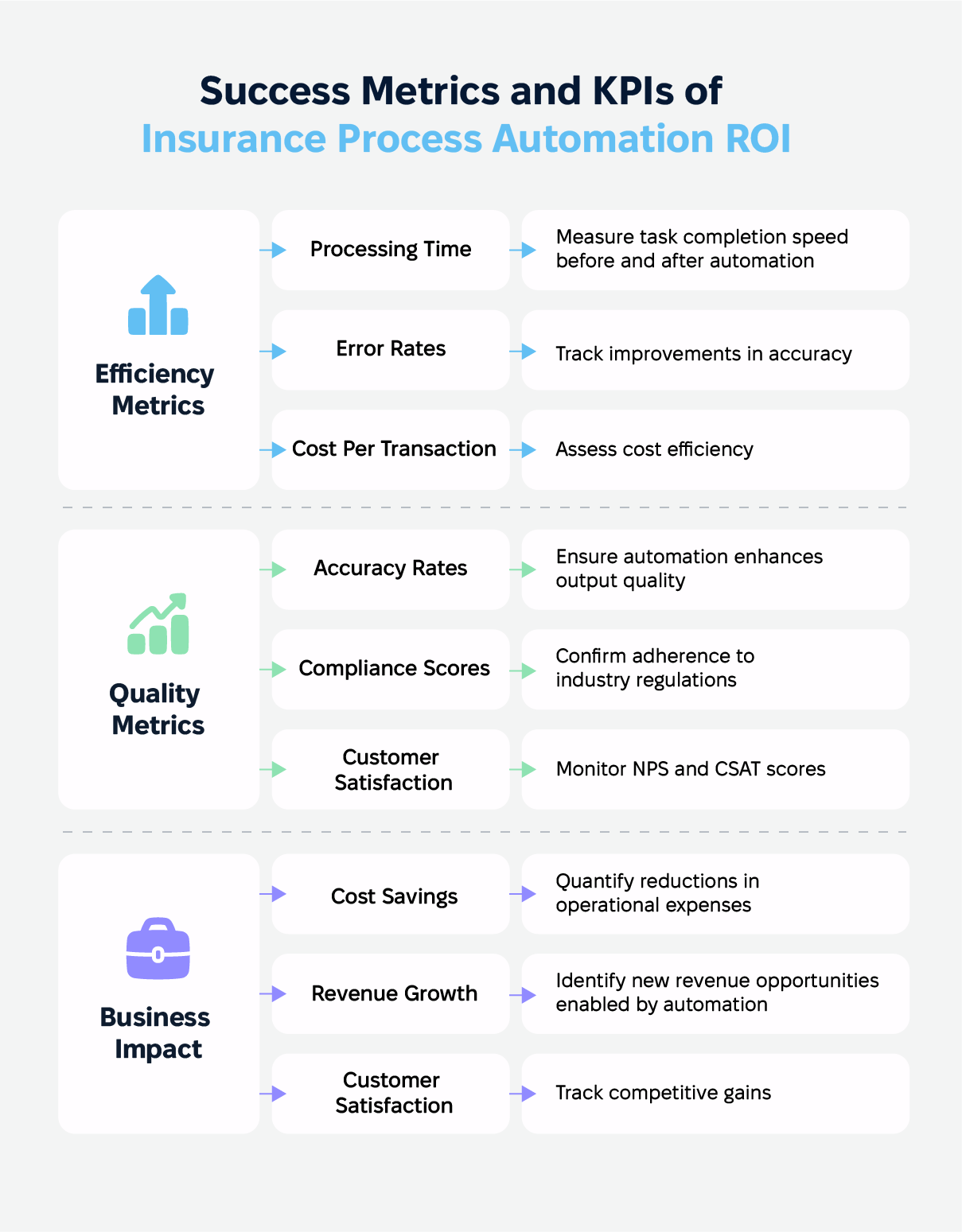

Success Metrics and KPIs of Insurance Process Automation ROI

Risk Management and ROI Protection

Automation in insurance isn’t without its hurdles, but a proactive approach ensures risks are minimized and ROI remains intact. Resistance to change is often the first obstacle, so communicating the benefits to all stakeholders, especially employees, is crucial. Framing automation as a tool to simplify repetitive tasks and enhance strategic work fosters acceptance.

