Legacy systems have been the backbone of the insurance industry for decades, but they’re past their prime. As tech advances, these aging giants become hurdles instead of helpers. Insurance legacy system transformation is a necessity if you want to stay in the game. But let’s be real: the process can feel like trying to rebuild a plane mid-flight, which is risky and complicated.

In this guide, we’ll

- unpack a risk-free approach to insurance legacy system modernization,

- tackle common fears,

- offer practical strategies to make the insurance digital transformation as smooth as silk.

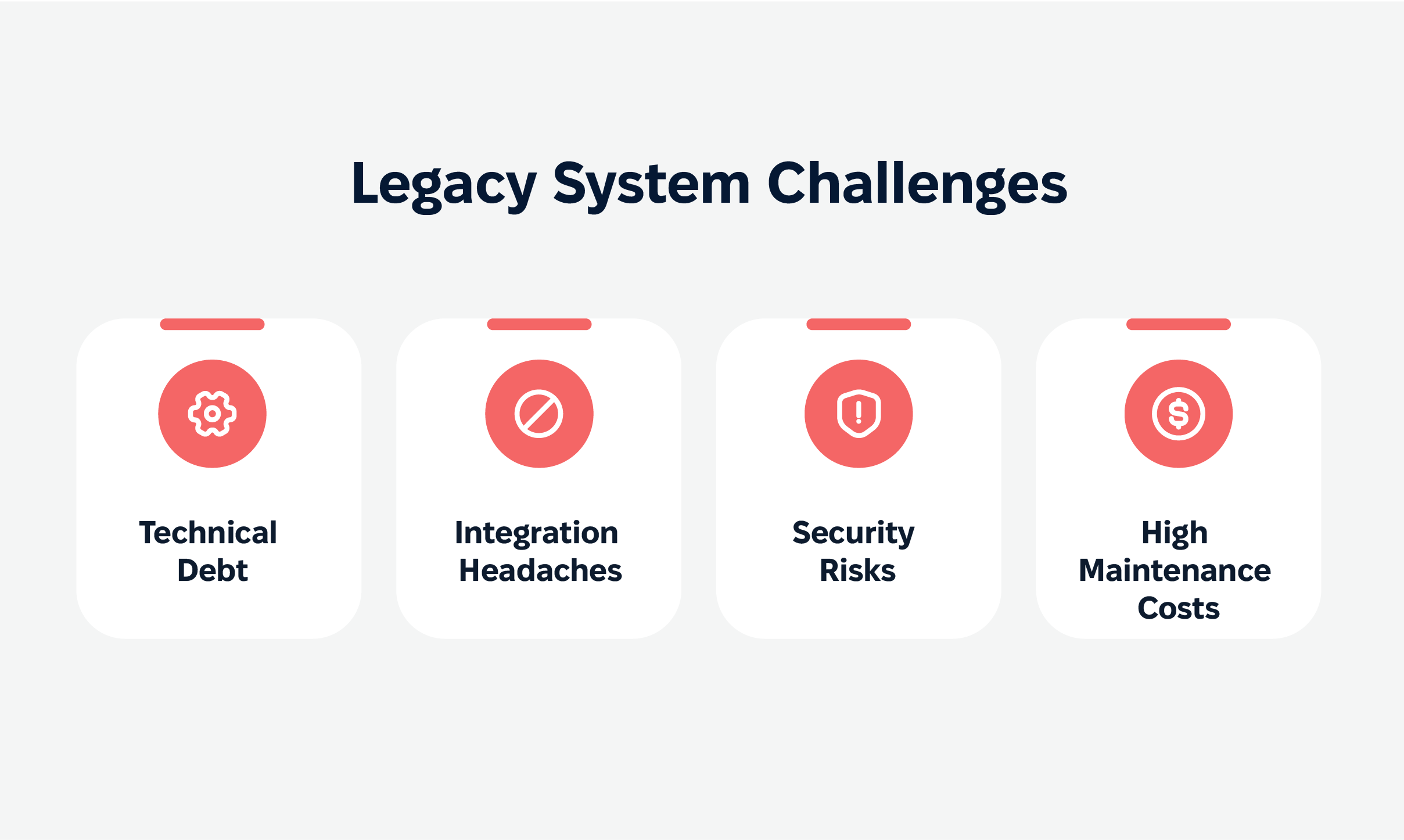

Understanding Legacy System Challenges

Legacy systems might’ve been cutting-edge in their heyday, but now? They’re the tech equivalent of a rotary phone in a smartphone world. They come with the following:

- Technical debt: outdated code and architecture make upgrades a nightmare.

