Claims processing in insurance is on the fast track to a digital makeover, and not a moment too soon. Customers today expect their claims to be settled faster than a pizza delivery. The good news? With insurance claims AI implementation leading the charge, basic claims are processed faster than ever with automation, fraud detection, and risk prevention.

The pandemic didn’t just shake things up; it turbocharged digital adoption. Virtual claims assessments and telemedicine have gone from fringe to front and center. Meanwhile, tools like IoT sensors in cars and homes are feeding insurers real-time data, creating a future where claims are resolved before your coffee gets cold

This shift isn’t just cool; it delivers measurable AI claims ROI by cutting costs and improving customer experiences. By 2025, expect near-instant resolutions for simple claims, with humans stepping in only where empathy or complex decisions are needed. Insurers that don’t embrace this change risk being left in the dust.

So, in our new blog post, we’ll discuss:

- The difference between traditional and AI-powered claims.

- How to use AI in insurance claims processing.

- How to measure AI claims ROI.

- Challenges, solutions, and future trends.

The Evolution of Claims Processing

Historically, settling a claim could feel like navigating a maze – lengthy forms, manual reviews, and human error were just part of the process. Now, thanks to AI in insurance claims, insurers are turning that maze into a highway, speeding up workflows and cutting through red tape.

Traditional vs. AI-powered claims

Traditional Claims | AI-Powered Claims | |

How It Works | Relies on manual work – lots of paperwork and effort. | Automates repetitive tasks, like scanning documents. |

Speed | Slow as molasses – decisions can take days or weeks. | Lightning-fast – decisions in just minutes. |

Accuracy | Mistakes happen often because it’s all done by hand. | Gets it right the first time with smart tools. |

Fraud Detection | Plays catch-up with fraud after it happens. | Stays one step ahead with real-time detection. |

Customer Experience | Customers are left in the dark, waiting too long. | Keeps customers in the loop with updates and quick answers. |

Scalability | Struggles to grow as demands increase. | Scales up easily to handle more work. |

Operational Costs | Costs an arm and a leg due to inefficiency. | Saves money by cutting out the grunt work. |

Adapting to Change | Can’t keep up with rising expectations or competitors. | Moves with the times, meeting customer demands head-on. |

Innovation | Stuck in the past with no clever solutions. | Thinks ahead, like warning customers about storms before they hit. |

AI Applications in Claims Processing

Claims intake and FNOL (First Notice of Loss)

Gone are the days of long phone queues and endless forms. With AI in insurance claims, policyholders can report their losses through chatbots or virtual assistants anytime, anywhere. These tools don’t just speed things up—they ensure accuracy, reducing the back-and-forth that frustrates customers. Think of them as the ultimate first responder for claims, minus the flashing lights.

Document analysis

If paperwork were an Olympic event, insurers might have gold medals by now. Luckily, claims processing automation eliminates the heavy lifting. AI extracts key information from forms, invoices, and supporting documents in record time. The result? Fewer errors, faster approvals, and a lot less groaning from your claims team.

Damage assessment

Ever seen AI play detective? It can analyze images or videos of damaged property to estimate repair costs with impressive accuracy. This means no more guesswork or disputes overestimates. For adjusters, it’s like having an expert consultant who works 24/7 and never takes a coffee break.

Fraud detection

Fraudsters, your days are numbered. With insurance claims AI implementation, algorithms can spot red flags in patterns, transactions, or historical data. It’s like having a Sherlock Holmes in your corner, but one that doesn’t need a deerstalker hat. The result? Less money lost to fraud and a better reputation for your company.

Claims routing and triage

Not all claims are created equal, and AI knows it. By analyzing complexity and urgency, AI in insurance claims ensures they are routed to the right adjuster or team. This triage approach prioritizes high-value or time-sensitive cases while streamlining simpler claims for quick resolutions. It’s traffic control but without the honking horns.

Settlement prediction

AI doesn’t just process claims—it predicts outcomes. By using historical claims data, it can estimate settlement amounts quickly and accurately, helping adjusters set clear expectations. This level of insight boosts transparency and trust while contributing directly to AI claims ROI.

Payment processing

Nobody likes waiting for a check in the mail. With automated workflows, AI ensures payments for approved claims are processed accurately and on time. For policyholders, it’s the ultimate customer service move. For insurers, it’s a big step toward building loyalty and satisfaction.