Budget control is another critical factor. Detailed planning that accounts for all costs—software, integration, training, and maintenance—prevents financial overruns. Quality assurance further safeguards ROI. Regularly monitoring performance metrics, conducting audits, and fine-tuning processes ensure automation operates efficiently and stays compliant with regulations.

Change management plays a pivotal role. Training staff thoroughly and setting clear expectations reduce friction during adoption. Scaling automation sustainably and adapting to the evolving market needs to solidify long-term benefits, keeping your organization ahead of the curve.

Real-World Examples

Allianz Insurance has implemented AI-based automation in claims processing with their “60-second claims service,” allowing customers to process claims in a minute by uploading photos and documents. This has cut claim handling times and costs by up to 50%, improving efficiency and customer satisfaction.

Zurich Insurance Group adopted Robotic Process Automation (RPA) to automate over 50 manual processes, reducing errors and processing times. This saved millions in operational costs and allowed employees to focus on higher-value tasks like customer service and underwriting, further enhancing customer experiences.

Read about our experience in working with insurance products:

Online portal for clients of the insurance company Case Study

Future Trends and ROI Potential (2025)

The future of insurance process automation ROI is brimming with opportunities for innovation, scalability, and ROI growth. Here’s what lies ahead:

Watch for AI and Blockchain innovations

AI’s getting smarter every day. It’s now handling more complex tasks like fraud detection and predictive underwriting—basically, it’s becoming the brains behind the operation. And with blockchain stepping in, it’s adding a layer of security and transparency to make claims settlements smoother and reduce fraud risk. Put them together, and you’ve got a recipe for better, more efficient operations.

Shift toward fully digital insurance ecosystems

Insurers are catching on to the digital wave, moving toward all-in-one platforms that integrate policy issuance, claims handling, and customer interactions. This shift doesn’t just make things easier internally; it also improves the customer experience, which is a win for retention and revenue. It’s all about making things faster and more seamless for everyone involved.

Value in predictive analytics and customer personalization

Predictive analytics is the foundation of industry, helping insurance companies foresee customer needs and risks before they pop up. It’s more than just relevant data crunching—this is what allows insurers to offer products tailored to each customer. It’ll go way beyond just marketing; we’ll start to see personalized claims resolutions and policy suggestions. If you’re not offering tailored services, you’ll be left behind.

Plan for scalability and future-proofing to take the most of insurance automation benefits

Insurance companies that want to stay ahead need to think long-term. By investing in scalable, flexible automation systems now, they’ll be ready to roll with whatever challenges come their way—be it new customer demands, regulatory changes, or market shifts. It’s about setting up for success, no matter what the future throws at them.

Evolution of embedded insurance

Embedded insurance is going mainstream, and it’s all about integrating coverage into everyday purchases—think buying a plane ticket and being offered travel insurance right there on the spot. Automation will make this process easier, opening new revenue streams and reaching customers where they need it without all the traditional sales tactics.

Rise of hyper-automation

Get ready for hyper-automation! This is when multiple technologies—AI, RPA, and machine learning—work together to automate nearly every part of the insurance operation. We’re talking efficiency on steroids. Hyper-automation doesn’t just improve operations; it strengthens compliance and risk management, making it a game-changer for the industry.

Conclusion: Action Plan

As the insurance industry evolves, automation is essential for staying competitive and driving real, measurable returns. By automating key processes like claims handling, underwriting, and customer service, insurers can reap benefits such as reduced costs, improved accuracy, and quicker response times.

To make sure the ROI is as high as possible, insurers need to take a smart, phased approach to automation:

- Start small: Begin with automating repetitive, easy-to-implement tasks that show quick results and provide real insurance automation benefits.

- Scale strategically: As you gain confidence, expand automation to more complex workflows using AI, RPA, and intelligent process management.

- Measure continuously: Keep an eye on metrics such as processing time, error reduction, and customer satisfaction to ensure long-term success and continued improvement.

The future holds even more potential with innovations like AI-driven predictive analytics, hyper-automation, and blockchain. These will open doors for further innovation, scalability, and new opportunities. By embracing these technologies today, insurers will be able to future-proof their operations, deliver exceptional value to customers, and maximize ROI in the years to come.

Ready to take the leap? Book a free ROI consultation with our experts and find out how automation can transform your insurance business.