- Integration headaches: ever tried plugging a square peg into a round hole? that’s integrating legacy systems with modern tech.

- Security risks: like leaving your front door open in a sketchy neighbourhood.

- High maintenance costs: keeping these dinosaurs running eats up budgets fast.

How does it impact your business?

Legacy systems drag down your operations, customer experience, and competitiveness. They’re slow, clunky, and can’t keep up with today’s market demands. If your competitors are driving sports cars, sticking with legacy systems is like cruising on a unicycle.

Risk Assessment Framework

Insurance legacy system modernization can feel like walking a tightrope, but with a good plan, you can cross without a scratch. Here’s how to tackle the big risks:

- Business continuity as a part of legacy modernization risks. Nobody wants their systems crashing mid-upgrade. Run old and new systems in parallel and have a fallback plan ready – just in case.

- Data security as a part of legacy modernization risks. Moving data is like moving a house – things can get lost or broken. Keep it safe with encryption and double-check everything before unpacking. Encrypt sensitive information during the transfer and verify the integrity of data before switching systems to avoid nasty surprises.

- Integration risks. Not everything plays nicely together. Thorough testing and smart middleware can help your systems get along like old friends. Use integration tools that act as translators to smooth over communication hiccups between old and new components.

- Resources as a part of legacy modernization risks. Short-staffed or lacking expertise? Plan ahead, and don’t hesitate to call in reinforcements. Consider external consultants or temporary staffing to bridge gaps during critical phases of the project.

- Compliance risks. Regulations can be a minefield. Have legal experts guide you to avoid stepping on anything explosive. A proactive approach with regular compliance checks ensures your insurance legacy system modernization aligns with industry standards.

- Cost overrun as a part of legacy modernization risks. Every project needs a budget, but let’s be honest – surprises happen. Build in some wiggle room so unexpected costs don’t sink the ship. Use agile methods to adjust and allocate resources dynamically as priorities shift.

Insurance Legacy System Modernization Approaches

Complete replacement in insurance legacy system modernization

Sometimes, you just have to start fresh. Replacing everything wipes the slate clean but can be pricey and disruptive. It’s like renovating your whole house at once – exciting but also stressful.

Pros: A clean slate allows for modern architecture, no legacy baggage, and future-proof scalability.

Cons: High initial costs, longer implementation times, and a steep learning curve for staff.

Best for: Organizations with severely outdated systems and deep pockets willing to handle the temporary disruption for long-term gains.

Phased insurance legacy system modernization

Swap out parts of the system piece by piece. It’s slower but way less risky. Think of it as renovating one room at a time.

Pros: Minimizes legacy modernization risks, spreads costs over time, and ensures smoother transitions.

Cons: Takes longer to achieve a fully modern system and may involve interim compatibility issues.

Best for: Businesses looking for steady progress without disrupting ongoing operations.

Parallel implementation

Keep the old system running while testing the new one. It’s like having training wheels on a bike – safe but a bit clunky.

Pros: Reduces risk of operational downtime and allows for thorough testing before a full switchover.

Cons: Involves double the workload and higher resource demands during the overlap period.

Best for: Companies with mission-critical operations that can’t afford downtime during transitions.

Hybrid approach to insurance legacy system modernization

Combine methods to balance speed, cost, and risk. Hybrid is your Swiss Army knife solution.

Pros: Offers flexibility to adapt to specific needs and Constraints, allowing a custom-fit strategy.

Cons: Can be complex to manage and requires detailed planning and coordination.

Best for: Organizations with diverse needs and varying levels of modernization across different departments.

Microservices in insurance digital transformation

Ditch the big, bulky system for small, nimble services. It’s like trading a battleship for a fleet of speedboats.

Pros: Improves scalability, agility, and resilience. Each service can evolve independently.

Cons: Requires significant architectural redesign and expertise in managing microservices.

Best for: Tech-savvy organizations aiming for scalability and continuous innovation.

API-first insurance legacy system modernization

Build your system around APIs for ultimate flexibility. It’s like adding a universal remote to your tech setup.

Pros: Ensures seamless integration with other systems and prepares for future tech adoption.

Cons: Needs upfront investment in API development and robust security measures.

Best for: Companies focused on interoperability and future tech readiness.