Read also: Insurance Digital Transformation Guide 2025

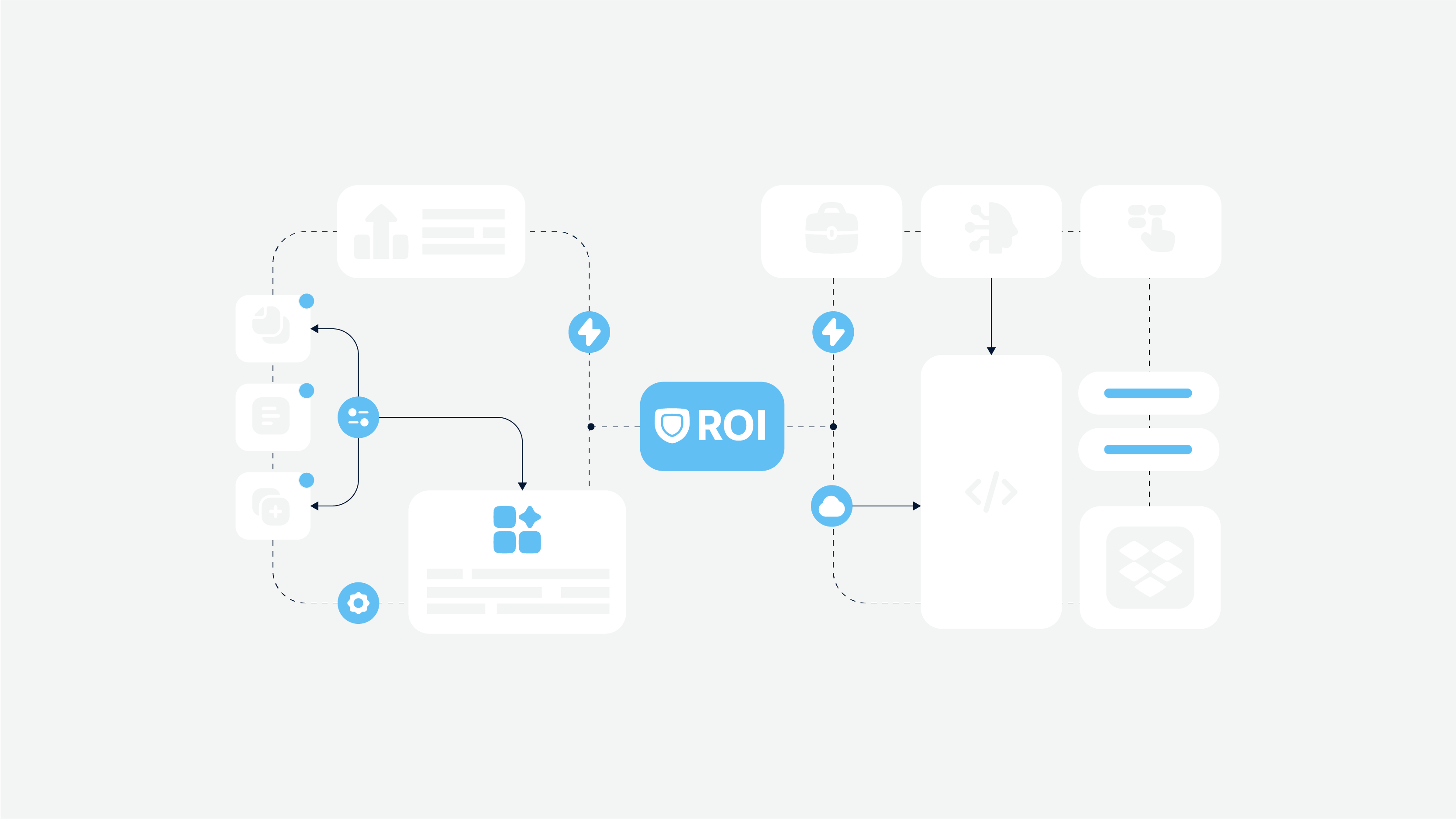

ROI Analysis Framework

When it comes to implementing AI, one question always bubbles to the top: What’s the AI claims ROI? Decision-makers need a clear picture of the payoff before jumping into uncharted waters. Let’s break down how AI in insurance claims delivers results that make the investment worthwhile.

Cost reduction metrics

What to include:

- Processing time reduction

- Labor cost savings

- Error reduction impact

- Fraud prevention savings

Imagine shaving 50–70% off your claims processing time. With claims processing automation, that’s not a pipe dream – it’s the reality. AI takes on repetitive tasks like document handling and data entry, reducing the workload on your team and slashing labor costs. Think of it as upgrading from a typewriter to a turbo-charged laptop.

And let’s not forget about fewer mistakes. By automating key processes, AI reduces errors that could lead to costly rework or disputes. No more “oops” moments—just smooth, efficient workflows.

Error reduction and fraud prevention

Here’s where AI shines brightest. Human error is a fact of life, but AI doesn’t get tired or distracted. Studies show that automation can lower error rates by up to 80%, giving you cleaner data and faster approvals.

And fraudsters? They’ve met their match. With claims processing automation, AI detects patterns that would take human agents and analysts weeks to uncover. The result? Significant fraud prevention savings – up to $30 billion across the industry. That’s money back in your pocket, not in a scammer’s wallet.

Revenue benefits

What to include:

- Customer satisfaction impact

- Retention improvements

- Market competitiveness

Customer satisfaction isn’t just about good vibes; it’s a competitive edge. Faster claims resolutions, enabled by AI, keep policyholders happy, boosting retention rates and attracting new business.

But the perks don’t stop there. Efficiency gains and reduced errors also make your company more competitive. In a crowded market, being the insurer that settles claims quickly and accurately is a huge selling point. And when your operations are running smoothly, everyone wins.

Implementation costs

What to include:

- Technology investment

- Training and development

- Integration costs

Of course, insurance claims AI implementation isn’t free. There’s an upfront investment in technology and integration, not to mention training your team to use the new tools effectively. But here’s the thing: these costs are manageable and short-term. The long-term business benefits—hello, AI claims ROI—far outweigh the initial spend.

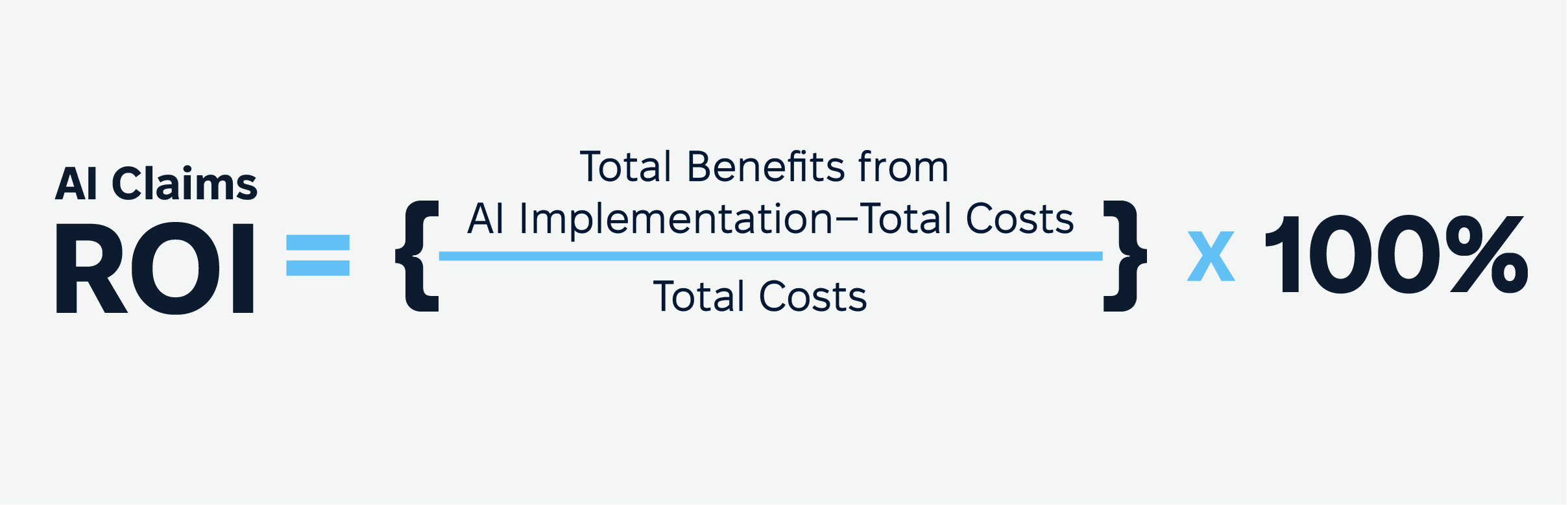

AI claims ROI formula

Ready to see what AI can do for your claims process? Let’s chat! Book your free consultation now, and we’ll help you uncover smart solutions to boost your ROI and simplify your workflow.