Risk Mitigation Strategies

Keep the business running

Parallel running is a lifesaver for ensuring smooth operations during modernization. By maintaining your old system alongside the new one, you minimize disruptions. This dual operation allows for live comparisons, ensuring the new system is functioning correctly before a full switchover.

To pull this off effectively, invest in robust monitoring tools to flag inconsistencies and assign a dedicated team to manage parallel workloads. Fallback procedures – like snapshots of operational states – should also be baked into the strategy to revert seamlessly if hiccups arise.

Protect your data in insurance digital transformation

Data is the heart of insurance systems, and protecting it during migration is non-negotiable. Techniques like end-to-end encryption shield sensitive data in transit and at rest. Implement role-based access controls (RBAC) to limit who can access what, ensuring compliance with data protection regulations.

Before insurance digital transformation, perform data integrity checks and post-migration audits to verify that no information has been lost or corrupted. Backup solutions like cloud storage redundancy act as a failsafe against catastrophic loss.

Manage technical risks

A well-defined technical risk management plan ensures that your system architecture holds up under pressure. Begin with stress testing before you modernize insurance systems to see how the new system performs under peak loads. Use containerization tools like Docker to isolate and test individual components without affecting the rest of the system.

Monitoring platforms such as Prometheus or New Relic offer real-time insights into performance, helping you spot bottlenecks before they escalate. For integration testing, tools like Postman and Selenium streamline validation processes by simulating real-world user interactions.

Smooth operational transitions

Transitioning operations isn’t just about flipping a switch. Effective training programs ensure that your team can hit the ground running. Use learning management systems (LMS) to deliver role-specific tutorials and hands-on workshops.

Gamified training platforms can even make learning the new system engaging. Simultaneously, review and tweak business processes to align with the upgraded technology. Process mining tools, such as Celonis, can analyze workflows and identify bottlenecks for optimization.

Fallback procedures

Fallback procedures are your safety net in insurance digital transformation. Whether it’s database rollbacks, system snapshots, or disaster recovery sites, having a plan B ensures operational continuity.

Use incremental backups to reduce downtime during restoration, and keep a disaster recovery playbook handy with clear steps for resolving failures. Cloud-based services like AWS or Azure offer scalable recovery solutions with near-instantaneous failover capabilities.

Ready to ditch the old and embrace the new? We’re here to guide you every step of the way. Book a Free Consultation Today, and let’s future-proof your insurance systems together!

Implementation Framework

Assessment phase

The first step in any successful insurance legacy system modernization is a thorough assessment. Dive deep into your current system to uncover technical debt, potential legacy modernization risks, and opportunities for improvement.

Tools like dependency mapping and automated code analysis platforms can help identify weaknesses. Engage stakeholders from IT to operations early on to ensure alignment on goals and priorities.

Planning phase

Once you know where you stand, it’s time to draw up a plan. Develop a clear modernization roadmap that outlines the following:

- Architecture design: Use modern, scalable frameworks like microservices.

- Technology selection: Pick tech that aligns with your long-term business goals and requirements of insurance digital transformation.

- Timeline: Break the project into manageable phases to minimize disruption.

- Resource allocation: Ensure you have the right mix of in-house expertise and external consultants.

Execution phase

Here’s where the rubber meets the road. Implement changes in carefully planned phases. Start with low-risk, high-reward areas to build momentum. Conduct rigorous testing at every stage, including unit tests, integration tests, and user acceptance tests (UAT). Utilize tools like Jenkins for CI/CD pipelines to ensure seamless updates.

Post-implementation

Congratulations, you’ve modernized! But the journey of insurance digital transformation doesn’t end here. Set up ongoing monitoring systems to track performance and catch any issues early. Optimize processes based on user feedback and continuously update to stay ahead of technological advancements. Having a dedicated support team ensures your shiny new system runs like a dream.

What Success Metrics to Track?

Measuring success isn’t just about feeling good – it’s about proving value. Track:

- Technical wins: uptime, speed, and fewer errors.

- Business gains: better efficiency, happier customers, and growing revenue.

- Risk reduction: fewer incidents, better compliance, and a budget that stays on track.

- ROI: the ultimate question – was it worth it? (hint: if you did it right, the answer is yes.)

Cost Analysis

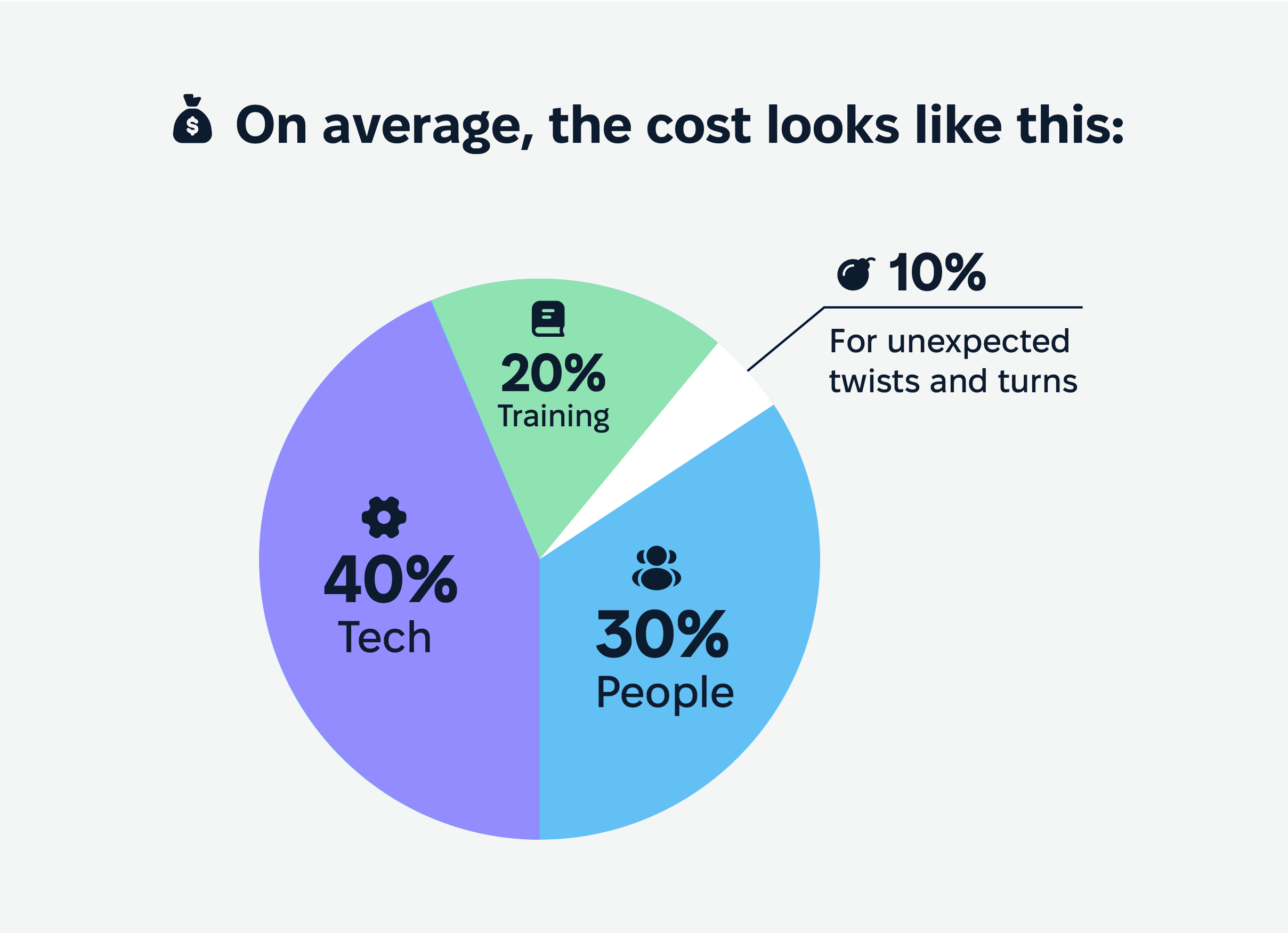

Modernizing insurance systems comes with a price tag, but the real cost depends on various factors. It’s not a one-size-fits-all deal, and understanding these nuances can help you budget smarter and avoid unpleasant surprises.

What drives insurance legacy system modernization costs?

- System complexity. Older and more complex systems typically cost more to modernize insurance systems. If your legacy setup is deeply embedded into your operations, untangling and upgrading it can take significant time and resources.

- The approach chosen. Complete replacement is often the most expensive due to the need for entirely new infrastructure and software. In contrast, phased modernization or API-first strategies can spread costs over time.