Implementation Guide

Integrating AI in insurance claims is a game-changer, but success depends on getting the groundwork right. Here’s a practical guide to making it happen smoothly, from preparation to full deployment.

Readiness assessment

Before diving into claims processing automation, it’s critical to assess your readiness. Think of this as a diagnostic check for your organization.

- Technical requirements. Ensure your current infrastructure can handle AI systems. Compatibility with existing tools and platforms is key. Can your tech stack support real-time processing and high data volumes?

- Data requirements. AI thrives on good data. Do you have clean, structured, and sufficient datasets for training? If your data is disorganized or incomplete, AI outcomes won’t meet expectations.

- Process requirements. Review your current claims workflows. Identify repetitive, time-consuming tasks where claims processing automation can make an immediate impact.

- Team capabilities. Assess your team’s skill set. Do you have people familiar with AI tools, or will you need training? It’s also worth checking if they’re open to adapting to new technologies.

Implementation phases

Phase 1. Planning and preparation

Set clear goals. Are you looking to speed up claims processing, reduce errors, or improve fraud detection? Define what success looks like, establish KPIs, and allocate resources.

Phase 2. Pilot program

Implementing AI in insurance claims, start small. Test AI on a manageable process like an ai insurance claims intake or document analysis. This helps fine-tune the technology and build internal confidence without disrupting operations.

Phase 3. Scaling strategy

Once the pilot shows positive results, expand AI across more processes. Gradually implement claims processing automation to ensure smooth transitions and avoid overwhelming your teams.

Phase 4. Full deployment

This is where everything comes together. AI integrates fully into your claims operations, handling tasks like routing, settlement predictions, and fraud detection. Monitor performance and refine as needed.

How to mitigate the risks of AI in insurance claims?

AI’s potential is huge, but risks like data security and compliance must be addressed upfront.

- Data security. Protect sensitive customer information by implementing robust cybersecurity measures. AI systems must be secure to avoid breaches.

- Compliance considerations. Ensure AI complies with industry regulations and standards. Whether it’s GDPR, HIPAA, or local insurance laws, compliance is non-negotiable.

- Quality control. Monitor AI outputs regularly. Human oversight is essential to ensure accuracy and fairness, especially in complex claims.

Success Metrics and KPIs

Tracking the right metrics is essential to measure the effectiveness of AI in claims processing. Here’s a table summarizing the key success metrics and what they reflect:

Metric | Description | Why It Matters |

Processing Efficiency | Measures the average time to process a claim and adherence to SLA timeframes. | Demonstrates reduced bottlenecks and faster workflows. |

Accuracy | Tracks error rates in claims handling and percentage of accurately flagged fraud cases. | Ensures reliability and reduces disputes or rework. |

Customer Satisfaction | Includes metrics like Net Promoter Score (NPS), survey results, and chatbot feedback. | Indicates improved customer experience and trust in the claims process. |

Cost Reduction | Evaluates savings from labor automation, fewer errors, and fraud prevention efforts. | Highlights operational savings and better resource allocation. |

Return on Investment (ROI) | Compares initial implementation costs to savings and revenue gains, including improved retention. | Validates the financial success of AI implementation and identifies areas for further optimization. |

AI in Insurance Claims: Common Challenges and Solutions

Adopting AI in insurance claims can unlock massive efficiencies and cost savings, but it’s not without hurdles.

Data quality issues

AI systems depend on accurate and well-organized data, but insurers often deal with inconsistent or incomplete datasets.

Solution

For example, CCC Information Services, a leader in claims technology, tackled this issue by integrating real-time data from vehicles. This approach ensures their AI models have the clean, standardized, and relevant data inputs needed for accurate damage assessments and fraud detection.

Insurers should invest in tools that automate data cleansing and governance processes. They not only improve data quality but also streamline operations, resulting in faster claim resolutions.

Integration challenges

Many insurance companies operate on legacy systems, which can make implementing AI feel like trying to fit a square peg in a round hole.

Solution

Integration challenges can be mitigated by using APIs or cloud-based solutions that act as a bridge between old and new systems.

AXA Insurance, for instance, successfully navigated this obstacle by using middleware solutions to connect their AI-powered tools to older systems. This enabled them to automate claims processing without needing a complete tech overhaul.

User adoption

Employees are often wary of AI, fearing job displacement or struggling to trust the technology.

Solution

Lemonade Insurance, an AI-first insurance company, faced this head-on. Their claims chatbot, AI Jim, initially raised questions about replacing human workers. However, by being transparent about the chatbot’s role – handling repetitive tasks so humans can focus on complex cases– they built trust both internally and externally.