- Data migration needs. Moving data safely and accurately from legacy systems to new ones isn’t cheap. The volume of data and the complexity of your data architecture can significantly influence costs.

- Customization. Off-the-shelf solutions might be cheaper, but tailoring a system to your specific needs often requires additional development time and budget.

- Compliance requirements. Ensuring your system meets industry regulations, such as GDPR or HIPAA, can involve added expenses for audits, updates, and legal consultation.

- External expertise. Hiring external consultants, architects, or implementation partners to guide your modernization can add to costs but often reduces risks and ensures smoother execution.

Investment breakdown

- Software and tools: Licensing, subscriptions, or outright purchases of new platforms.

- Hardware: Upgrades or replacements for outdated servers, storage devices, and networking equipment.

- Labor costs: Internal team efforts, external consultants, and temporary staff.

- Testing and validation: Rigorous testing processes, including automated tools and user acceptance testing, ensure everything works seamlessly.

- Training and change management: Training staff and adapting workflows are critical to getting everyone on board with the new system.

Success Modernization: Real-World Examples

Challenge

AXA, a global insurance giant, faced challenges with siloed data, slow policy issuance, and high operational costs due to legacy mainframe systems.

Solution

AXA partnered with Microsoft to migrate their core systems to a cloud-based infrastructure using Azure. They implemented advanced analytics and machine learning capabilities for better risk assessment and customer insights.

Outcome

Modernization has led to a 40% reduction in IT infrastructure costs, significantly faster policy issuance, and improved customer satisfaction through personalized services.

Challenge

Allianz struggled with integrating its aging systems with modern technologies, which hindered its ability to innovate and launch digital services.

Solution

Allianz adopted an API-first approach, creating a unified interface to connect legacy systems with modern applications. They used microservices to isolate critical functionalities for quicker deployment.

Outcome

The company reduced integration time for new services by 50%, accelerated digital product rollouts, and enhanced operational efficiency while keeping legacy systems operational during the transition.

Our experience: modernizing insurance client interactions with an online portal

Challenge

An insurance company relied on traditional, paper-based processes for client interactions, causing inefficiencies in policy management, claims processing, and customer service. Their outdated legacy systems lacked the agility to meet modern customer expectations or integrate with emerging technologies.

Solution

We designed and developed an intuitive online portal to digitize and streamline client-facing services. The portal integrated with the company’s legacy systems through APIs, enabling policy management, claims tracking, and direct communication. It also incorporated secure authentication and user-friendly navigation to enhance the customer experience.

Outcome

- The online portal provided clients with 24/7 access to insurance services, resulting in a 40% boost in customer engagement.

- Automation of routine processes reduced administrative workloads by 30%.

- API-driven integration ensured the legacy system remained operational while new features were rolled out, minimizing downtime.

- The modular design allowed for scalability and easy addition of new features.

Wrapping Up: Future-Proofing Strategy for Insurance Legacy System Modernization

Insurance legacy system modernization is a two-sided stick: you need to address today’s challenges and set up for tomorrow’s needs at the same time. Future-proofing strategy ensures your organization can scale, adapt, and innovate in an ever-evolving market.

Start with scalability. Growth is inevitable, and your systems need to keep up. Scalability ensures your infrastructure can handle increasing demands without breaking a sweat. For instance, leveraging cloud-based platforms like AWS or Microsoft Azure allows insurance companies to scale storage and processing power dynamically. According to Gartner, by 2025, 80% of enterprises will have shifted from traditional data centers to scalable cloud infrastructure, ensuring flexibility and cost efficiency.

Don’t forget that technology doesn’t stand still, and neither should your systems. Adopting modern architectures like microservices ensures your insurance platform can evolve incrementally. This reduces the need for large-scale overhauls in the future.

Also, you must remember that the future is interconnected. Your systems should be ready to integrate with emerging technologies like IoT, AI, and blockchain. According to McKinsey, integrated systems can boost operational efficiency by up to 30%, making integration readiness a critical component of future-proofing.

And last but not least, modernized systems enable faster experimentation and deployment of new products or services, so be innovative. For example, AI-driven tools can analyze customer behavior to tailor personalized insurance packages, a growing trend. A PwC report reveals that 60% of insurance executives view innovation as a top priority for staying competitive.

Insurance digital transformation doesn’t have to be a leap of faith. With a solid plan, the right partners, and a little courage, you’ll thrive. Get a free consultation and kick off your modernization journey with confidence!