So, provide clear communication and training about AI’s purpose. Highlight how it complements human expertise rather than replacing it. Lemonade also involves employees in the AI training process, ensuring their insights shape how the technology evolves.

Compliance concerns

Regulations like GDPR and data privacy laws are crucial to consider when dealing with sensitive customer data.

Solution

Work with legal experts to design AI systems that prioritize data protection. Secure encryption, for instance, helps insurers maintain compliance while safeguarding customer trust.

In other words, try to incorporate AI solutions with built-in compliance features, such as automatic data anonymization and secure encryption protocols. This ensures insurers can use AI confidently without running afoul of legal standards.

Change resistance

AI can disrupt long-established workflows, leading to pushback from both employees and management.

Solution

Allianz Insurance tackled this by launching pilot programs to test AI on smaller scales, such as automating routine claims. These programs highlighted measurable benefits, including faster processing and fewer errors, which helped gain buy-in from skeptics.

Future Trends (2025 and Beyond)

Let’s start with some stats

By 2030, AI will automate over half of claims processing, handling tasks like routing, data analysis, and image recognition. These systems speed up claims, reduce errors, and provide quicker, more accurate results.

This is crucial for customers – 87% say effective claims processing influences their renewal decision. By using data from images, sensors, and historical trends, AI delivers faster, more satisfying settlements. However, the insurance industry has been slow to adopt AI compared to other sectors. While 32% of tech companies are investing in AI, only 1.33% of insurers have done the same.

Still, McKinsey predicts AI could reduce operational costs by 40% and increase productivity, with 21% of insurers already preparing their teams for AI. As adoption increases, AI will transform the insurance industry itself, making it faster, smarter, and more customer-focused.

Advanced AI capabilities

The next wave of AI in insurance claims will introduce smarter algorithms and machine learning that speed up claims processing while increasing accuracy. These systems will learn from past claims and predict future outcomes, improving decision-making. AI will help insurers resolve claims faster, reduce errors, and significantly enhance AI claims ROI by automating complex tasks.

Integration with emerging tech

AI will also integrate with emerging technologies like IoT, blockchain, and connected devices. This claims processing automation will pull real-time data from sensors, wearables, and even self-driving cars to speed up claims resolution and customer engagement. By analyzing this data, AI will ensure faster, more accurate decisions and create a seamless, personalized experience for customers.

Market evolution

As customer expectations rise, insurers must adapt to provide faster, more transparent, and personalized service. With AI in insurance claims handling more tasks, insurance companies can deliver quicker claim resolutions and enhance the overall customer experience, staying competitive in an increasingly crowded market.

Regulatory changes

As insurance claims AI implementation grows, regulations will evolve to ensure ethical use of artificial intelligence and protect customer data. Insurers will need to stay compliant with changing laws, balancing innovation with transparency and fairness to maintain trust in their AI-driven claims systems.

Implementation Checklist With Timeline

Step 1: Conduct readiness assessment (Week 1–2)

Evaluate your systems, data quality, and team capabilities. Identify any gaps that could hinder successful insurance claims AI implementation.

Step 2: Develop a pilot program (Month 1–3)

Test AI in insurance claims on a specific process, such as fraud detection or document analysis. This allows you to assess its effectiveness and address any issues early on.

Step 3: Scale AI in insurance claims across processes (Month 4–9)

Gradually implement claims processing automation across all operations. Ensure smooth integration with your current systems and provide employee training as needed.

Step 4: Monitor KPIs and refine (Ongoing)

Track metrics like processing times and accuracy to measure the impact of claims processing automation. Continuously refine processes and algorithms for sustained improvements.

Conclusion and Action Steps

The future of the insurance sector and claims management isn’t just knocking on the door; it’s already moving in. With insurance claims AI implementation, insurers are shifting gears from snail-paced processes to turbocharged automation. Gone are the days of lengthy paperwork and unpredictable wait times. Instead, AI brings faster approvals, smarter fraud detection, and customer experiences that don’t just meet expectations – they exceed them.

By embracing claims management process automation, you and your clients can unlock benefits like lower costs, higher accuracy, and the ability to scale effortlessly. AI solutions are not just faster; they’re smarter, too.

So, if you’re ready to transform your claims process and lead the pack, we’re here for you. Contact us today to explore tailored AI solutions that deliver results. Let’s innovate together and make your claims process as seamless as your customers deserve!